Question: PLZ PLZ HELP QUESTION 1 Given the returns and probabilities for the three possible states listed here, calculate the Covariance and Correlation Coefficient between the

PLZ PLZ HELP

QUESTION 1

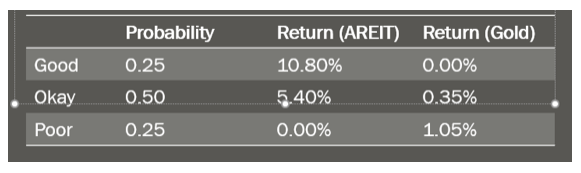

Given the returns and probabilities for the three possible states listed here, calculate the Covariance and Correlation Coefficient between the returns of share holdings in an Australian Real Estate Investment Trust (AREIT) and shareholdings in Gold.

QUESTION 2

Smooth Trade Ltd is a fast-growing online retail company. The company did not pay a dividend last year and is not expected to do so for the next 2 years. Last year the companys growth accelerated, and they expect to grow at a rate of 25.0% for the next 5 years before slowing down to a more stable growth rate of 6.2% for the next several years. In the third year, the company has forecasted a dividend payment of $11.10. The required rate of return for such shares is 14.0%.

Calculate the share price of the company at the end of its rapid growth period (that is, at the end of 5 years).

Also, calculate the current price of these shares.

Good Okay Probability 0.25 0.50 Return (AREIT) Return (Gold) 10.80% 0.00% 5.40% 0.35% Poor 0.25 0.00% 1.05%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts