Question: PLZ post a correct and clear answer, thx . Question 27 Not answered Marked out of 23.00 P Flag question Presented below is information related

PLZ post a correct and clear answer, thx .

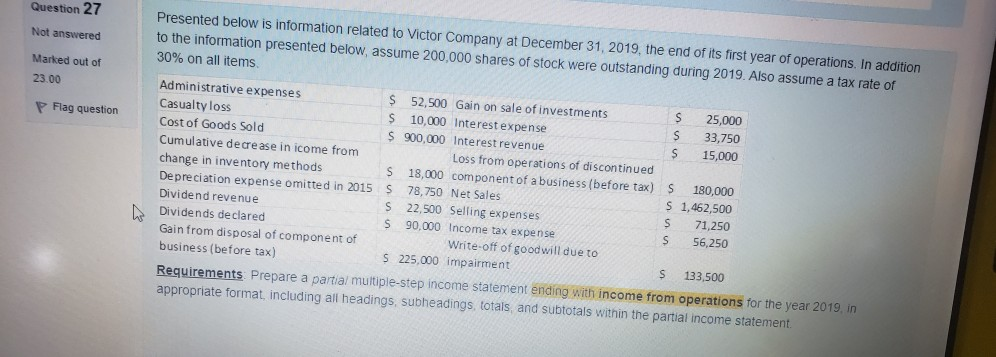

Question 27 Not answered Marked out of 23.00 P Flag question Presented below is information related to Victor Company at December 31, 2019, the end of its first year of operations. In addition to the information presented below, assume 200,000 shares of stock were outstanding during 2019. Also assume a tax rate of 30% on all items Administrative expenses $ 52,500 Gain on sale of investments S 25.000 Casualty loss S 10,000 Interest expense S 33,750 Cost of Goods Sold $ 900,000 Interest revenue S 15.000 Cumulative decrease in icome from Loss from operations of discontinued change in inventory methods S 18,000 component of a business (before tax) S 180,000 Depreciation expense omitted in 2015 S 78,750 Net Sales $ 1,462,500 Dividend revenue S 22,500 Selling expenses S 71,250 h Dividends declared S 90,000 Income tax expense $ 56,250 Gain from disposal of component of Write-off of goodwill due to business (before tax) $ 225,000 impairment $ 133,500 Requirements Prepare a partial multiple-step income statement ending with income from operations for the year 2019. in appropriate format, including all headings, subheadings, totals, and subtotals within the partial income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts