Question: PLZ SHOW ALL WRITTEN WORK NO SPREADSHEET Show transcribed image text Expert Answer An expert answer will be posted here Suppose Guthrie's Golden Fried Chicken

PLZ SHOW ALL WRITTEN WORK NO SPREADSHEET

Show transcribed image text

Expert Answer

An expert answer will be posted here

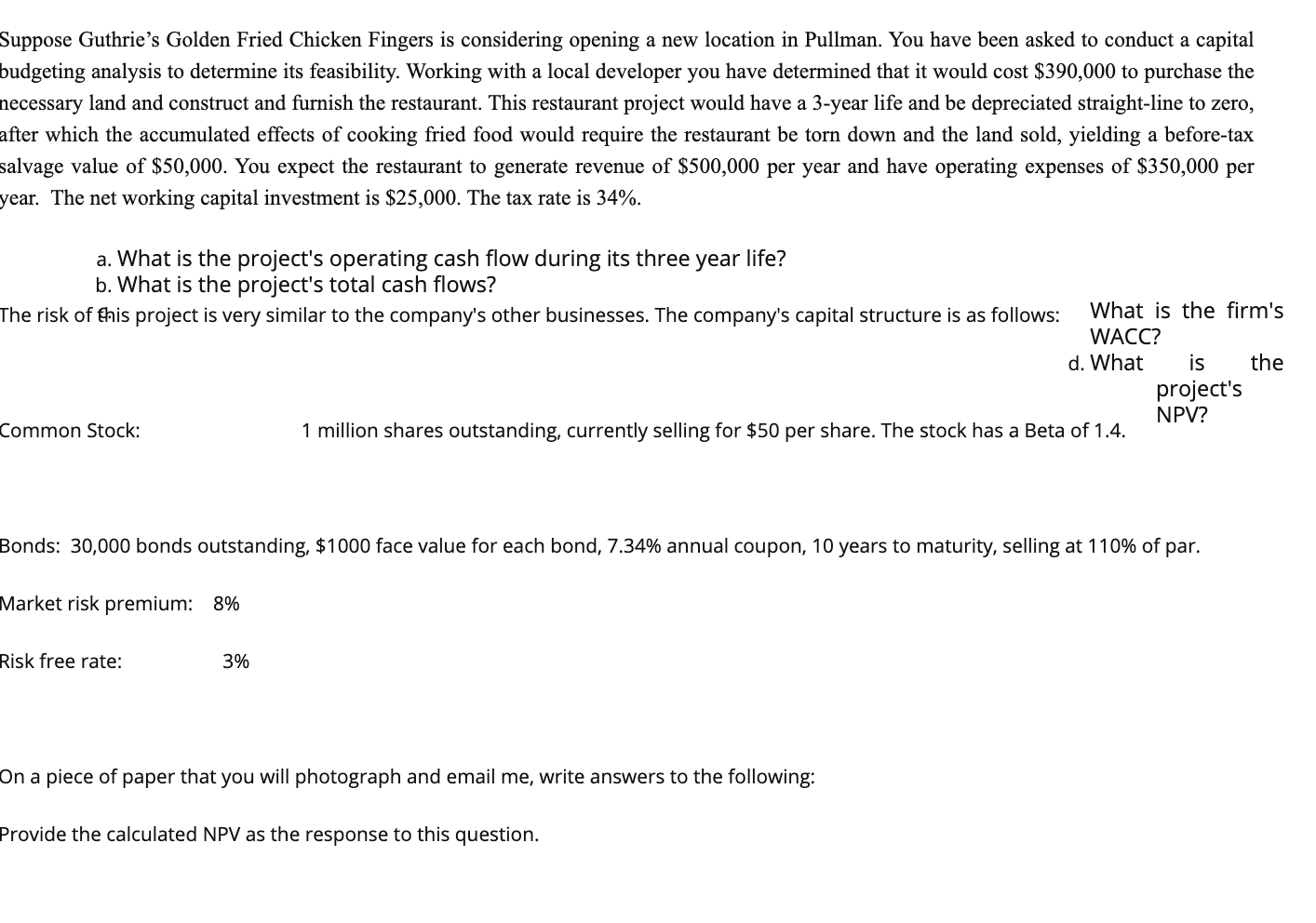

Suppose Guthrie's Golden Fried Chicken Fingers is considering opening a new location in Pullman. You have been asked to conduct a capital budgeting analysis to determine its feasibility. Working with a local developer you have determined that it would cost $390,000 to purchase the necessary land and construct and furnish the restaurant. This restaurant project would have a 3-year life and be depreciated straight-line zero, after which the accumulated effects of cooking fried food would require the restaurant be torn down and the land sold, yielding a before-tax salvage value of $50,000. You expect the restaurant to generate revenue of $500,000 per year and have operating expenses of $350,000 per year. The net working capital investment is $25,000. The tax rate is 34%. a. What is the project's operating cash flow during its three year life? b. What is the project's total cash flows? The risk of this project is very similar to the company's other businesses. The company's capital structure is as follows: What is the firm's WACC? d. What is the project's NPV? Common Stock: 1 million shares outstanding, currently selling for $50 per share. The stock has a ta of 1.4. Bonds: 30,000 bonds outstanding, $1000 face value for each bond, 7.34% annual coupon, 10 years to maturity, selling at 110% of par. Market risk premium: 8% Risk free rate: 3% On a piece of paper that you will photograph and email me, write answers to the following: Provide the calculated NPV as the response to this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts