Question: PLZ SHOW STEPS AND WORK FOR PROBLEM 1. (50 points) A construction company's revenue is $1,500,000 for the year 2018. Direct costs of construction equals

PLZ SHOW STEPS AND WORK FOR PROBLEM

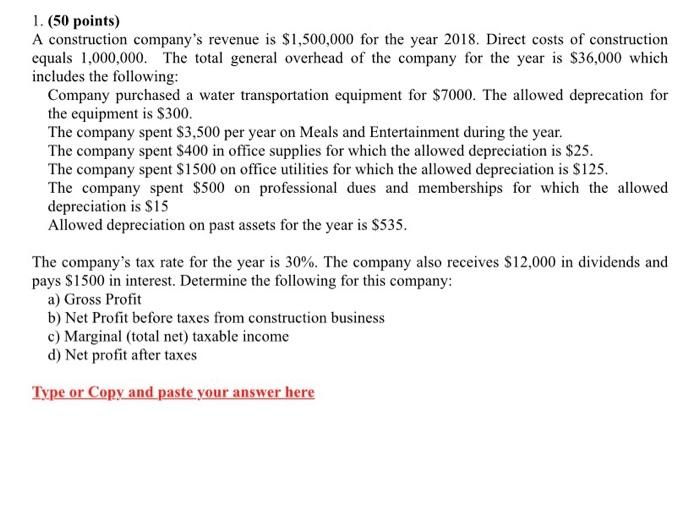

1. (50 points) A construction company's revenue is $1,500,000 for the year 2018. Direct costs of construction equals 1,000,000. The total general overhead of the company for the year is $36,000 which includes the following: Company purchased a water transportation equipment for $7000. The allowed deprecation for the equipment is $300. The company spent $3,500 per year on Meals and Entertainment during the year. The company spent $400 in office supplies for which the allowed depreciation is $25. The company spent $1500 on office utilities for which the allowed depreciation is $125. The company spent $500 on professional dues and memberships for which the allowed depreciation is $15 Allowed depreciation on past assets for the year is $535. The company's tax rate for the year is 30%. The company also receives $12,000 in dividends and pays $1500 in interest. Determine the following for this company: a) Gross Profit b) Net Profit before taxes from construction business c) Marginal (total net) taxable income d) Net profit after taxes Type or Copy and paste your answer here

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock