Question: plz solve these questions Problem 1. (10 pts) A trader wants to invest in gold. At the current moment the trader can buy gold for

plz solve these questions

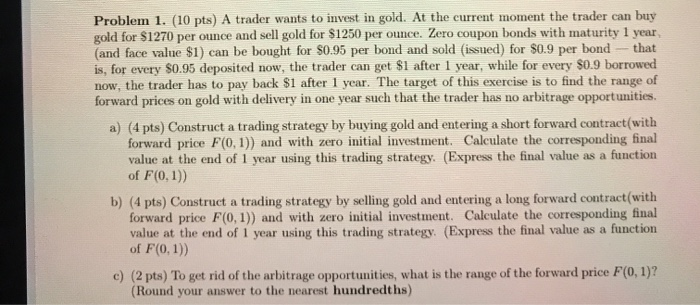

plz solve these questionsProblem 1. (10 pts) A trader wants to invest in gold. At the current moment the trader can buy gold for $1270 per ounce and sell gold for $1250 per ounce. Zero coupon bonds with maturity 1 year (and face value $1) can be bought for $0.95 per bond and sold (issued) for $0.9 per bond - that is, for every $0.95 deposited now, the trader can get $1 after 1 year, while for every $0.9 borrowed now, the trader has to pay back $1 after 1 year. The target of this exercise is to find the range of forward prices on gold with delivery in one year such that the trader has no arbitrage opportunities. a) (4 pts) Construct a trading strategy by buying gold and entering a short forward contract(with forward price F(0,1)) and with zero initial investment. Calculate the corresponding final value at the end of 1 year using this trading strategy. (Express the final value as a function of F(0.1)) b) (4 pts) Construct a trading strategy by selling gold and entering a long forward contract (with forward price F(0,1)) and with zero initial investment Calculate the corresponding final value at the end of 1 year using this trading strategy. (Express the final value as a function of F(0,1)) c) (2 pts) To get rid of the arbitrage opportunities, what is the range of the forward price F(0, 1)? (Round your answer to the nearest hundredths)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts