Question: plz solve this in 5 mints plz BUKO Question 1 Marks 8 On January 1, 2020, XYZ Company acquired a new machine with an estimate

plz solve this in 5 mints plz

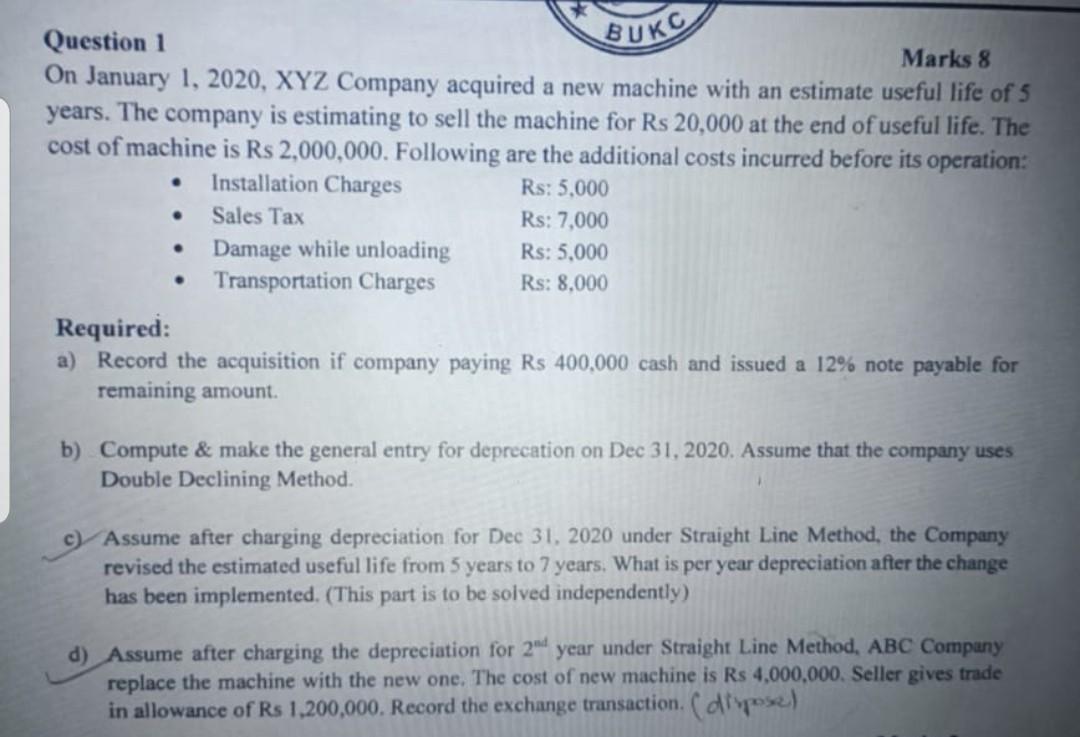

BUKO Question 1 Marks 8 On January 1, 2020, XYZ Company acquired a new machine with an estimate useful life of 5 years. The company is estimating to sell the machine for Rs 20,000 at the end of useful life. The cost of machine is Rs 2,000,000. Following are the additional costs incurred before its operation: Installation Charges Rs: 5.000 Sales Tax Rs: 7.000 Damage while unloading Rs: 5.000 Transportation Charges Rs: 8.000 . . Required: a) Record the acquisition if company paying Rs 400,000 cash and issued a 12% note payable for remaining amount b) Compute & make the general entry for deprecation on Dec 31, 2020. Assume that the company uses Double Declining Method. Assume after charging depreciation for Dec 31, 2020 under Straight Line Method, the Company revised the estimated useful life from 5 years to 7 years. What is per year depreciation after the change has been implemented. (This part is to be solved independently) d) Assume after charging the depreciation for 20 year under Straight Line Method, ABC Company replace the machine with the new one. The cost of new machine is Rs 4,000,000. Seller gives trade in allowance of Rs 1,200,000. Record the exchange transaction. (dispose)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts