Question: plz someone help! this is my second time posting this wuestion and its due tonight! plz help! REQUIRED: Use the following information to determine the

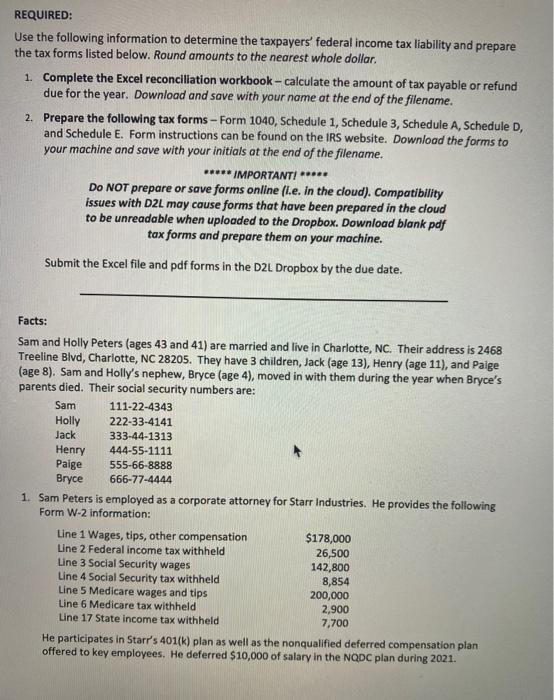

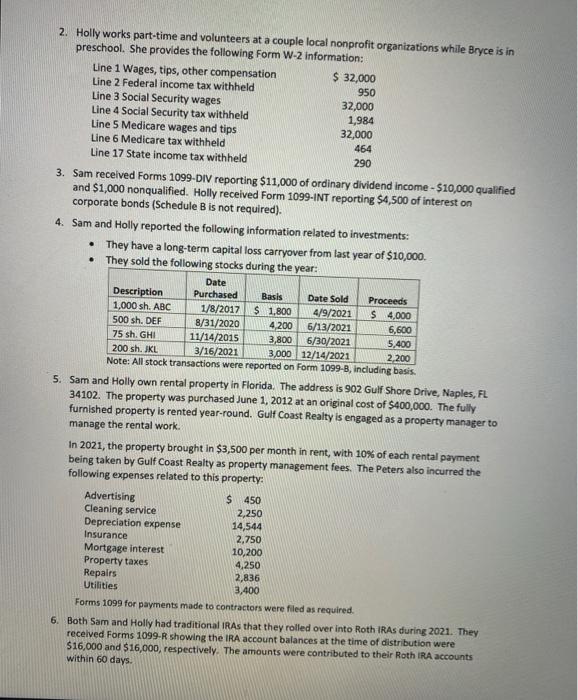

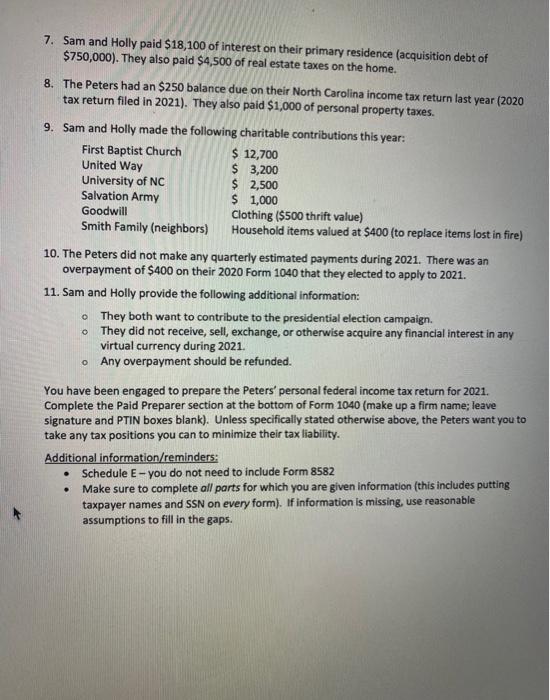

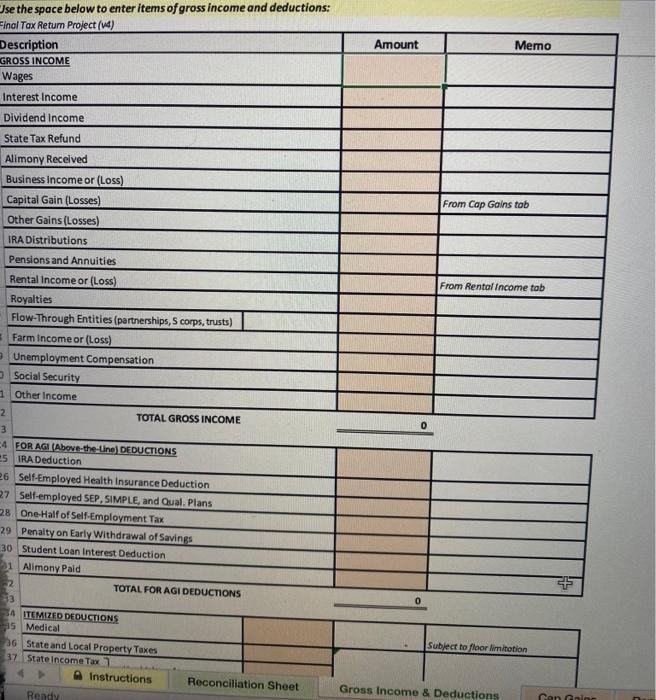

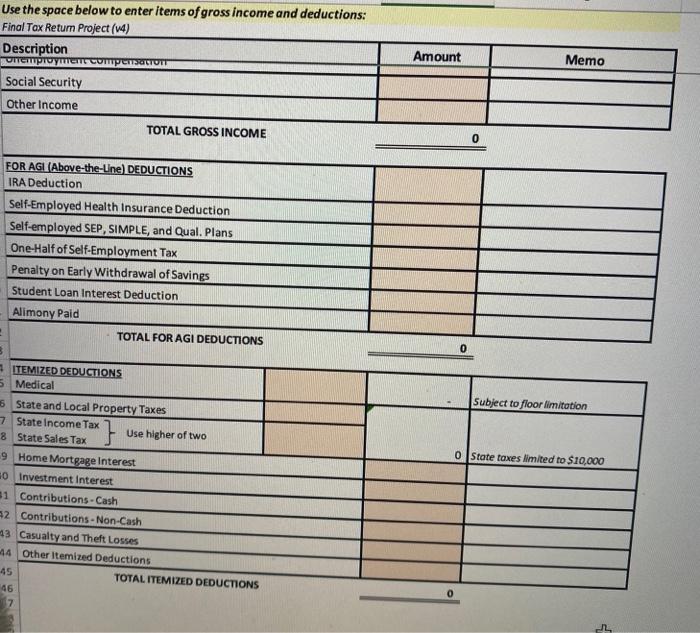

REQUIRED: Use the following information to determine the taxpayers' federal income tax liability and prepare the tax forms listed below. Round amounts to the nearest whole dollar. 1. Complete the Excel reconciliation workbook-calculate the amount of tax payable or refund due for the year. Download and save with your name at the end of the filename. 2. Prepare the following tax forms-Form 1040, Schedule 1, Schedule 3, Schedule A, Schedule D, and Schedule E. Form instructions can be found on the IRS website. Download the forms to your machine and save with your initials at the end of the filename. ***** IMPORTANT! ***** Do NOT prepare or save forms online (i.e. in the cloud). Compatibility issues with D2L may cause forms that have been prepared in the cloud to be unreadable when uploaded to the Dropbox. Download blank pdf tax forms and prepare them on your machine. Submit the Excel file and pdf forms in the D2L Dropbox by the due date. Facts: Sam and Holly Peters (ages 43 and 41) are married and live in Charlotte, NC. Their address is 2468 Treeline Blvd, Charlotte, NC 28205. They have 3 children, Jack (age 13), Henry (age 11), and Paige (age 8). Sam and Holly's nephew, Bryce (age 4), moved in with them during the year when Bryce's parents died. Their social security numbers are: Sam 111-22-4343 Holly 222-33-4141 Jack 333-44-1313 Henry 444-55-1111 Paige 555-66-8888 Bryce 666-77-4444 1. Sam Peters is employed as a corporate attorney for Starr Industries. He provides the following Form W-2 information: $178,000 26,500 142,800 Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld 8,854 200,000 2,900 Line 17 State income tax withheld 7,700 He participates in Starr's 401(k) plan as well. the nonqualified deferred compensation plan offered to key employees. He deferred $10,000 of salary in the NQDC plan during 2021. 2. Holly works part-time and volunteers at a couple local nonprofit organizations while Bryce is in preschool. She provides the following Form W-2 information: $ 32,000 950 Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld 32,000 1,984 32,000 464 Line 17 State income tax withheld 290 3. Sam received Forms 1099-DIV reporting $11,000 of ordinary dividend income - $10,000 qualified and $1,000 nonqualified. Holly received Form 1099-INT reporting $4,500 of interest on corporate bonds (Schedule B is not required). 4. Sam and Holly reported the following information related to investments: They have a long-term capital loss carryover from last year of $10,000. They sold the following stocks during the year: Date Purchased Basis Date Sold Proceeds Description 1,000 sh. ABC 1/8/2017 $1,800 4/9/2021 $ 4,000 500 sh. DEF 8/31/2020 6/13/2021 6,600 4,200 3,800 75 sh. GHI 11/14/2015 6/30/2021 5,400 200 sh. JKL 3/16/2021 3,000 12/14/2021 2,200 Note: All stock transactions were reported on Form 1099-8, including basis. 5. Sam and Holly own rental property in Florida. The address is 902 Gulf Shore Drive, Naples, FL 34102. The property was purchased June 1, 2012 at an original cost of $400,000. The fully furnished property is rented year-round. Gulf Coast Realty is engaged as a property manager to manage the rental work. In 2021, the property brought in $3,500 per month in rent, with 10% of each rental payment being taken by Gulf Coast Realty as property management fees. The Peters also incurred the following expenses related to this property: $ 450 Advertising Cleaning service 2,250 Depreciation expense 14,544 Insurance 2,750 Mortgage interest 10,200 Property taxes 4,250 Repairs 2,836 Utilities 3,400 Forms 1099 for payments made to contractors were filed as required. 6. Both Sam and Holly had traditional IRAS that they rolled over into Roth IRAs during 2021. They received Forms 1099-R showing the IRA account balances at the time of distribution were $16,000 and $16,000, respectively. The amounts were contributed to their Roth IRA accounts within 60 days. 7. Sam and Holly paid $18,100 of interest on their primary residence (acquisition debt of $750,000). They also paid $4,500 of real estate taxes on the home. 8. The Peters had an $250 balance due on their North Carolina income tax return last year (2020 tax return filed in 2021). They also paid $1,000 of personal property taxes. 9. Sam and Holly made the following charitable contributions this year: First Baptist Church $ 12,700 United Way $ 3,200 University of NC $ 2,500 Salvation Army $ 1,000 Goodwill Clothing ($500 thrift value) Smith Family (neighbors) Household items valued at $400 (to replace items lost in fire) 10. The Peters did not make any quarterly estimated payments during 2021. There was an overpayment of $400 on their 2020 Form 1040 that they elected to apply to 2021. 11. Sam and Holly provide the following additional information: o They both want to contribute to the presidential election campaign. o They did not receive, sell, exchange, or otherwise acquire any financial interest in any virtual currency during 2021. o Any overpayment should be refunded. You have been engaged to prepare the Peters' personal federal income tax return for 2021. Complete the Paid Preparer section at the bottom of Form 1040 (make up a firm name; leave signature and PTIN boxes blank). Unless specifically stated otherwise above, the Peters want you to take any tax positions you can to minimize their tax liability. Additional information/reminders: Schedule E-you do not need to include Form 8582 . Make sure to complete all parts for which you are given information (this includes putting taxpayer names and SSN on every form). If information is missing, use reasonable assumptions to fill in the gaps. Use the space below to enter items of gross income and deductions: Final Tax Return Project (4) Description GROSS INCOME Wages Interest Income Dividend Income State Tax Refund Alimony Received Business income or (Loss) Capital Gain (Losses) Other Gains (Losses) IRA Distributions Pensions and Annuities Rental Income or (Loss) Royalties Flow-Through Entities (partnerships, S corps, trusts) Farm Income or (Loss) Unemployment Compensation Social Security Other Income TOTAL GROSS INCOME 3 24 FOR AGI (Above-the-Line) DEDUCTIONS 25 IRA Deduction 26 Self-Employed Health Insurance Deduction 27 Self-employed SEP, SIMPLE, and Qual. Plans 28 One-Half of Self-Employment Tax 29 Penalty on Early Withdrawal of Savings 30 Student Loan Interest Deduction 1 Alimony Paid 2 33 34 ITEMIZED DEDUCTIONS 35 Medical 36 State and Local Property Taxes 37 State Income Tax 1 Instructions Ready 1 2 TOTAL FOR AGI DEDUCTIONS Reconciliation Sheet Amount 0 Memo From Cap Gains tab From Rental Income tab Subject to floor limitation Gross Income & Deductions Gan Gaine Use the space below to enter items of gross income and deductions: Final Tax Return Project (14) Description Onemployment compensaLTOTT Social Security Other Income TOTAL GROSS INCOME FOR AGI (Above-the-Line) DEDUCTIONS IRA Deduction Self-Employed Health Insurance Deduction Self-employed SEP, SIMPLE, and Qual. Plans One-Half of Self-Employment Tax Penalty on Early Withdrawal of Savings Student Loan Interest Deduction Alimony Paid ITEMIZED DEDUCTIONS 5 Medical 5 State and Local Property Taxes 7 State Income Tax State Sales Tax Home Mortgage Interest 8 9 0 Investment Interest #1 Contributions-Cash 42 Contributions-Non-Cash 43 Casualty and Theft Losses 44 Other Itemized Deductions -45 46 TOTAL FOR AGI DEDUCTIONS Use higher of two 7 TOTAL ITEMIZED DEDUCTIONS Amount 0 0 Memo Subject to floor limitation O State taxes limited to $10,000 0 REQUIRED: Use the following information to determine the taxpayers' federal income tax liability and prepare the tax forms listed below. Round amounts to the nearest whole dollar. 1. Complete the Excel reconciliation workbook-calculate the amount of tax payable or refund due for the year. Download and save with your name at the end of the filename. 2. Prepare the following tax forms-Form 1040, Schedule 1, Schedule 3, Schedule A, Schedule D, and Schedule E. Form instructions can be found on the IRS website. Download the forms to your machine and save with your initials at the end of the filename. ***** IMPORTANT! ***** Do NOT prepare or save forms online (i.e. in the cloud). Compatibility issues with D2L may cause forms that have been prepared in the cloud to be unreadable when uploaded to the Dropbox. Download blank pdf tax forms and prepare them on your machine. Submit the Excel file and pdf forms in the D2L Dropbox by the due date. Facts: Sam and Holly Peters (ages 43 and 41) are married and live in Charlotte, NC. Their address is 2468 Treeline Blvd, Charlotte, NC 28205. They have 3 children, Jack (age 13), Henry (age 11), and Paige (age 8). Sam and Holly's nephew, Bryce (age 4), moved in with them during the year when Bryce's parents died. Their social security numbers are: Sam 111-22-4343 Holly 222-33-4141 Jack 333-44-1313 Henry 444-55-1111 Paige 555-66-8888 Bryce 666-77-4444 1. Sam Peters is employed as a corporate attorney for Starr Industries. He provides the following Form W-2 information: $178,000 26,500 142,800 Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld 8,854 200,000 2,900 Line 17 State income tax withheld 7,700 He participates in Starr's 401(k) plan as well. the nonqualified deferred compensation plan offered to key employees. He deferred $10,000 of salary in the NQDC plan during 2021. 2. Holly works part-time and volunteers at a couple local nonprofit organizations while Bryce is in preschool. She provides the following Form W-2 information: $ 32,000 950 Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld 32,000 1,984 32,000 464 Line 17 State income tax withheld 290 3. Sam received Forms 1099-DIV reporting $11,000 of ordinary dividend income - $10,000 qualified and $1,000 nonqualified. Holly received Form 1099-INT reporting $4,500 of interest on corporate bonds (Schedule B is not required). 4. Sam and Holly reported the following information related to investments: They have a long-term capital loss carryover from last year of $10,000. They sold the following stocks during the year: Date Purchased Basis Date Sold Proceeds Description 1,000 sh. ABC 1/8/2017 $1,800 4/9/2021 $ 4,000 500 sh. DEF 8/31/2020 6/13/2021 6,600 4,200 3,800 75 sh. GHI 11/14/2015 6/30/2021 5,400 200 sh. JKL 3/16/2021 3,000 12/14/2021 2,200 Note: All stock transactions were reported on Form 1099-8, including basis. 5. Sam and Holly own rental property in Florida. The address is 902 Gulf Shore Drive, Naples, FL 34102. The property was purchased June 1, 2012 at an original cost of $400,000. The fully furnished property is rented year-round. Gulf Coast Realty is engaged as a property manager to manage the rental work. In 2021, the property brought in $3,500 per month in rent, with 10% of each rental payment being taken by Gulf Coast Realty as property management fees. The Peters also incurred the following expenses related to this property: $ 450 Advertising Cleaning service 2,250 Depreciation expense 14,544 Insurance 2,750 Mortgage interest 10,200 Property taxes 4,250 Repairs 2,836 Utilities 3,400 Forms 1099 for payments made to contractors were filed as required. 6. Both Sam and Holly had traditional IRAS that they rolled over into Roth IRAs during 2021. They received Forms 1099-R showing the IRA account balances at the time of distribution were $16,000 and $16,000, respectively. The amounts were contributed to their Roth IRA accounts within 60 days. 7. Sam and Holly paid $18,100 of interest on their primary residence (acquisition debt of $750,000). They also paid $4,500 of real estate taxes on the home. 8. The Peters had an $250 balance due on their North Carolina income tax return last year (2020 tax return filed in 2021). They also paid $1,000 of personal property taxes. 9. Sam and Holly made the following charitable contributions this year: First Baptist Church $ 12,700 United Way $ 3,200 University of NC $ 2,500 Salvation Army $ 1,000 Goodwill Clothing ($500 thrift value) Smith Family (neighbors) Household items valued at $400 (to replace items lost in fire) 10. The Peters did not make any quarterly estimated payments during 2021. There was an overpayment of $400 on their 2020 Form 1040 that they elected to apply to 2021. 11. Sam and Holly provide the following additional information: o They both want to contribute to the presidential election campaign. o They did not receive, sell, exchange, or otherwise acquire any financial interest in any virtual currency during 2021. o Any overpayment should be refunded. You have been engaged to prepare the Peters' personal federal income tax return for 2021. Complete the Paid Preparer section at the bottom of Form 1040 (make up a firm name; leave signature and PTIN boxes blank). Unless specifically stated otherwise above, the Peters want you to take any tax positions you can to minimize their tax liability. Additional information/reminders: Schedule E-you do not need to include Form 8582 . Make sure to complete all parts for which you are given information (this includes putting taxpayer names and SSN on every form). If information is missing, use reasonable assumptions to fill in the gaps. Use the space below to enter items of gross income and deductions: Final Tax Return Project (4) Description GROSS INCOME Wages Interest Income Dividend Income State Tax Refund Alimony Received Business income or (Loss) Capital Gain (Losses) Other Gains (Losses) IRA Distributions Pensions and Annuities Rental Income or (Loss) Royalties Flow-Through Entities (partnerships, S corps, trusts) Farm Income or (Loss) Unemployment Compensation Social Security Other Income TOTAL GROSS INCOME 3 24 FOR AGI (Above-the-Line) DEDUCTIONS 25 IRA Deduction 26 Self-Employed Health Insurance Deduction 27 Self-employed SEP, SIMPLE, and Qual. Plans 28 One-Half of Self-Employment Tax 29 Penalty on Early Withdrawal of Savings 30 Student Loan Interest Deduction 1 Alimony Paid 2 33 34 ITEMIZED DEDUCTIONS 35 Medical 36 State and Local Property Taxes 37 State Income Tax 1 Instructions Ready 1 2 TOTAL FOR AGI DEDUCTIONS Reconciliation Sheet Amount 0 Memo From Cap Gains tab From Rental Income tab Subject to floor limitation Gross Income & Deductions Gan Gaine Use the space below to enter items of gross income and deductions: Final Tax Return Project (14) Description Onemployment compensaLTOTT Social Security Other Income TOTAL GROSS INCOME FOR AGI (Above-the-Line) DEDUCTIONS IRA Deduction Self-Employed Health Insurance Deduction Self-employed SEP, SIMPLE, and Qual. Plans One-Half of Self-Employment Tax Penalty on Early Withdrawal of Savings Student Loan Interest Deduction Alimony Paid ITEMIZED DEDUCTIONS 5 Medical 5 State and Local Property Taxes 7 State Income Tax State Sales Tax Home Mortgage Interest 8 9 0 Investment Interest #1 Contributions-Cash 42 Contributions-Non-Cash 43 Casualty and Theft Losses 44 Other Itemized Deductions -45 46 TOTAL FOR AGI DEDUCTIONS Use higher of two 7 TOTAL ITEMIZED DEDUCTIONS Amount 0 0 Memo Subject to floor limitation O State taxes limited to $10,000 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts