Question: plz type the answer Part (A) A.1) The market price of KTC stock is 25 per share. An investor buys 25,000 shares of KTC stock.

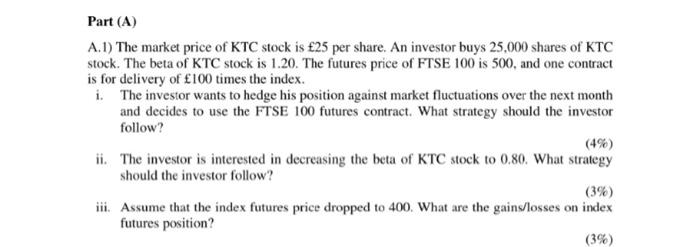

Part (A) A.1) The market price of KTC stock is 25 per share. An investor buys 25,000 shares of KTC stock. The beta of KTC stock is 1.20. The futures price of FTSE 100 is 500, and one contract is for delivery of 100 times the index. i. The investor wants to hedge his position against market fluctuations over the next month and decides to use the FTSE 100 futures contract. What strategy should the investor follow? ii. The investor is interested in decreasing the beta of KTC stock to 0.80. What strategy should the investor follow? (3%) iii. Assume that the index futures price dropped to 400. What are the gains/losses on index futures position? (3%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts