Question: plz type the answer.thx B.1) Smart technology (SMT) is a corporation with 40 million shares outstanding and no debt. Currently, SMT stocks are trading for

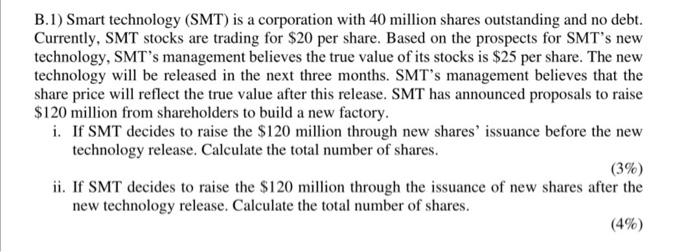

B.1) Smart technology (SMT) is a corporation with 40 million shares outstanding and no debt. Currently, SMT stocks are trading for $20 per share. Based on the prospects for SMT's new technology, SMT's management believes the true value of its stocks is $25 per share. The new technology will be released in the next three months. SMT's management believes that the share price will reflect the true value after this release. SMT has announced proposals to raise $120 million from shareholders to build a new factory. i. If SMT decides to raise the $120 million through new shares' issuance before the new technology release. Calculate the total number of shares. (3%) ii. If SMT decides to raise the $120 million through the issuance of new shares after the new technology release. Calculate the total number of shares. (4%)

Step by Step Solution

There are 3 Steps involved in it

To solve this well calculate how many new shares need to be issued in each scenario to rais... View full answer

Get step-by-step solutions from verified subject matter experts