Question: plz type your answer Question 4 Suppose Excel Corporation will pay a dividend of 2.30 per share at the end of this year and plans

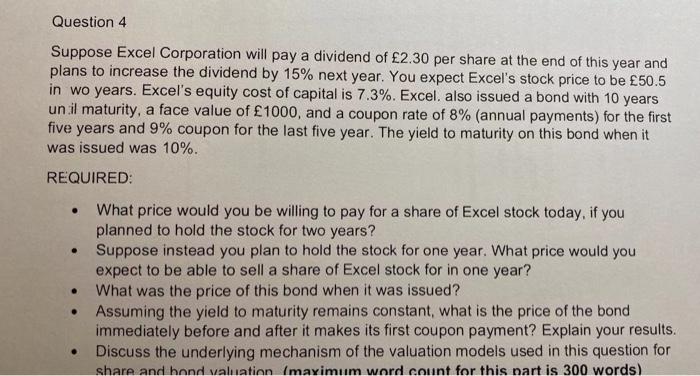

Question 4 Suppose Excel Corporation will pay a dividend of 2.30 per share at the end of this year and plans to increase the dividend by 15% next year. You expect Excel's stock price to be 50.5 in wo years. Excel's equity cost of capital is 7.3%. Excel. also issued a bond with 10 years un il maturity, a face value of 1000, and a coupon rate of 8% (annual payments) for the first five years and 9% coupon for the last five year. The yield to maturity on this bond when it was issued was 10%. REQUIRED: What price would you be willing to pay for a share of Excel stock today, if you planned to hold the stock for two years? Suppose instead you plan to hold the stock for one year. What price would you expect to be able to sell a share of Excel stock for in one year? What was the price of this bond when it was issued? Assuming the yield to maturity remains constant, what is the price of the bond immediately before and after it makes its first coupon payment? Explain your results. Discuss the underlying mechanism of the valuation models used in this question for share and hond valuation (maximum word count for this part is 300 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts