Question: plz write clearly and circle only answer for red do not copy other chegg answers!!!!!!! (1 point) Let So = 86.5 stock price at t=0

plz write clearly and circle

only answer for red

do not copy other chegg answers!!!!!!!

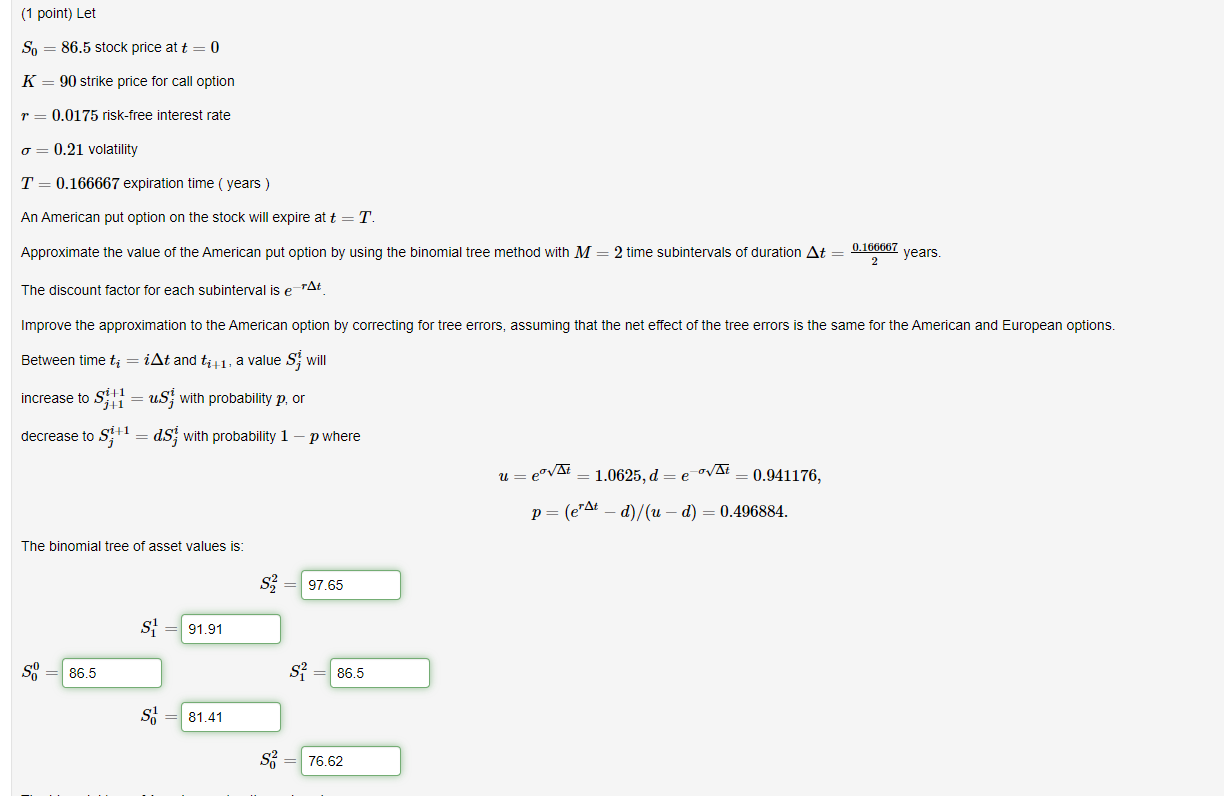

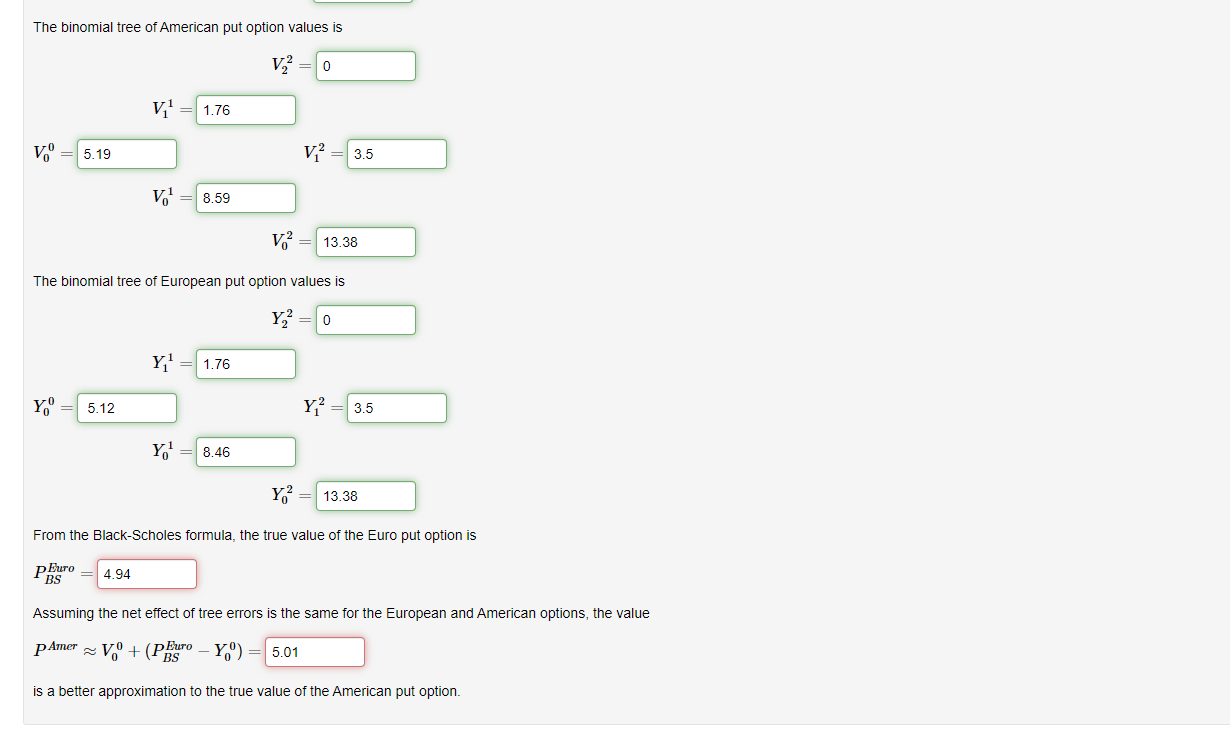

(1 point) Let So = 86.5 stock price at t=0 K = 90 strike price for call option r= 0.0175 risk-free interest rate o= 0.21 volatility T 0.166667 expiration time (years) An American put option on the stock will expire at t=T. Approximate the value of the American put option by using the binomial tree method with M = 2 time subintervals of duration At 0.166667 years. 2 The discount factor for each subinterval is erAt Improve the approximation to the American option by correcting for tree errors, assuming that the net effect of the tree errors is the same for the American and European options. Between time t = iAt and ti+1, a value S, will increase to S/ 11 us with probability p, or decrease to Sit! = ds with probability 1 - p where u= evAt = 1.0625, d = e At = 0.941176, p= (e"At d)/(u - d) 0.496884. The binomial tree of asset values is: S3 = 97.65 S 91.91 S = 86.5 s? 86.5 So 81.41 S = 76.62 The binomial tree of American put option values is V2 = 0 V 1.76 VO 5.19 V? 3.5 Vol 8.59 V.? 13.38 The binomial tree of European put option values is Y2 0 Y, 1.76 YO 5.12 Y? 3.5 Yo 8.46 Y? 13.38 From the Black-Scholes formula, the true value of the Euro put option is pEuro BS 4.94 Assuming the net effect of tree errors is the same for the European and American options, the value p.Amer V. + (PESTO YO) = 5.01 BS is a better approximation to the true value of the American put option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts