Question: plzz help me find the answer asap Insert Column U Overline AON IN Merge Cell Delete Colume 2- Delete Rom CLICK HERE TO SAVE YOUR

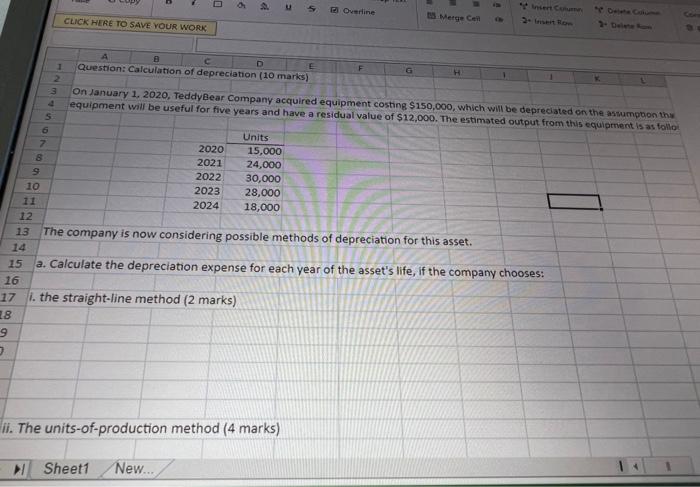

Insert Column U Overline AON IN Merge Cell Delete Colume 2- Delete Rom CLICK HERE TO SAVE YOUR WORK B D 1 Question: Calculation of depreciation (10 marks) 2 3 On January 1, 2020, TeddyBear Company acquired equipment costing $150,000, which will be depreciated on the assumption tha equipment will be useful for five years and have a residual value of $12,000. The estimated output from this equipment is as follo 4 Units 2020 15,000 2021 24,000 2022 30,000 2023 28,000 2024 18,000 12 13 The company is now considering possible methods of depreciation for this asset. 14 15 a. Calculate the depreciation expense for each year of the asset's life, if the company chooses: 16 17. the straight-line method (2 marks) 18 9 7 ii. The units-of-production method (4 marks) Sheet1 New... 9 10 11 CA S 6 7 8 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts