Question: plzz solve its really important.. (Common-size analysis and differences in profitability and leverage) Comparative financial statement data for Cool Brewery Ltd. and Northern Beer Ltd,

plzz solve its really important..

plzz solve its really important..

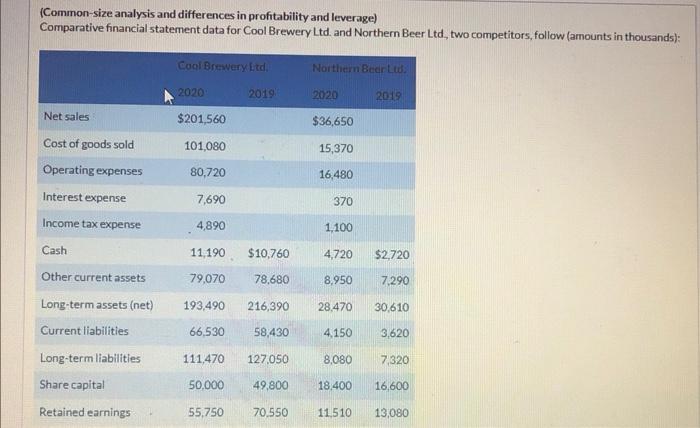

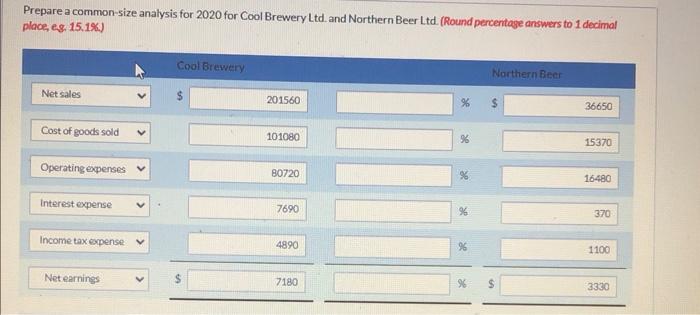

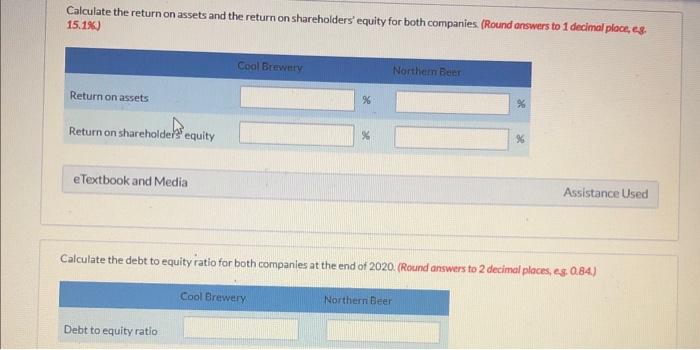

(Common-size analysis and differences in profitability and leverage) Comparative financial statement data for Cool Brewery Ltd. and Northern Beer Ltd, two competitors, follow (amounts in thousands): Cool Brewery Ltd Northern Berlid 2020 2019 2020 2019 Net sales $201,560 $36,650 101,080 15,370 80,720 16,480 7,690 370 4,890 1,100 11 190 $10,760 4,720 $2.720 Cost of goods sold Operating expenses Interest expense Income tax expense Cash Other current assets Long-term assets (net) Current liabilities Long-term liabilities Share capital Retained earnings 79,070 78.680 8,950 7.290 193,490 216,390 28.470 30,610 66,530 58,430 4.150 3,620 111,470 127,050 8,080 7,320 50.000 49,800 18,400 16,600 55,750 70.550 11510 13,080 Prepare a common size analysis for 2020 for Cool Brewery Ltd. and Northern Beer Ltd. (Round percentage answers to 1 decimal place, eg. 15.1%) Cool Brewery Northern Beer Net sales 201560 % $ 36650 Cost of goods sold 101080 56 15370 Operating expenses 80720 9 16480 Interest expense 7690 96 370 Income tax expense 4890 96 1100 Net earnings 7180 $ 3330 Calculate the return on assets and the return on shareholders' equity for both companies (Round answers to 1 decimal place, 6.8. 15.1%) Cool Brewery Northern Beer Return on assets %% % Return on shareholdels equity %6 e Textbook and Media Assistance Used Calculate the debt to equity ratio for both companies at the end of 2020. (Round answers to 2 decimal places, s.0.84) Cool Brewery Northern Beer Debt to equity ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts