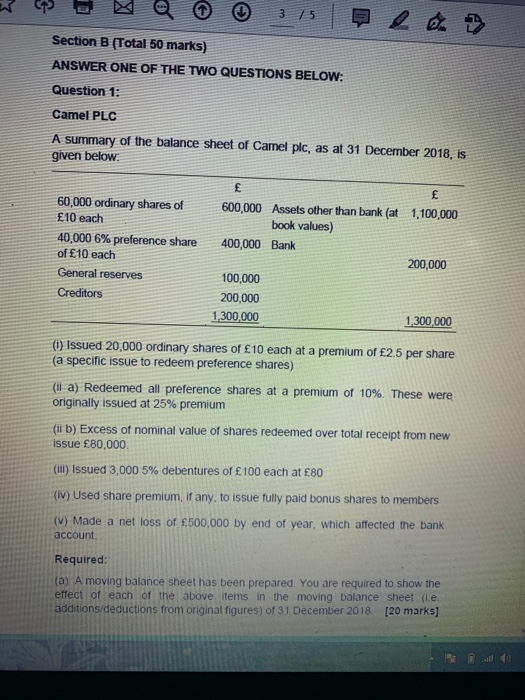

Question: po 315 en > Section B (Total 50 marks) ANSWER ONE OF THE TWO QUESTIONS BELOW: Question 1: Camel PLC A summary of the balance

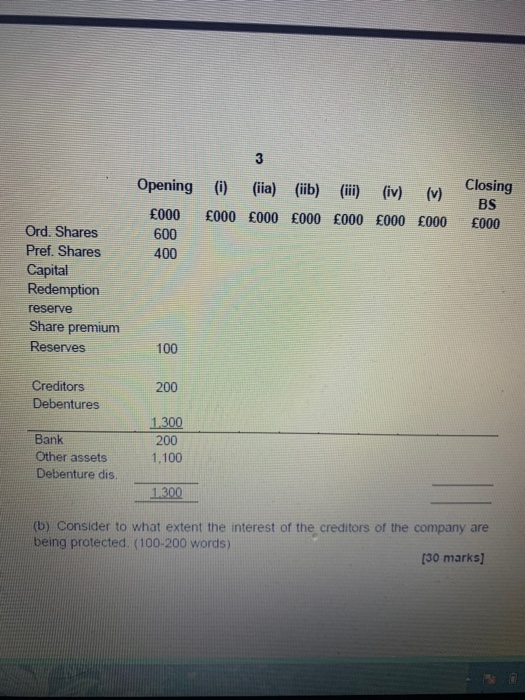

po 315 en > Section B (Total 50 marks) ANSWER ONE OF THE TWO QUESTIONS BELOW: Question 1: Camel PLC A summary of the balance sheet of Camel pic, as at 31 December 2018, is given below 60,000 ordinary shares of 10 each 40,000 6% preference share of 10 each General reserves Creditors 600,000 Assets other than bank (at 1,100,000 book values) 400,000 Bank 200,000 100,000 200,000 1,300,000 1,300,000 (1) Issued 20,000 ordinary shares of 10 each at a premium of 2.5 per share (a specific issue to redeem preference shares) (il a) Redeemed all preference shares at a premium of 10%. These were originally issued at 25% premium (ii b) Excess of nominal value of shares redeemed over total receipt from new issue 80,000 (ill) Issued 3,000 5% debentures of 100 each at 80 (IV) Used share premium, if any, to issue fully paid bonus shares to members (v) Made a net loss of f.500,000 by end of year, which affected the bank account Required: (a) A moving balance sheet has been prepared. You are required to show the effect of each of the above items in the moving balance sheet (e additions/deductions from original figures) of 31 December 2018. [20 marks] 3 Opening () (iia) (iib) (iii) (iv) (v) 000 000 000 000 000 000 000 600 400 Closing BS 000 Ord. Shares Pref. Shares Capital Redemption reserve Share premium Reserves 100 200 Creditors Debentures Bank Other assets Debenture dis 1.300 200 1,100 1.300 (b) Consider to what extent the interest of the creditors of the company are being protected. (100-200 words) [30 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts