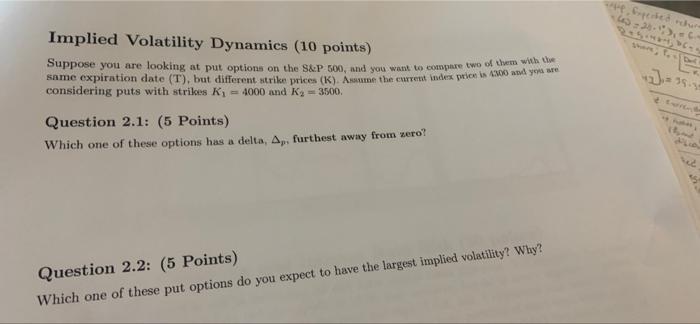

Question: pochure 49), * Implied Volatility Dynamics (10 points) Suppose you are looking at put options on the S&P 500, and you want to compare two

pochure 49), * Implied Volatility Dynamics (10 points) Suppose you are looking at put options on the S&P 500, and you want to compare two of my ore same expiration date (T), but different strike prices (1) Auto the current index pevce is 800 any w considering puts with strikes Ki = 4000 and Ky = 3500 359 Question 2.1: (5 Points) Which one of these options has a delta, A, furthest away from vero? Question 2.2: (5 Points) Which one of these put options do you expect to have the largest implied volatility? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts