Question: points] 2 Financial Statement Impacts [6.5 points) Background: ABC Co recently spent $1,200,000 to acquire a piece of equipment. The accounting staff is unsure how

![points] 2 Financial Statement Impacts [6.5 points) Background: ABC Co recently](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbda212ad3f_40866fbda207c2cb.jpg)

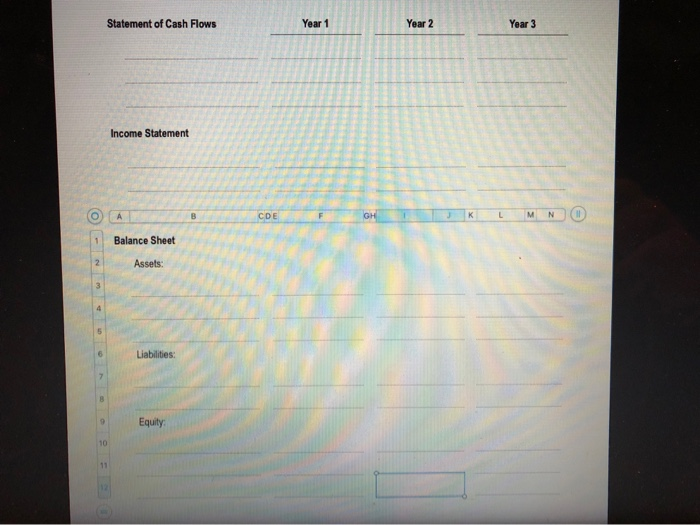

points] 2 Financial Statement Impacts [6.5 points) Background: ABC Co recently spent $1,200,000 to acquire a piece of equipment. The accounting staff is unsure how to properly classify and record the purchase. One employee argues that future benefits of the equipment are unknown beyond the current year and that the expenditure should be expensed completely on the current year income statement. Another employee argues that the expenditure will benefit the current year plus two additional years and should be capitalized as a depreciable asset, depreciating it to a $0 salvage value using straight-ine over a 3 year time period. Required: Using the template provided on Blackboard, show the financial statement impacts of these two alteratives over the three year period. Ignore income taxes. You wil not need to use al lines in the template. ACCT 321 CHAPTER 10/11 HANDOUT| PAGE 1 Statement of Cash Flows Income Statement 1 Balance Sheet Assets: Liabilities: Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts