Question: Points: 25 Question 6 PART B Question 4 (a) Powertek Bhd's preferred stock is selling for RM33.00 in the market and pays an annual dividend

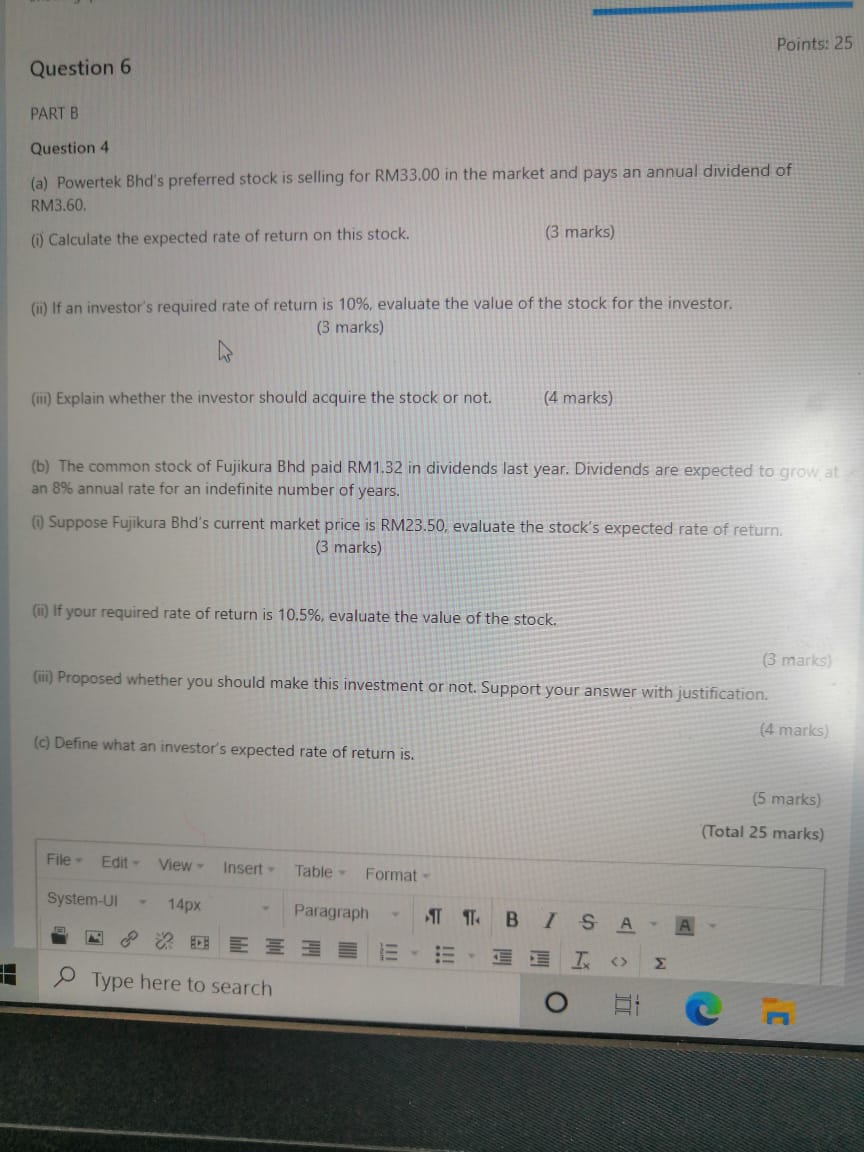

Points: 25 Question 6 PART B Question 4 (a) Powertek Bhd's preferred stock is selling for RM33.00 in the market and pays an annual dividend of RM3.60. (0) Calculate the expected rate of return on this stock. (3 marks) (ii) If an investor's required rate of return is 10%, evaluate the value of the stock for the investor. (3 marks) (1) Explain whether the investor should acquire the stock or not. (4 marks) (b) The common stock of Fujikura Bhd paid RM1.32 in dividends last year. Dividends are expected to grow at an 8% annual rate for an indefinite number of years. Suppose Fujikura Bhd's current market price is RM25.50. evaluate the stock's expected rate of return (3 marks) (m) If your required rate of return is 10.5%, evaluate the value of the stock. (3 marks () Proposed whether you should make this investment or not. Support your answer with justification (4 marks) (c) Define what an investor's expected rate of return is. (5 marks) (Total 25 marks) File - Edit - View Insert - Table - Format System-UI 14px - T. Paragraph EE B 7 SA I. Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts