Question: points, ( : 5 * * 1 } a . According to the rule of 7 2 , how many times your money will be

points, :

a According to the rule of how many times your money will be doubled over a year period if it earns a rate of return of per year? Show your work.

b Using the rule of estimate the value of an initial investment of $ at the end of a year period if it earns a rate of return of per year? Show your work.

c According to the rule, what the size of your investment portfolio needs to be in order for you to withdraw an initial annual amount of $ Show your work.

d Referring to part what will be your annual withdrawal amount if the inflation rate during the years since your initial withdrawal averaged per year? Show your work.

points, Consider the "buy vs rent" Excel spreadsheet provided to you in tab A

a According to the assumptions made in that spreadsheet, should the average individual buy or rent? Briefly explain.

b Using "Goal Seek" alter the "buy vs rent" Excel spreadsheet so that it shows the minimum rate of price appreciation the homeowner must receive in order to be better off buying than renting. Highlight in yellow the cell that includes this price appreciation rate.

points, Consider the levered DCF model provided to you in tab A of the Excel spreadsheet.

a Calculate the maximum price that an investor with the assumptions made in the model should be willing to pay for that property. Show this maximum price in cell C

b If you expect a general increase in the risk premium for real estate investments over the next years, how would this affect the expected levered return on this property? Briefly Explain.

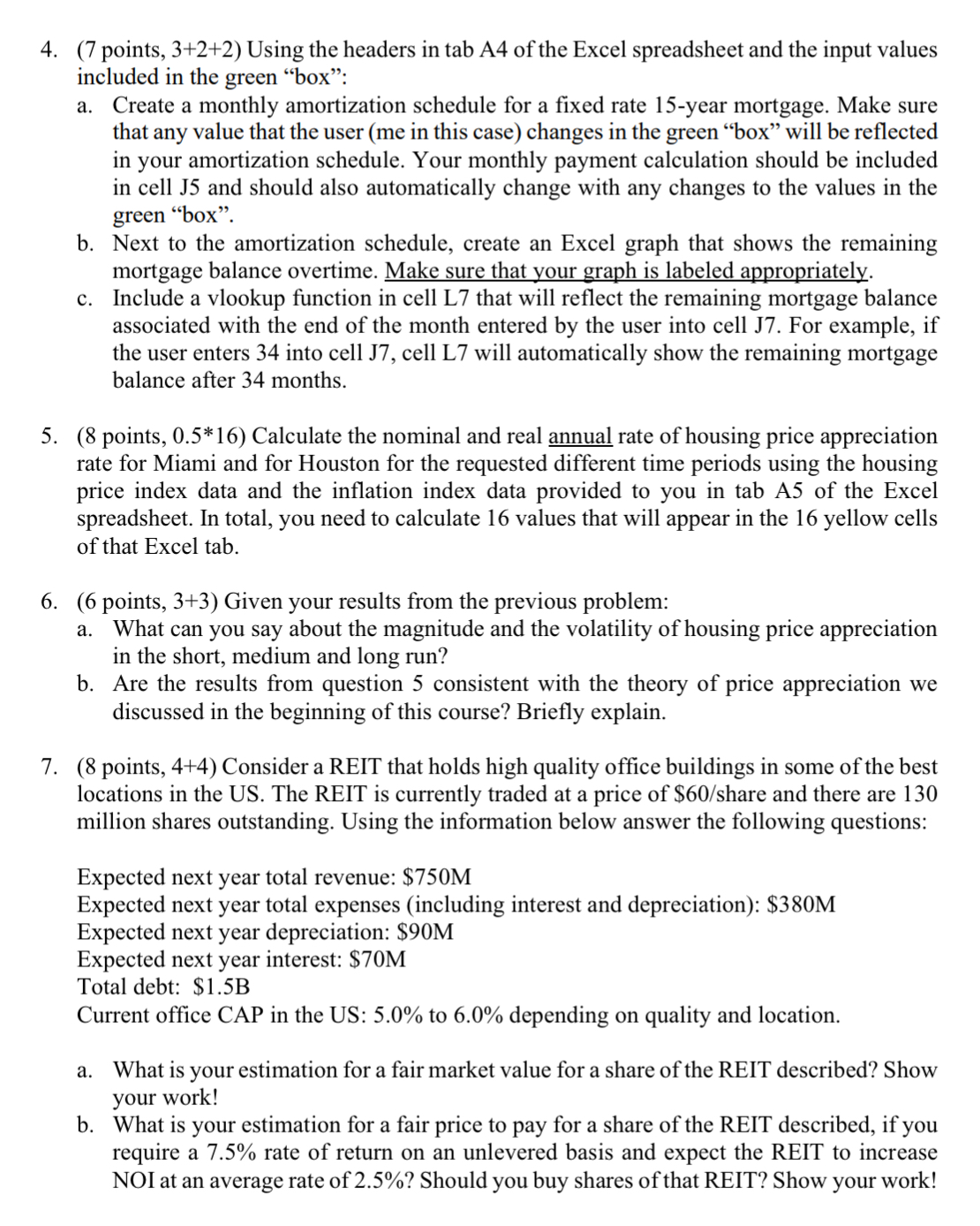

points, Using the headers in tab A of the Excel spreadsheet and the input values included in the green "box":

a Create a monthly amortization schedule for a fixed rate year mortgage. Make sure that any value that the user me in this case changes in the green "box" will be reflected in your amortization schedule. Your monthly payment calculation should be included in cell and should also automatically change with any changes to the values in the green "box".

b Next to the amortization schedule, create an Excel graph that shows the remaining mortgage balance overtime. Make sure that your graph is labeled appropriately.

c Include a vlookup function in cell L that will reflect the remaining mortgage balance associated with the end of the month entered by the user into cell J For example, if the user enters into cell J cell L will automatically show the remaining mortgage balance after months.

points, : Calculate the nominal and real annual rate of housing price appreciation rate for Miami and for Houston for the requested different time periods using the housing price index data and the inflation index data provided to you in tab A of the Excel spreadsheet. In total, you need to calculate values that will appear in the yellow cells of that Excel tab.

points, Given your results from the previous problem:

a What can you say about the magnitude and the volatility of housing price appreciation in the short, medium and long run?

b Are the results from question consistent with the theory of price appreciation we discussed in the beginning of this course? Briefly explain.

points, Consider a REIT that holds high quality office buildings in some of the best locations in the US The REIT is currently traded at a price of $share and there are million shares outstanding. Using the information below answer the following questions:

Expected next year total revenue: $

Expected next year total expenses including interest and depreciation: $

Expected next year depreciation: $

Expected next year interest: $

Total debt: $

Current office CAP in the US: to depending on quality and location.

a What is your estimation for a fair market value for a share of the REIT described? Show your work!

b What is your estimation for a fair price to pay for a share of the REIT described, if you require a rate of return on an unlevered basis and expect the REIT to increase NOI at an average rate of Should you buy shares of that REIT? Show your work!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock