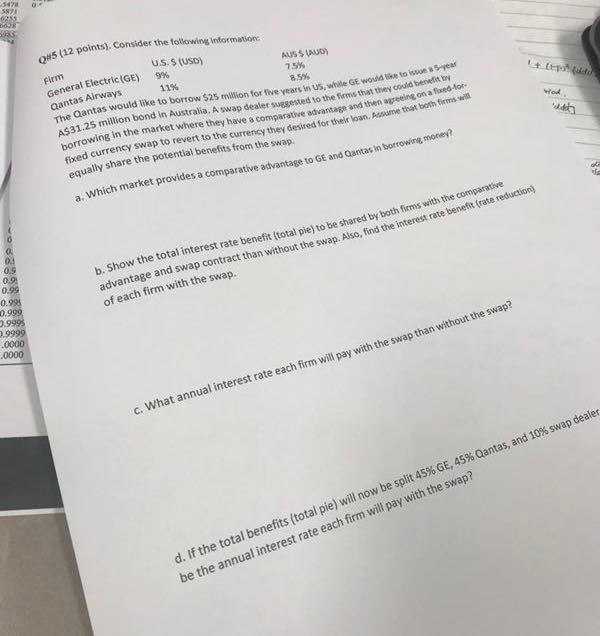

Question: points). Consider the folowing information U.S.$ (USD) 9% Firm General Electric(GE) Qantas Alrways AUS S (AUD) 7.5% 11% 8.5% ntas would like to borrow $25

points). Consider the folowing information U.S.$ (USD) 9% Firm General Electric(GE) Qantas Alrways AUS S (AUD) 7.5% 11% 8.5% ntas would like to borrow $25 million for five years in US, wile GE wous S million bond in Australia. A swap dealer sugsested to t GE would like to issue a S year e firms that they could benefst by in the market where they have a comparatve advantage and then agreeing on a fixed-tor- fixed currency swap to revert to the equally share the potential benefits from the sw currency thev desired for their loan. Assume that both rsw a. Which market provides a comparative advantage to GE and Qantas in borrowing money? 0 04 0.9 0.9 0.99 b. Show the total interest rate benefit (total pie) to be shared by both firms with dvantage and swap contract than without the swap. Also, find the interest rate be of each firm with the swap. nefit (rate reduction) 0.99 0.999 c. What annual interest rate each firm will pay with the swap than without the swap? d, if the total benefits (total pie) will now be split 45% GE, 45% Qantas, and 10% swap dealer be the annual interest rate each firm will pay with the swap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts