Question: Points for correct and fast answers U Question 18 5 pts Last month, Dow Chemical analyzed a project with an initial cash outflow of $1

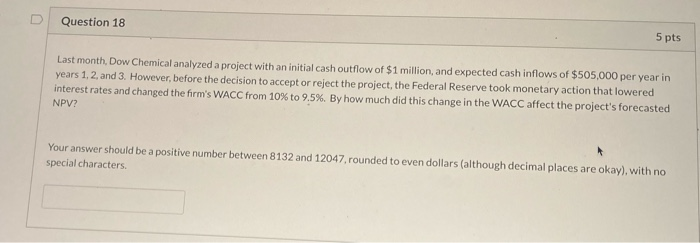

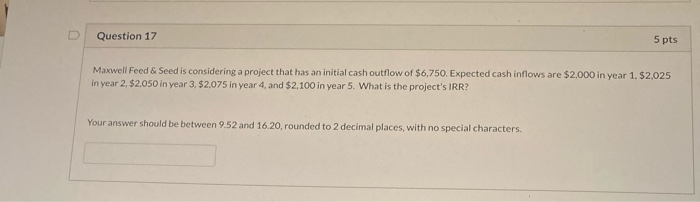

U Question 18 5 pts Last month, Dow Chemical analyzed a project with an initial cash outflow of $1 million, and expected cash inflows of $505,000 per year in years 1, 2 and 3. However, before the decision to accept or reject the project, the Federal Reserve took monetary action that lowered interest rates and changed the firm's WACC from 10% to 9.5%. By how much did this change in the WACC affect the project's forecasted NPV? Your answer should be a positive number between 8132 and 12047 rounded to even dollars (although decimal places are okay), with no special characters Question 17 5 pts Maxwell Feed & Seed is considering a project that has an initial cash outflow of $6.750. Expected cash inflows are $2,000 in year 1. $2,025 in year 2. $2,050 in year 3. $2,075 in year 4, and $2.100 in year 5. What is the project's IRR? Your answer should be between 9.52 and 16.20, rounded to 2 decimal places, with no special characters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts