Question: Points Problem 1 The first tey principle to take away from this problem is that the swap rate at the outset of a contract is

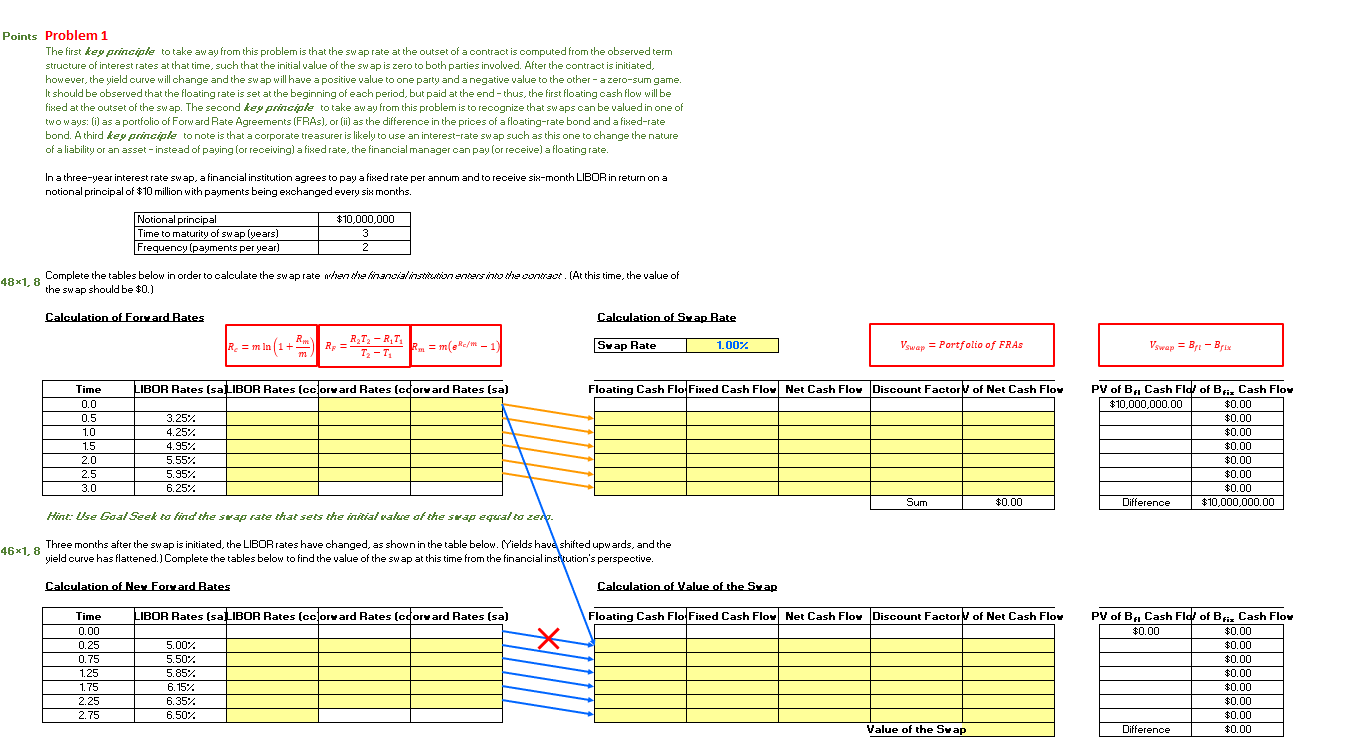

Points Problem 1 The first tey principle to take away from this problem is that the swap rate at the outset of a contract is computed from the observed term structure of interest rates at that time, such that the initial value of the swap is zero to both parties involved. After the contract is initiated, however, the yield curve will change and the swap will have a positive value to one party and a negative value to the other - a zero-sum game. It should be observed that the floating rate is set at the beginning of each period, but paid at the end - thus, the first floating cash flow will be fixed at the outset of the swap. The second key principle to take away from this problem is to recognize that swaps can be valued in one of two ways: (i) as a portfolio of Forward Rate Agreements (FRAS), or (ii) as the difference in the prices of a floating-rate bond and a fixed-rate bond. Athird key principle to note is that a corporate treasurer is likely to use an interest-rate swap such as this one to change the nature of a liability or an asset - instead of paying (or receiving) a fixed rate, the financial manager can pay Correceive) a floating rate. In a three-year interest rate swap, a financial institution agrees to pay a fixed rate per annum and to receive six-month LIBOR in return on a notional principal of $10 million with payments being exchanged every six months. Notional principal Time to maturity of swap (years) Frequency (payments per year) $10,000,000 3 2 48x1,8 Complete the tables below in order to calculate the swap rate when we finaliseringers in the core. (At this time, the value of the swap should be $0.) Calculation of Forward Rates Calculation of Swap Rate R = m In (1+FR = Rp R.T-RT T2-T 2. = m(e/- Svap Rate 1.00% Vswap = Portfolio of FRAs Vswap = Br - Brix LIBOR Rates (saLIBOR Rates (ccorvard Rates (corvard Rates (sa) Floating Cash Flo Fixed Cash Flow Net Cash Flow Discount Factory of Net Cash Flox Time 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.25% 4.25% 4.95% 5.55% 5.95% % 6.25% PV of B. Cash Fld of Briz Cash Flow $10,000,000.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Difference $10,000,000.00 Sum $0.00 Hint: Use Goal Seek to find the stap rate that sets the initial value of the stap equal to zen 46x1,8 Three months after the swap is initiated, the LIBOR rates have changed, as shown in the table below. Yields have shifted upwards, and the yield curve has flattened.) Complete the tables below to find the value of the swap at this time from the financial institution's perspective. Calculation of Ner Forvard Rates Calculation of Value of the Swap LIBOR Rates (saLIBOR Rates (ccorvard Rates (coorvard Rates (sa) Floating Cash Flo Fixed Cash Flow Net Cash Flow Discount Factory of Net Cash Floy * Time 0.00 0.25 0.75 1.25 1.75 2.25 2.75 5.00% 5.50% 5.85% 6.15% 6.35% 6.50% PV of B. Cash Fld of Bfiz Cash Floy $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Difference $0.00 Value of the Swap Points Problem 1 The first tey principle to take away from this problem is that the swap rate at the outset of a contract is computed from the observed term structure of interest rates at that time, such that the initial value of the swap is zero to both parties involved. After the contract is initiated, however, the yield curve will change and the swap will have a positive value to one party and a negative value to the other - a zero-sum game. It should be observed that the floating rate is set at the beginning of each period, but paid at the end - thus, the first floating cash flow will be fixed at the outset of the swap. The second key principle to take away from this problem is to recognize that swaps can be valued in one of two ways: (i) as a portfolio of Forward Rate Agreements (FRAS), or (ii) as the difference in the prices of a floating-rate bond and a fixed-rate bond. Athird key principle to note is that a corporate treasurer is likely to use an interest-rate swap such as this one to change the nature of a liability or an asset - instead of paying (or receiving) a fixed rate, the financial manager can pay Correceive) a floating rate. In a three-year interest rate swap, a financial institution agrees to pay a fixed rate per annum and to receive six-month LIBOR in return on a notional principal of $10 million with payments being exchanged every six months. Notional principal Time to maturity of swap (years) Frequency (payments per year) $10,000,000 3 2 48x1,8 Complete the tables below in order to calculate the swap rate when we finaliseringers in the core. (At this time, the value of the swap should be $0.) Calculation of Forward Rates Calculation of Swap Rate R = m In (1+FR = Rp R.T-RT T2-T 2. = m(e/- Svap Rate 1.00% Vswap = Portfolio of FRAs Vswap = Br - Brix LIBOR Rates (saLIBOR Rates (ccorvard Rates (corvard Rates (sa) Floating Cash Flo Fixed Cash Flow Net Cash Flow Discount Factory of Net Cash Flox Time 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.25% 4.25% 4.95% 5.55% 5.95% % 6.25% PV of B. Cash Fld of Briz Cash Flow $10,000,000.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Difference $10,000,000.00 Sum $0.00 Hint: Use Goal Seek to find the stap rate that sets the initial value of the stap equal to zen 46x1,8 Three months after the swap is initiated, the LIBOR rates have changed, as shown in the table below. Yields have shifted upwards, and the yield curve has flattened.) Complete the tables below to find the value of the swap at this time from the financial institution's perspective. Calculation of Ner Forvard Rates Calculation of Value of the Swap LIBOR Rates (saLIBOR Rates (ccorvard Rates (coorvard Rates (sa) Floating Cash Flo Fixed Cash Flow Net Cash Flow Discount Factory of Net Cash Floy * Time 0.00 0.25 0.75 1.25 1.75 2.25 2.75 5.00% 5.50% 5.85% 6.15% 6.35% 6.50% PV of B. Cash Fld of Bfiz Cash Floy $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Difference $0.00 Value of the Swap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts