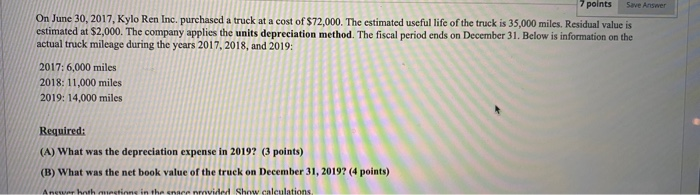

Question: > points Save Answer On June 30, 2017, Kylo Ren Inc. purchased a truck at a cost of $72,000. The estimated useful life of the

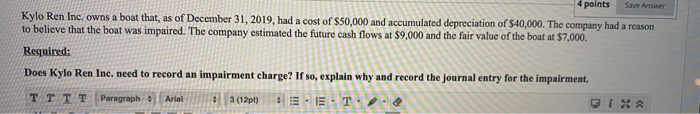

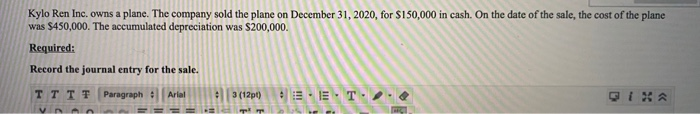

> points Save Answer On June 30, 2017, Kylo Ren Inc. purchased a truck at a cost of $72,000. The estimated useful life of the truck is 35,000 miles. Residual value is! estimated at $2,000. The company applies the units depreciation method. The fiscal period ends on December 31. Below is information on the actual truck mileage during the years 2017, 2018, and 2019: 2017: 6,000 miles 2018: 11,000 miles 2019: 14,000 miles Required: (A) What was the depreciation expense in 2019? (B) What was the net book value of the truck on December 31, 2019? (4 points) ided Show calculations Kylo Ren Inc. owns a boat that, as of December 31, 2019, had a cost of $50,000 and accumulated depreciation of $40,000. The company had a reason to believe that the boat was impaired. The company estimated the future cash flows at $9.000 and the fair value of the boat at $7,000 Required: Does Kylo Ren Inc. need to record an impairment charge? If so, explain why and record the journal entry for the impairment. TTTT Paragraph Ariel (12) Kylo Ren Inc. owns a plane. The company sold the plane on December 31, 2020, ,2020, for $150,000 in cash. On the date of the sale, the cost of the plane was $450,000. The accumulated depreciation was $200,000. Required: Record the journal entry for the sale. TT TT Paragraph : Arial v = = = = 3 (12pt) =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts