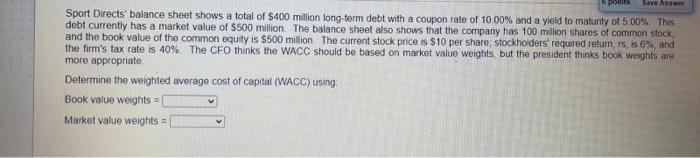

Question: points Save Answer Sport Directs' balance sheet shows a total of $400 million long term debt with a coupon rate of 1000% and a yield

points Save Answer Sport Directs' balance sheet shows a total of $400 million long term debt with a coupon rate of 1000% and a yield to matunty of 5.00% This debt currently has a market value of $500 million. The balance sheet also shows that the company has 100 million shares of common stock and the book value of the common equity is $500 million. The current stock price is $10 per share; stockholders' required return, rs, is 6%, and the firm's tax rate is 40% The CFO thinks the WACC should be based on market value weights, but the president thinks book weights are more appropriate Determine the weighted average cost of capital (WACC) using Book value weights = 1 Market value weights =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts