Question: points Save Answer Webber's gross tax liability is $417. Webber is entitled to an $764 nonrefundable personal tax credit, a $301 business tax credit, and

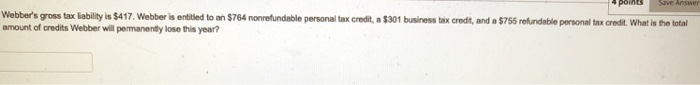

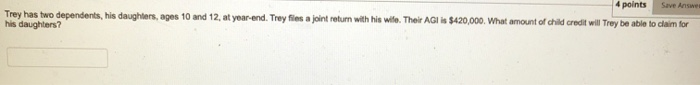

points Save Answer Webber's gross tax liability is $417. Webber is entitled to an $764 nonrefundable personal tax credit, a $301 business tax credit, and a $755 refundable personal tax credit. What is the total amount of credits Webber wil permanently lose this year? Save Answer 4 points Trey has two dependents, his daughters, ages 10 and 12, at year-end. Trey files a joint return with his wife. Their AGB is $420,000. What amount of child credit will Trey be able to claim for his daughters

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock