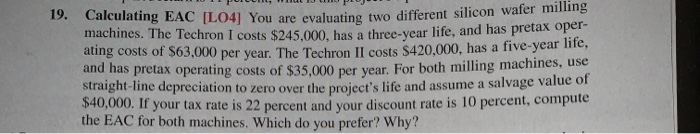

Question: POLIPE 19. Calculating EAC L04) You are evaluating two different silicon wan machines. The Techron I costs $245,000, has a three-year life, and has pretas

POLIPE 19. Calculating EAC L04) You are evaluating two different silicon wan machines. The Techron I costs $245,000, has a three-year life, and has pretas . ating costs of $63,000 per year. The Techron Il costs $420,000, has a five-year lite, and has pretax operating costs of $35,000 per year. For both milling machines, straight-line depreciation to zero over the project's life and assume a salvage value of $40,000. If your tax rate is 22 percent and your discount rate is 10 percent, compute the EAC for both machines. Which do you prefer? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts