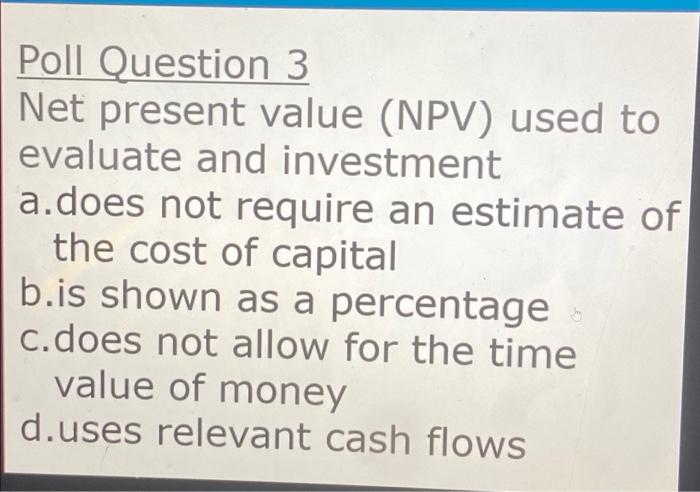

Question: Poll Question 3 Net present value (NPV) used to evaluate and investment a.does not require an estimate of the cost of capital b.is shown as

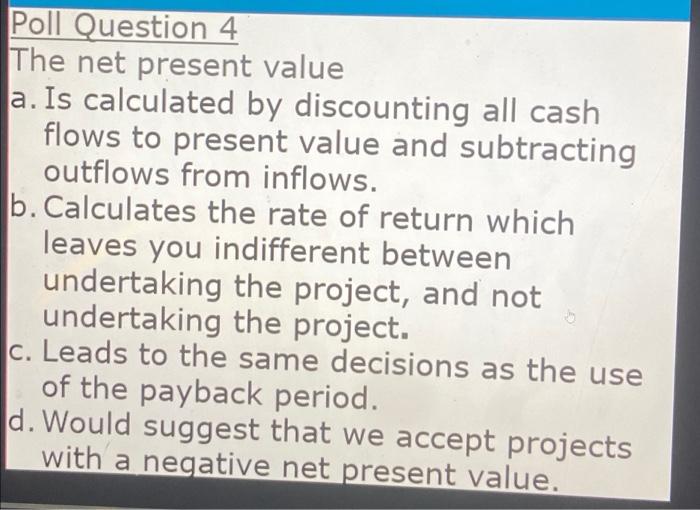

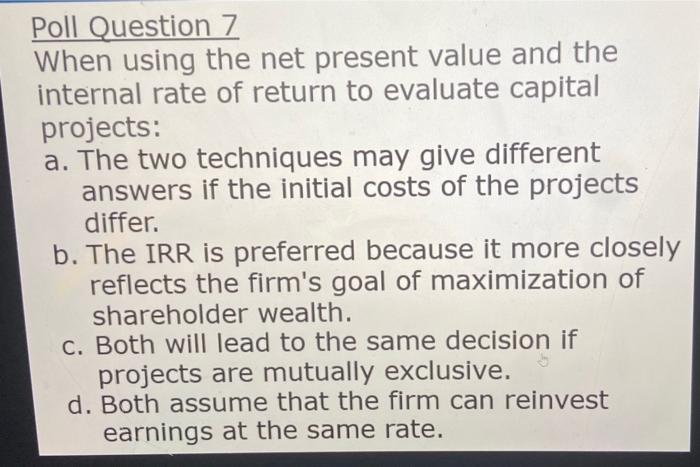

Poll Question 3 Net present value (NPV) used to evaluate and investment a.does not require an estimate of the cost of capital b.is shown as a percentage c.does not allow for the time value of money d.uses relevant cash flows Poll Question 4 The net present value a. Is calculated by discounting all cash flows to present value and subtracting outflows from inflows. b. Calculates the rate of return which leaves you indifferent between undertaking the project, and not undertaking the project. c. Leads to the same decisions as the use of the payback period. d. Would suggest that we accept projects with a negative net present value. Poll Question 7 When using the net present value and the internal rate of return to evaluate capital projects: a. The two techniques may give different answers if the initial costs of the projects differ. b. The IRR is preferred because it more closely reflects the firm's goal of maximization of shareholder wealth. c. Both will lead to the same decision if projects are mutually exclusive. d. Both assume that the firm can reinvest earnings at the same rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts