Question: Pop Corporation exchanged 4 0 , 0 0 0 previously unissued no par common shares for a 4 0 percent interest in Son Corporation on

Pop Corporation exchanged previously unissued no par common shares for a percent interest

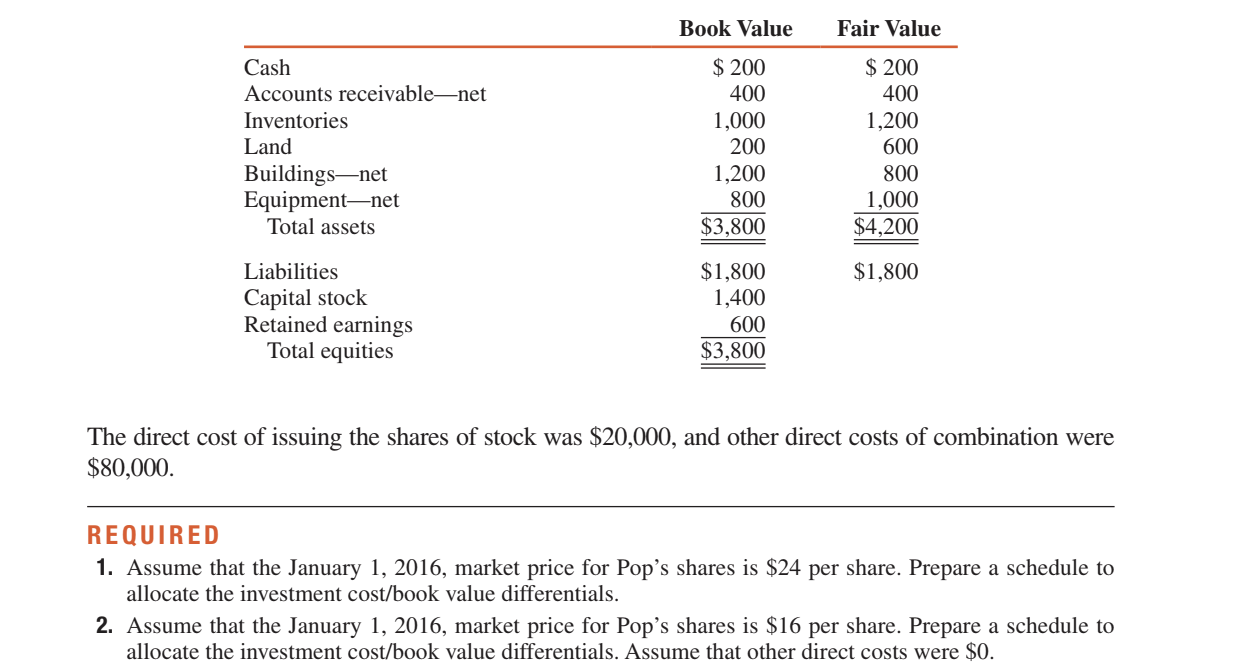

in Son Corporation on January The assets and liabilities of Son on that date after the exchange

were as follows in thousands: The direct cost of issuing the shares of stock was $ and other direct costs of combination were

$

REQUIRED

Assume that the January market price for Pop's shares is $ per share. Prepare a schedule to

allocate the investment costbook value differentials.

Assume that the January market price for Pop's shares is $ per share. Prepare a schedule to

allocate the investment costbook value differentials. Assume that other direct costs were $

Info Adicional:

El inventario subvaluado se vende, el terreno no se deprecia, el edificio queda una vida til remanente de aos y el equipo de aos

Valor nominal acciones $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock