Question: porfolio management QUESTIONS: A Create a plot that shows the daily variance estimates (from Table 3) for the construction industry (CNSTR) over the 1976-2020 sample.

porfolio management

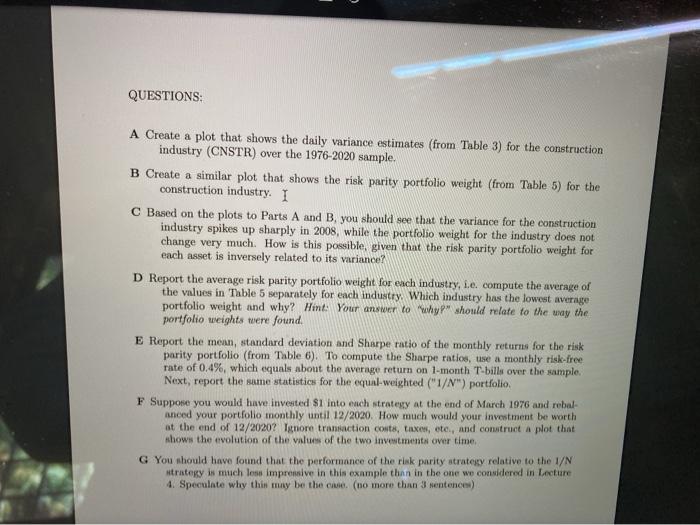

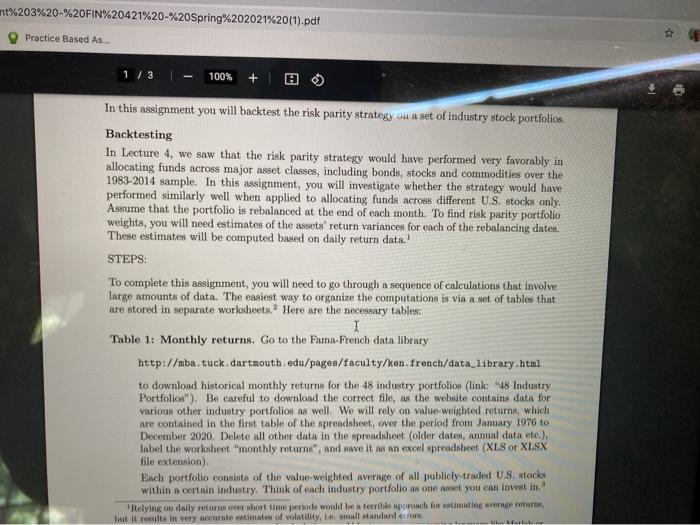

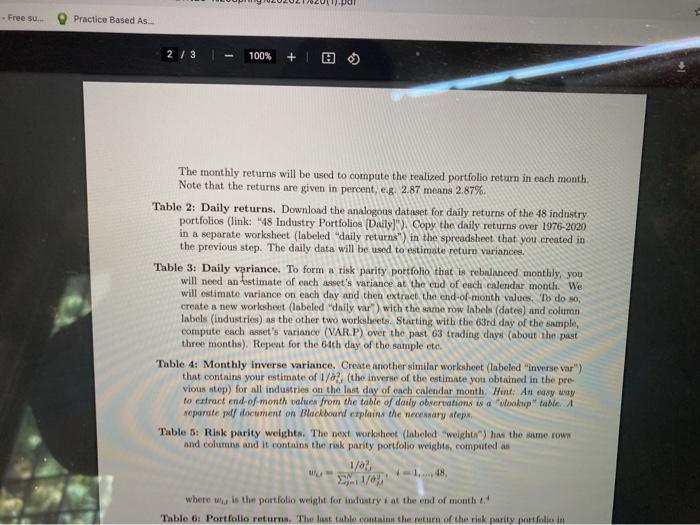

QUESTIONS: A Create a plot that shows the daily variance estimates (from Table 3) for the construction industry (CNSTR) over the 1976-2020 sample. B Create a similar plot that shows the risk parity portfolio weight (from Table 5) for the construction industry. I C Based on the plots to Parts A and B, you should see that the variance for the construction industry spikes up sharply in 2008, while the portfolio weight for the industry does not change very much. How is this possible, given that the risk parity portfolio weight for each asset is inversely related to its variance D Report the average risk parity portfolio weight for each industry, i.e. compute the average of the values in Table 5 separately for each industry. Which industry has the lowest average portfolio weight and why? Hint: Your answer to why should relate to the way the portfolio weights were found. E Report the mean, standard deviation and Sharpe ratio of the monthly returns for the risk parity portfolio (from Table 6). To compute the Sharpe ratios, use a monthly risk-free rate of 0.4%, which equals about the average return on 1-month T-bills over the sample. Next, report the same statistics for the equat-weighted ("1/N) portfolio F Suppose you would have invested $1 into each strategy at the end of March 1976 and rebal- anced your portfolio monthly until 12/2020. How much would your investment be worth at the end of 12/2020? Ignore transaction costs, taxes, etc., and construct a plot that shows the evolution of the values of the two investments over time. G You should have found that the performance of the risk parity strategy relative to the 1/N strategy is much less impressive in this example than in the one we considered in Lecture 4. Speculate why this may be the case. (no more than 3 sentences) nt%203%20-%20FIN%20421%20-%20Spring%202021%20(1).pdf Practice Based As... 1/3 100% In this assignment you will backtest the risk parity strategy on a set of industry stock portfolios. Backtesting In Lecture 4, we saw that the risk parity strategy would have performed very favorably in allocating funds across major asset classes, including bonds, stocks and commodities over the 1983-2014 sample. In this assignment, you will investigate whether the strategy would have performed similarly well when applied to allocating funds across different U.S. stocks only. Assume that the portfolio is rebalanced at the end of each month. To find risk parity portfolio weights, you will need estimates of the assets' return variances for each of the rebalancing dates. These estimates will be computed based on daily return data.! STEPS: To complete this assignment, you will need to go through a sequence of calculations that involve large amounts of data. The easiest way to organize the computations is via a set of tables that kre stored in separate worksheets. Here are the necessary tables: 1 Table 1: Monthly returns. Go to the Fama French data library http://mba tuck dartmouth.edu/pages/faculty/ken. french/data_library.html to download historical monthly returns for the 48 industry portfolios (link: "48 Industry Portfolios"). Be careful to download the correct file, as the website contains data for various other industry portfolios as well. We will rely on value-weighted returns, which are contained in the first table of the spreadsheet, over the period from January 1976 to December 2020. Delete all other data in the spreadsheet (older dates, annual data etc.), label the worksheet "monthly returns", and save it was an excel spreadsheet (XLS or XLSX file extension) Each portfolio consists of the value-weighted average of all publicly traded U.S. stockor within a certain industry. Think of each industry portfolio as one we you can invest in. Relying on daily returns over short time periode would be a terrible approach for eitimating ageretur, but it was in very accurate estimates of volatility, 14, wmall andard errors - Free su Practice Based As 2/3 100% + The monthly returns will be used to compute the realized portfolio return in each month Note that the returns are given in percent, e.g. 2.87 means 2.87% Table 2: Daily returns. Download the analogous dataset for daily returns of the 48 industry portfolios (link: "48 Industry Portfolios (Daily). Copy the daily returns over 1976-2000 in a separate worksheet (labeled daily returns") in the spreadsheet that you created in the previous step. The daily data will be used to estimate return variances. Table 3: Daily vpriance. To form a risk parity portfolio that is rebalanced monthly, you will need an estimate of each asset's variance at the cud of each calendar month. We will estimate variance on each day and then extract the end-of-month values. To do so create a new worksheet (labeled "daily var") with the same row labels (date) and column labels (industries as the other two worksheets. Starting with the 63rd day of the sample, compute each asset's variance (VAR.P) over the past 63 trading days (about the past three months). Repeat for the 6th day of the sample etc Table 4: Monthly Inverse variance. Create another similar worksheet (labeled "inverse var"> that contains your estimate of 1/0% (the inverse of the estimate you obtained in the pre- vious step) for all industries on the last day of each calendar mouth Hint: An easy way to extract end of month values from the table of daily observations is a wookup table. A Neparate al document on Blackboard explains the weary step Table 3: Risk parity weights. The next worksheet (labeled "weight") hus the same rown and columns and it contains the risk parity portfolio weight, computed as 1/02 1,48 where is the portfolio weight for industry at the end of month t." Table 6: Portfolio returns. The Inst table contains the return of the risk purity portfolio in Assignment 3 - FIN 421 - Sprix + y/Downloads/Assignment%203%20-%20FIN%20421%20-%20Spring%202021%20(1).pdf S StuDocu - Free Practice Based As... 2021 (1).pdf 2/3 100% + 0 to extract end-of-month values from the table of daily observations 15 a lookup taules separate pdf document on Blackboard explains the necessary steps Table 5: Risk parity weights. The next worksheet (labeled "weights") has the same rows and columns and it contains the risk parity portfolio weights, computed as 1/03 i=1,..., 48, where is the portfolio weight for industry i at the end of month." Table 6: Portfolio returns. The last table contains the return of the risk parity portfolio in each month, i.e. AP - Note the timing portfolio weights are computed at the end of month - I, where returns are observed over month t. Put differently, portfolio weights are based on volatility estimates that use daily returns up to the last day of t-1, and they are combined with the monthly returns of the industries in montht to find the portfolio return in month In the same table, compute the monthly returns for the naive 1/N portfolio in a separate column. This portfolio will serve as a point of comparison. Hint: The return of the equal weighted portfolio equals the simple average over the 18 industry portfolio returns, 1/N 140 1.. Recall from docture that this formularul in approximaterik parity portfolio wicht so it more cores. It is commonly used by practitioners due to its implicity. An exact solution would require the of solver, which is prohibitive for us in this content it would require a programming lane) 2/3 QUESTIONS: A Create a plot that shows the daily variance estimates (from Table 3) for the construction industry (CNSTR) over the 1976-2020 sample. B Create a similar plot that shows the risk parity portfolio weight (from Table 5) for the construction industry. I C Based on the plots to Parts A and B, you should see that the variance for the construction industry spikes up sharply in 2008, while the portfolio weight for the industry does not change very much. How is this possible, given that the risk parity portfolio weight for each asset is inversely related to its variance D Report the average risk parity portfolio weight for each industry, i.e. compute the average of the values in Table 5 separately for each industry. Which industry has the lowest average portfolio weight and why? Hint: Your answer to why should relate to the way the portfolio weights were found. E Report the mean, standard deviation and Sharpe ratio of the monthly returns for the risk parity portfolio (from Table 6). To compute the Sharpe ratios, use a monthly risk-free rate of 0.4%, which equals about the average return on 1-month T-bills over the sample. Next, report the same statistics for the equat-weighted ("1/N) portfolio F Suppose you would have invested $1 into each strategy at the end of March 1976 and rebal- anced your portfolio monthly until 12/2020. How much would your investment be worth at the end of 12/2020? Ignore transaction costs, taxes, etc., and construct a plot that shows the evolution of the values of the two investments over time. G You should have found that the performance of the risk parity strategy relative to the 1/N strategy is much less impressive in this example than in the one we considered in Lecture 4. Speculate why this may be the case. (no more than 3 sentences) nt%203%20-%20FIN%20421%20-%20Spring%202021%20(1).pdf Practice Based As... 1/3 100% In this assignment you will backtest the risk parity strategy on a set of industry stock portfolios. Backtesting In Lecture 4, we saw that the risk parity strategy would have performed very favorably in allocating funds across major asset classes, including bonds, stocks and commodities over the 1983-2014 sample. In this assignment, you will investigate whether the strategy would have performed similarly well when applied to allocating funds across different U.S. stocks only. Assume that the portfolio is rebalanced at the end of each month. To find risk parity portfolio weights, you will need estimates of the assets' return variances for each of the rebalancing dates. These estimates will be computed based on daily return data.! STEPS: To complete this assignment, you will need to go through a sequence of calculations that involve large amounts of data. The easiest way to organize the computations is via a set of tables that kre stored in separate worksheets. Here are the necessary tables: 1 Table 1: Monthly returns. Go to the Fama French data library http://mba tuck dartmouth.edu/pages/faculty/ken. french/data_library.html to download historical monthly returns for the 48 industry portfolios (link: "48 Industry Portfolios"). Be careful to download the correct file, as the website contains data for various other industry portfolios as well. We will rely on value-weighted returns, which are contained in the first table of the spreadsheet, over the period from January 1976 to December 2020. Delete all other data in the spreadsheet (older dates, annual data etc.), label the worksheet "monthly returns", and save it was an excel spreadsheet (XLS or XLSX file extension) Each portfolio consists of the value-weighted average of all publicly traded U.S. stockor within a certain industry. Think of each industry portfolio as one we you can invest in. Relying on daily returns over short time periode would be a terrible approach for eitimating ageretur, but it was in very accurate estimates of volatility, 14, wmall andard errors - Free su Practice Based As 2/3 100% + The monthly returns will be used to compute the realized portfolio return in each month Note that the returns are given in percent, e.g. 2.87 means 2.87% Table 2: Daily returns. Download the analogous dataset for daily returns of the 48 industry portfolios (link: "48 Industry Portfolios (Daily). Copy the daily returns over 1976-2000 in a separate worksheet (labeled daily returns") in the spreadsheet that you created in the previous step. The daily data will be used to estimate return variances. Table 3: Daily vpriance. To form a risk parity portfolio that is rebalanced monthly, you will need an estimate of each asset's variance at the cud of each calendar month. We will estimate variance on each day and then extract the end-of-month values. To do so create a new worksheet (labeled "daily var") with the same row labels (date) and column labels (industries as the other two worksheets. Starting with the 63rd day of the sample, compute each asset's variance (VAR.P) over the past 63 trading days (about the past three months). Repeat for the 6th day of the sample etc Table 4: Monthly Inverse variance. Create another similar worksheet (labeled "inverse var"> that contains your estimate of 1/0% (the inverse of the estimate you obtained in the pre- vious step) for all industries on the last day of each calendar mouth Hint: An easy way to extract end of month values from the table of daily observations is a wookup table. A Neparate al document on Blackboard explains the weary step Table 3: Risk parity weights. The next worksheet (labeled "weight") hus the same rown and columns and it contains the risk parity portfolio weight, computed as 1/02 1,48 where is the portfolio weight for industry at the end of month t." Table 6: Portfolio returns. The Inst table contains the return of the risk purity portfolio in Assignment 3 - FIN 421 - Sprix + y/Downloads/Assignment%203%20-%20FIN%20421%20-%20Spring%202021%20(1).pdf S StuDocu - Free Practice Based As... 2021 (1).pdf 2/3 100% + 0 to extract end-of-month values from the table of daily observations 15 a lookup taules separate pdf document on Blackboard explains the necessary steps Table 5: Risk parity weights. The next worksheet (labeled "weights") has the same rows and columns and it contains the risk parity portfolio weights, computed as 1/03 i=1,..., 48, where is the portfolio weight for industry i at the end of month." Table 6: Portfolio returns. The last table contains the return of the risk parity portfolio in each month, i.e. AP - Note the timing portfolio weights are computed at the end of month - I, where returns are observed over month t. Put differently, portfolio weights are based on volatility estimates that use daily returns up to the last day of t-1, and they are combined with the monthly returns of the industries in montht to find the portfolio return in month In the same table, compute the monthly returns for the naive 1/N portfolio in a separate column. This portfolio will serve as a point of comparison. Hint: The return of the equal weighted portfolio equals the simple average over the 18 industry portfolio returns, 1/N 140 1.. Recall from docture that this formularul in approximaterik parity portfolio wicht so it more cores. It is commonly used by practitioners due to its implicity. An exact solution would require the of solver, which is prohibitive for us in this content it would require a programming lane) 2/3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts