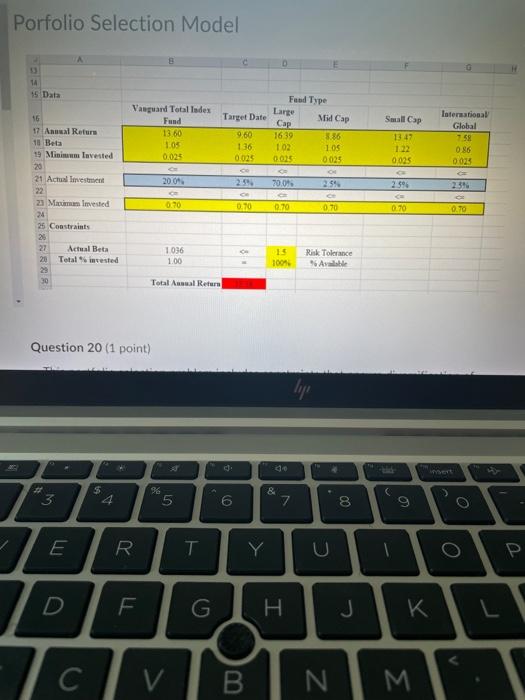

Question: Porfolio Selection Model This portfolio selection problem includes constraints that ensure diversification of the investment. Which constraints given in the figure above ensure diversification? a)

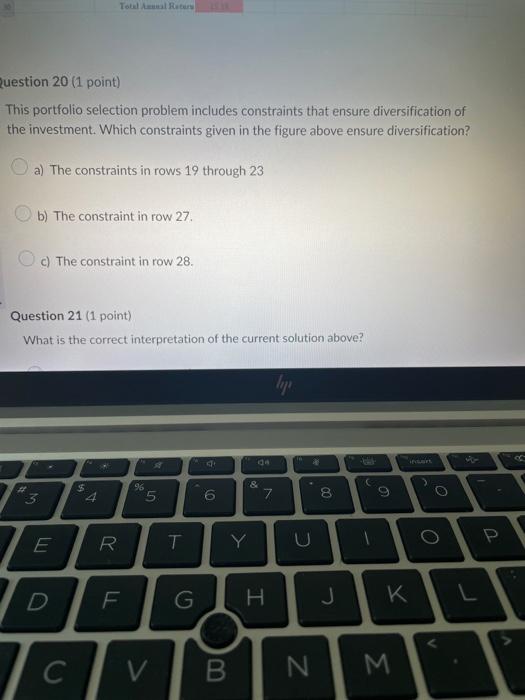

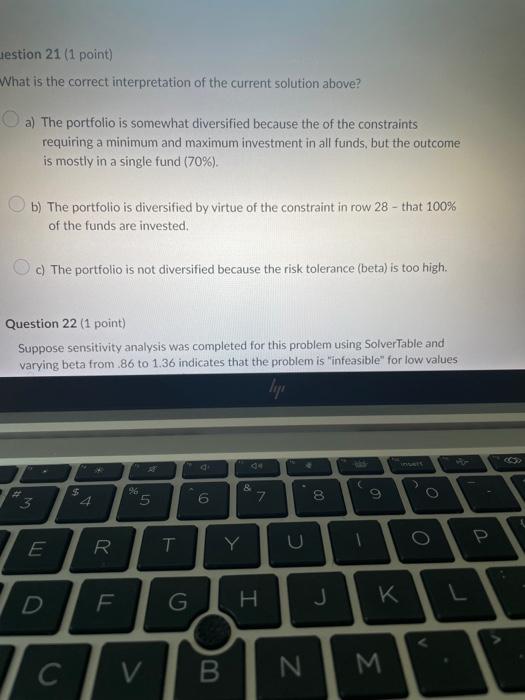

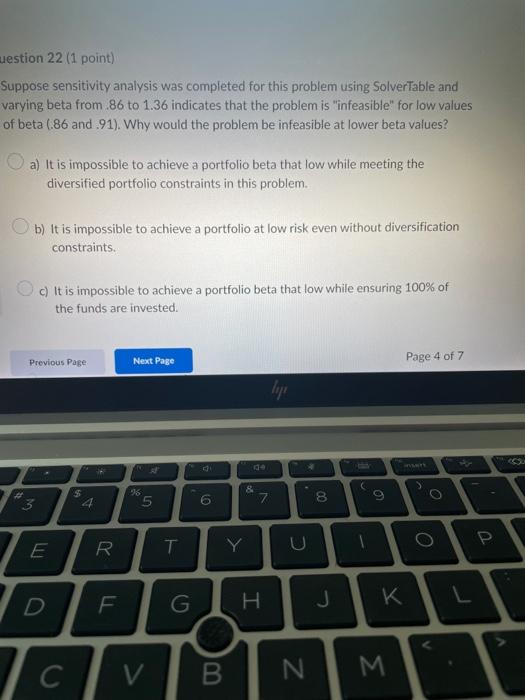

Porfolio Selection Model This portfolio selection problem includes constraints that ensure diversification of the investment. Which constraints given in the figure above ensure diversification? a) The constraints in rows 19 through 23 b) The constraint in row 27 . c) The constraint in row 28 . Question 21 (1 point) What is the correct interpretation of the current solution above? What is the correct interpretation of the current solution above? a) The portfolio is somewhat diversified because the of the constraints requiring a minimum and maximum investment in all funds, but the outcome is mostly in a single fund ( 70%). b) The portfolio is diversified by virtue of the constraint in row 28 - that 100% of the funds are invested. c) The portfolio is not diversified because the risk tolerance (beta) is too high. Question 22 (1 point) Suppose sensitivity analysis was completed for this problem using SolverTable and varying beta from .86 to 1.36 indicates that the problem is "infeasible" for low values lestion 22 (1 point) Suppose sensitivity analysis was completed for this problem using SolverTable and varying beta from .86 to 1.36 indicates that the problem is "infeasible" for low values of beta (.86 and .91). Why would the problem be infeasible at lower beta values? a) It is impossible to achieve a portfolio beta that low while meeting the diversified portfolio constraints in this problem. b) It is impossible to achieve a portfolio at low risk even without diversification constraints. c) It is impossible to achieve a portfolio beta that low while ensuring 100% of the funds are invested

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts