Question: Port Models include: CPM (Critical Path Method), PERT (Performance Evaluation & Review Technique) and Network Model to explain congestion at Yantian Port. https://www.youtube.com/watch?v=DdDzybQ_9vM&t=22s Identify the

Port Models include:

CPM (Critical Path Method), PERT (Performance Evaluation & Review Technique) and Network Model to explain congestion at Yantian Port.

- https://www.youtube.com/watch?v=DdDzybQ_9vM&t=22s

- Identify the relevant model(s) above. This also includes the justification/explanation about how the identified model(s) can be applied. Provide a general explanation.

a)

Identify the port logistics model(s)/framework(s) that can be applied to explain"the knock-on impact soon to be felt in both theEuropean and North American markets" referred to in the article above. Show how the model(s) can be applied to explain such an impact.

b)

Based on your answers to part a, provide recommendations on how port logistics may be managed to ensure the efficiency and resilience of port operations.

Yantian Port

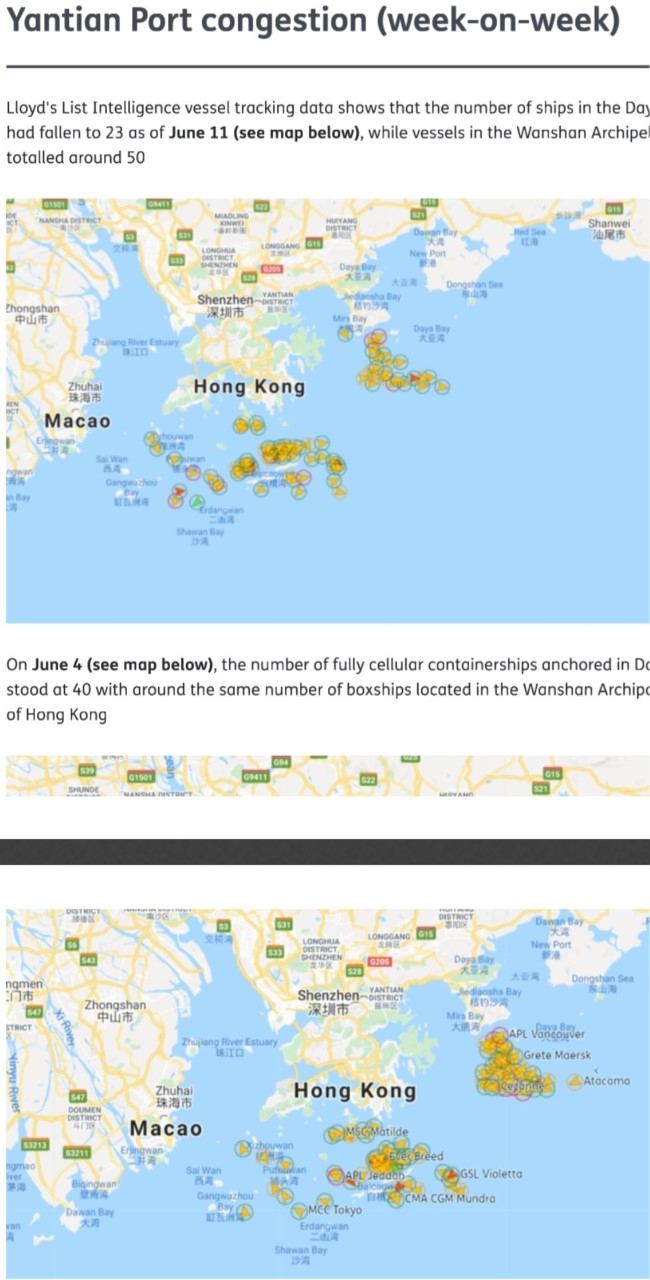

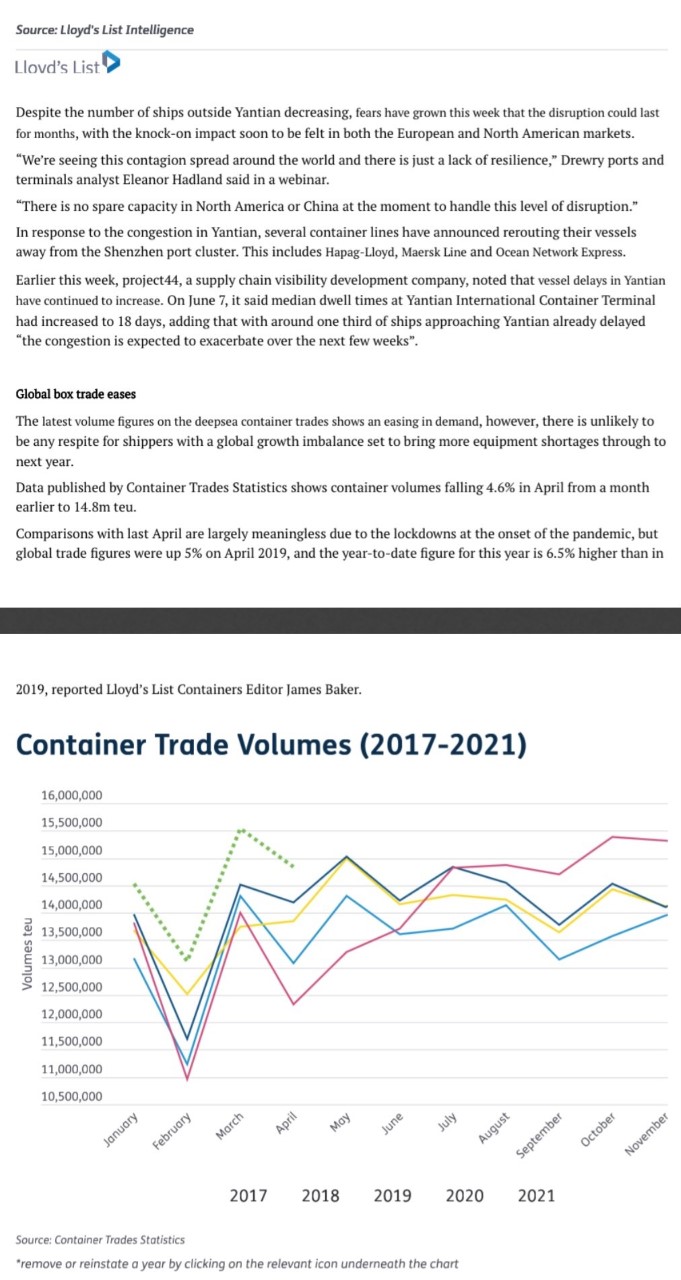

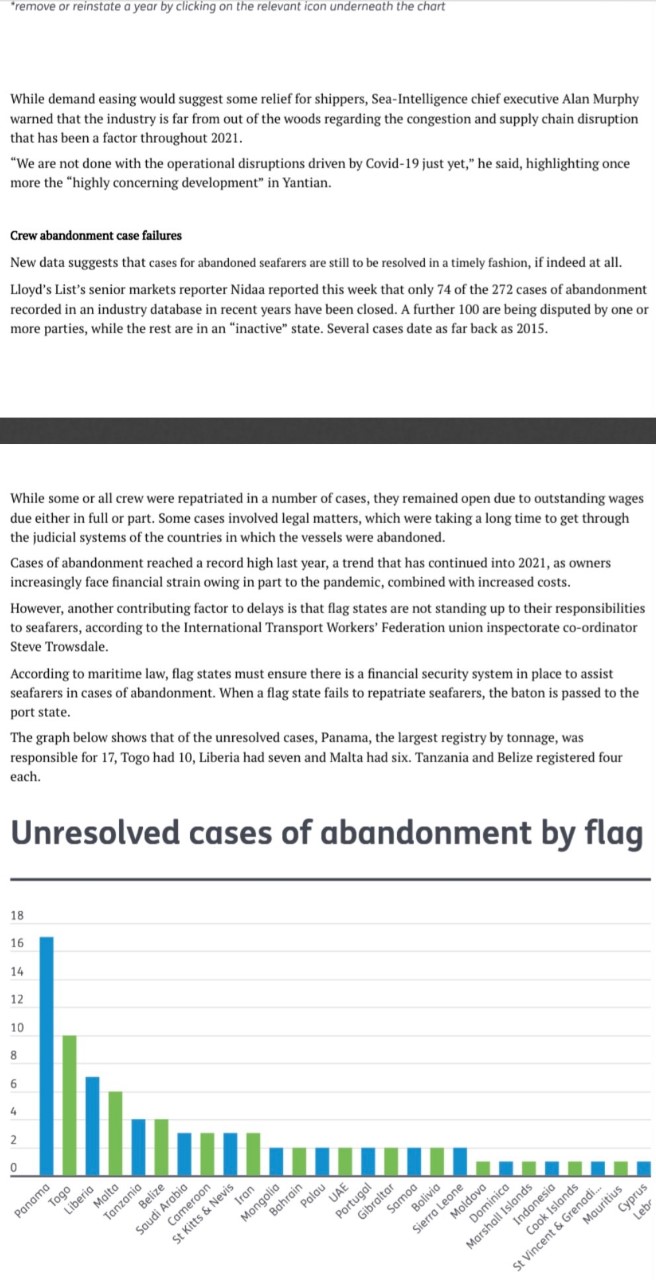

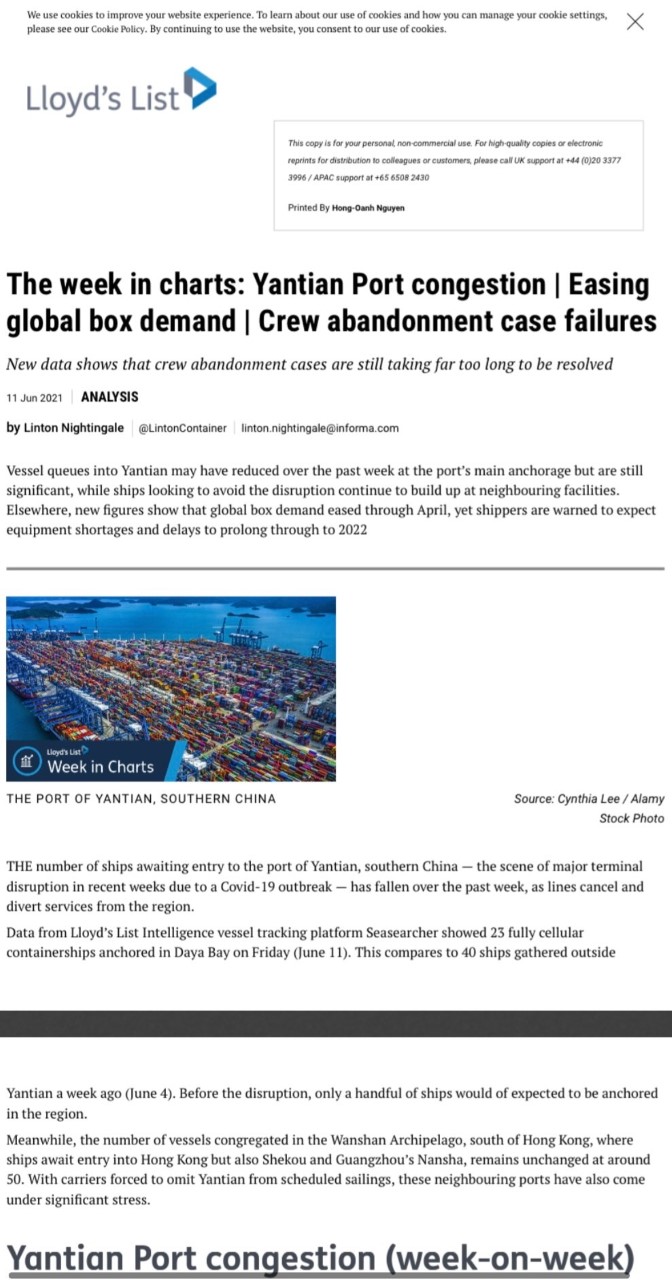

Yantian Port congestion (week-on-week) Lloyd's List Intelligence vessel tracking data shows that the number of ships in the Day had fallen to 23 as of June 11 (see map below), while vessels in the Wanshan Archipel totalled around 50 01801 HURIV ANC DISTRICT Shanwel n Bay Red Sea New Port Daya Bay REA Dongshan Sen YANTIAN Shenzhen-DISTRICT Dosha Bay Zhongshan Mirs Bay Daya Bay jiang River Estua Zhuhai Hong Kong Macao Sai Wan Gangwarhou in Bay Bay Shawan Bay DA On June 4 (see map below), the number of fully cellular containerships anchored in D stood at 40 with around the same number of boxships located in the Wanshan Archip of Hong Kong G1501 69411 SHLINDE DISTRICT Dawan Bay LONGHUA LONGGANG GIS DISTRICT, New Port SHINTHEN G205 Daya Bay ngmen Dongshan Sea YANTIAN Shenzhen-DISTRICT Jedipasha Bay 547 Zhongshan Mire Bay STRICT Xi River APL Vancouver Zhujiang Rover Estuary Grete Maersk Ninyu River Zhuhai Hong Kong Atacama 547 DOUMEN DISTRICT Macao CauseMatilde 83213 zhouwan $9211 auster Breed ngmac Sai Wan APL Jeddah GSL Violetta Gangwazhou CMA CGM Mundro Dawan Bay MCC Tokyo Erdangwan Shawan Bay DASource: Lloyd's List Intelligence Lloved's List Despite the number of ships outside Yantian decreasing, fears have grown this week that the disruption could last for months, with the knock-on impact soon to be felt in both the European and North American markets. "We're seeing this contagion spread around the world and there is just a lack of resilience," Drewry ports and terminals analyst Eleanor Hadland said in a webinar. "There is no spare capacity in North America or China at the moment to handle this level of disruption." In response to the congestion in Yantian, several container lines have announced rerouting their vessels away from the Shenzhen port cluster. This includes Hapag-Lloyd, Maersk Line and Ocean Network Express. Earlier this week, project44, a supply chain visibility development company, noted that vessel delays in Yantian have continued to increase. On June 7, it said median dwell times at Yantian International Container Terminal had increased to 18 days, adding that with around one third of ships approaching Yantian already delayed "the congestion is expected to exacerbate over the next few weeks". Global box trade eases The latest volume figures on the deepsea container trades shows an easing in demand, however, there is unlikely to be any respite for shippers with a global growth imbalance set to bring more equipment shortages through to next year. Data published by Container Trades Statistics shows container volumes falling 4.6% in April from a month earlier to 14.8m teu. Comparisons with last April are largely meaningless due to the lockdowns at the onset of the pandemic, but global trade figures were up 5% on April 2019, and the year-to-date figure for this year is 6.5% higher than in 2019, reported Lloyd's List Containers Editor James Baker. Container Trade Volumes (2017-2021) 16,000,000 15,500,000 15,000,000 14,500,000 14,000,000 13,500,000 Volumes teu 13,000,000 12,500,000 12,000,000 11,500,000 11,000,000 10,500,000 pril January March May June July February August September October November 2017 2018 2019 2020 2021 Source: Container Trades Statistics "remove or reinstate a year by clicking on the relevant icon underneath the chart'remove or reinstate a year by eliciting on the relevant icon underneath the chart While demand easing would suggest some reitei'for shippers, Sea-Intelligence chief executive Alan Murphy warned that the industry is far from out of the woods regarding the congestion and supply chain disruption that has been a factor throughout 202i. "We are not done with the operational disruptions driven by Covid-l9 iust yet.' he said. highlighting once more the \"highly concerning development' in Vantlsn. Crewdtarumtcaae Mime: New data suggests that cases for abandoned seafarers are still to be resolved in a timely fashion, if indeed at all. Lloyd's List's senior markets reporter Nidaa reported this week that only '14 of the 272 cases of abandonment recorded in an industry database in reoent years have been closed. A further 1m are being disputed by one or more parties. while the rest are in an \"inactive\" state. Several cases date as far back as 2015. While some or all crew were repatriated in a number ofcases, they remained open due to outstanding wages due either in full or part. Some cases involved lega] matters. which were taking a long time to get through the judicial systems of the countries in which the vessels were abandoned. Cases ofabandonrnent reached a record high last year, a trend that has continued into 2021, as onners increasingly face nancial stra In owing in part to the pandemic, combined with increased costs. However. another contributing factor to delays is that ag states are not standing up to their responsibilities to seafarers, according to the International Transport Workers' Federation union inspector-ate co-ordinator Steve 'I'rowsrlaie. According to maritime law. ag states rnust ensure there is a nancial security system in place to assist seafarers in cases of abandonment. When a ag state falls to repatriate seafarers, the baton is passed to the port state. The graph below shows that ol'the unresolved cases. Panama, the largest registry by tonnage, was responsible for 17. Togo had 10. Liberia had seven and Malta had six. Tanzania and Belize registered four each. Unresolved cases of abandonment by og l! We use cookies to improve your website experience. To learn about our use of cookies and how you can manage your cookie settings, please see our Cookie Policy. By continuing to use the website, you consent to our use of cookies. X Lloyd's List This copy is for your personal non-commercial use. For high-quality copies or electronic reprints for distribution to colleagues or customers, please call UK support at +44 (0)20 3377 3996 / APAC support at +65 6508 2430 Printed By Hong-Oanh Nguyen The week in charts: Yantian Port congestion | Easing global box demand | Crew abandonment case failures New data shows that crew abandonment cases are still taking far too long to be resolved 11 Jun 2021 ANALYSIS by Linton Nightingale @LintonContainer |linton.nightingale@informa.com Vessel queues into Yantian may have reduced over the past week at the port's main anchorage but are still significant, while ships looking to avoid the disruption continue to build up at neighbouring facilities. Elsewhere, new figures show that global box demand eased through April, yet shippers are warned to expect equipment shortages and delays to prolong through to 2022 Lloyd's List Week in Charts THE PORT OF YANTIAN, SOUTHERN CHINA Source: Cynthia Lee / Alamy Stock Photo THE number of ships awaiting entry to the port of Yantian, southern China - the scene of major terminal disruption in recent weeks due to a Covid-19 outbreak - has fallen over the past week, as lines cancel and divert services from the region. Data from Lloyd's List Intelligence vessel tracking platform Seasearcher showed 23 fully cellular containerships anchored in Daya Bay on Friday (June 11). This compares to 40 ships gathered outside Yantian a week ago (June 4). Before the disruption, only a handful of ships would of expected to be anchored in the region. Meanwhile, the number of vessels congregated in the Wanshan Archipelago, south of Hong Kong, where ships await entry into Hong Kong but also Shekou and Guangzhou's Nansha, remains unchanged at around 50. With carriers forced to omit Yantian from scheduled sailings, these neighbouring ports have also come under significant stress. Yantian Port congestion (week-on-week)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts