Question: Portfolio A has only one stock, while Portfolio B consists of all stocks that trade in the market, each held in proportion to its market

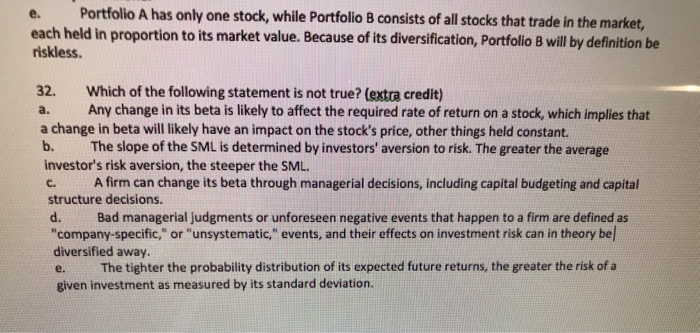

Portfolio A has only one stock, while Portfolio B consists of all stocks that trade in the market, each held in proportion to its market value. Because of its diversification, Portfolio B will by definition be riskless. 32 Which of the following statement is not true? (extra credit) Any change in its beta is likely to affect the required rate of return on a stock, which implies that a. a change in beta will likely have an impact on the stock's price, other things held constant. b. The slope of the SML is determined by investors' aversion to risk. The greater the average investor's risk aversion, the steeper the SML A firm can change its beta through managerial decisions, including capital budgeting and capital C. structure decisions. d. Bad managerial judgments or unforeseen negative events that happen to a firm are defined as "company-specific," or "unsystematic," events, and their effects on investment risk can in theory be diversified away The tighter the probability distribution of its expected future returns, the greater the risk of a e. given investment as measured by its standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts