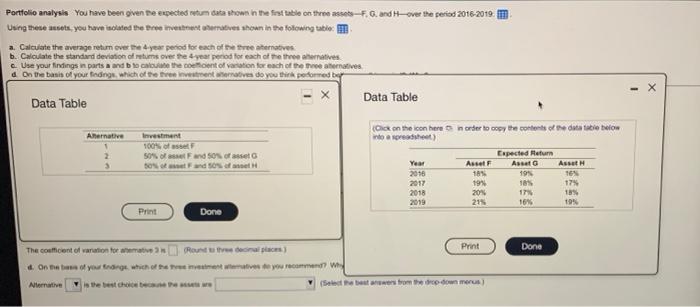

Question: Portfolio analysis You have been given the expected tutun data shown in the first table on the set-F. G. and over the period 2016-2019 m

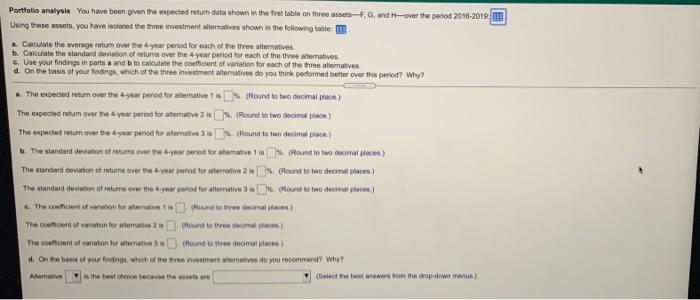

Portfolio analysis You have been given the expected tutun data shown in the first table on the set-F. G. and over the period 2016-2019 m Using these musets you have isolated the resteraves shown in the following table a. Calculate the average return over the 4-year period for each of the treeneratives b. Calculate the standard deviation of returns over the 4-year period for each of the three hernatives Use your findings in parts and be the cont of variation for each of the three alternatives d. On the basis of your fading, which of the enternatives do you think potomed by X Data Table Data Table Abernative Investment 100% of 50% off and son of to and son 3 (Gick on the icon here in order to copy the contents of the datatable below into a spreadsheet) Expected Return Asset Asset Asset 2016 1% 19N 16 2017 19% 18% 17% 2018 20% 175 18% 2019 214 16% 19% Print Done Print Done The cofficient of variation for et Round deals) d. One of you are which of the waves you can w Nternative (Se aber from the owners Portfolio analysie You have been given the expected return data shown in the first table on three sts, and over the penos 2016-2010 Using these sots, you have isolated the three investment attentives shown in the following table a. Calculate the average ratum over the 4-year period for each of the three alternatives Calculate the standard deviation of returns over the 4-year period for each of the three arternatives c. Use your findings in parts and b to calculate the coefficient of variation for each of the three amaties d. On me basis of your findings which of the three investment alternatives do you think performed better over this period? Why? The expected return over the 4-year pened to alternatives (Round to we decimal place) The expected return over the year period for atormative 2 (Round to two decina pace) The expected twum ver the year period for attentive (Round to two decimal place) 1. The standard deviation of returns over the year perioder mate1 1. Round to moderat place The standard deviation of future over the year period for terrative 2 Round to two decimal places) The standard deviation of return over the your ord for alternative (#ound to two decat place The coloration for wierties (Hot to deal The coont of a formatie Round to item The concent of anation for wat found to be decimal) on bois of your findings which of the matemat do you recommend? Why? Arema is the best choices are (Select the best on the powers)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts