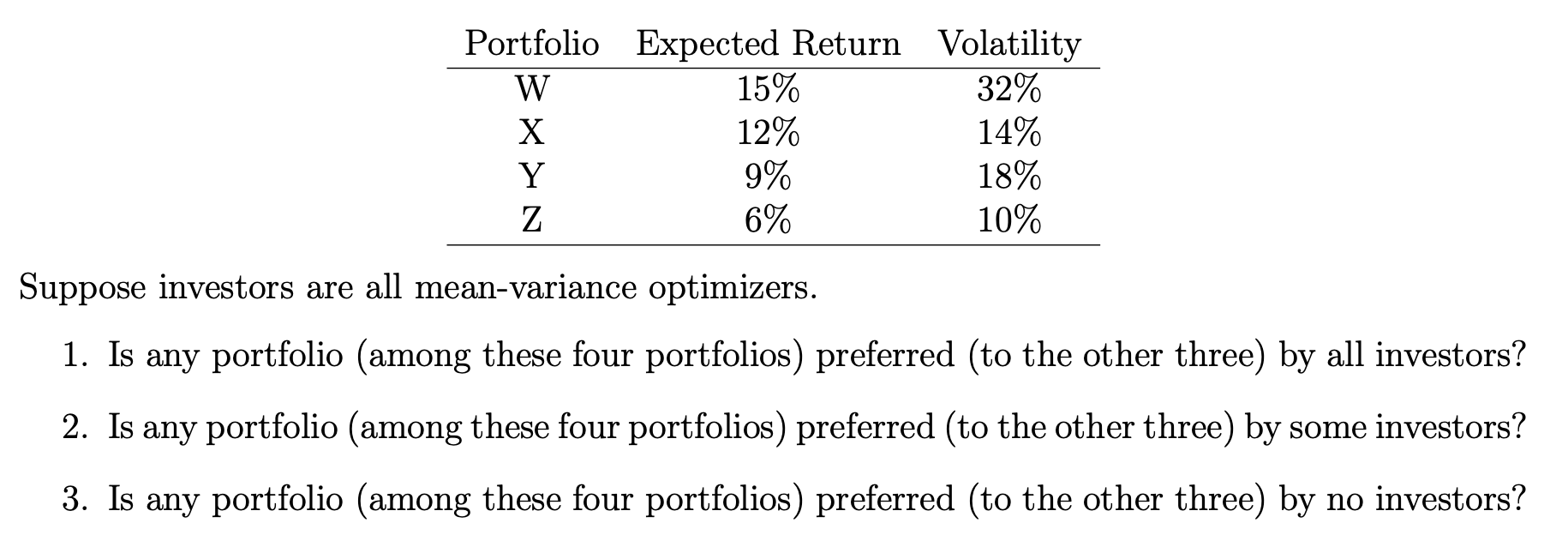

Question: Portfolio Expected Return Volatility W 15% 32% X 12% 14% Y 9% 18% Z 6% 10% Suppose investors are all mean-variance optimizers. 1. Is any

Portfolio Expected Return Volatility W 15% 32% X 12% 14% Y 9% 18% Z 6% 10% Suppose investors are all mean-variance optimizers. 1. Is any portfolio (among these four portfolios) preferred (to the other three) by all investors? 2. Is any portfolio (among these four portfolios) preferred (to the other three) by some investors? 3. Is any portfolio (among these four portfolios) preferred (to the other three) by no investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts