Question: portfolio management QUESTION 4 (25 MARKS) The Efficient Markets Hypothesis (EMH) described by Fama (1984) is comprised of three components; weak form, semi-strong form and

portfolio management

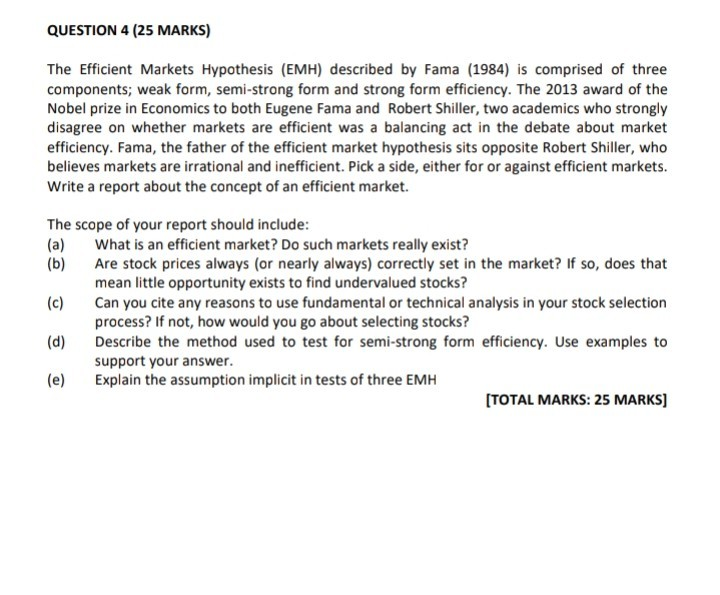

QUESTION 4 (25 MARKS) The Efficient Markets Hypothesis (EMH) described by Fama (1984) is comprised of three components; weak form, semi-strong form and strong form efficiency. The 2013 award of the Nobel prize in Economics to both Eugene Fama and Robert Shiller, two academics who strongly disagree on whether markets are efficient was a balancing act in the debate about market efficiency. Fama, the father of the efficient market hypothesis sits opposite Robert Shiller, who believes markets are irrational and inefficient. Pick a side, either for or against efficient markets. Write a report about the concept of an efficient market. The scope of your report should include: (a) What is an efficient market? Do such markets really exist? (b) Are stock prices always (or nearly always) correctly set in the market? If so, does that mean little opportunity exists to find undervalued stocks? Can you cite any reasons to use fundamental or technical analysis in your stock selection process? If not, how would you go about selecting stocks? Describe the method used to test for semi-strong form efficiency. Use examples to support your answer. (e) Explain the assumption implicit in tests of three EMH [TOTAL MARKS: 25 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts