Question: Portfolio optimisation (10 marks) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government

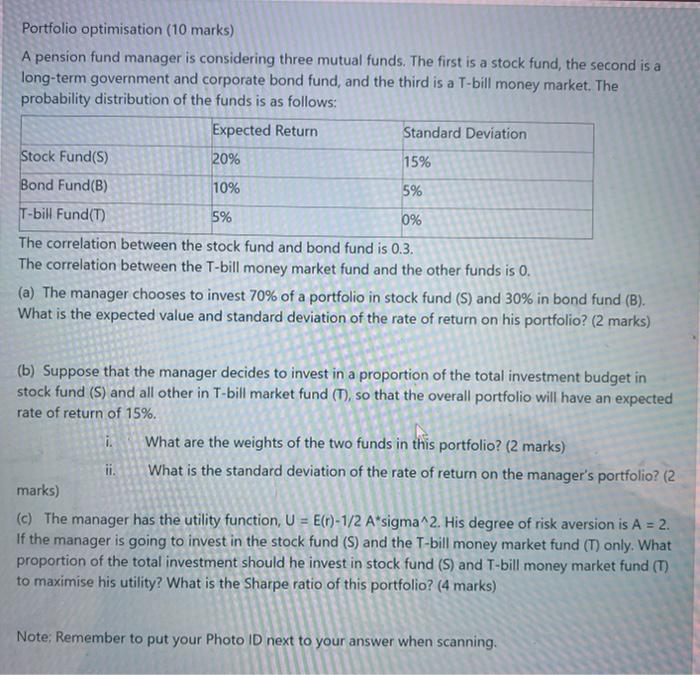

Portfolio optimisation (10 marks) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market. The probability distribution of the funds is as follows: Expected Return Standard Deviation Stock Fund(s) 20% 15% Bond Fund(B) 10% 5% T-bill Fund (T) 0% The correlation between the stock fund and bond fund is 0.3. The correlation between the T-bill money market fund and the other funds is 0. (a) The manager chooses to invest 70% of a portfolio in stock fund (S) and 30% in bond fund (B). What is the expected value and standard deviation of the rate of return on his portfolio? (2 marks) 5% (b) Suppose that the manager decides to invest in a proportion of the total investment budget in stock fund (S) and all other in T-bill market fund (T), so that the overall portfolio will have an expected rate of return of 15%. What are the weights of the two funds in this portfolio? (2 marks) ii. What is the standard deviation of the rate of return on the manager's portfolio? (2 marks) (c) The manager has the utility function, U = E(r)-1/2 A*sigma^2. His degree of risk aversion is A = 2. If the manager is going to invest in the stock fund (S) and the T-bill money market fund (T) only. What proportion of the total investment should he invest in stock fund (S) and T-bill money market fund (T) to maximise his utility? What is the Sharpe ratio of this portfolio? (4 marks) Note: Remember to put your Photo ID next to your answer when scanning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts