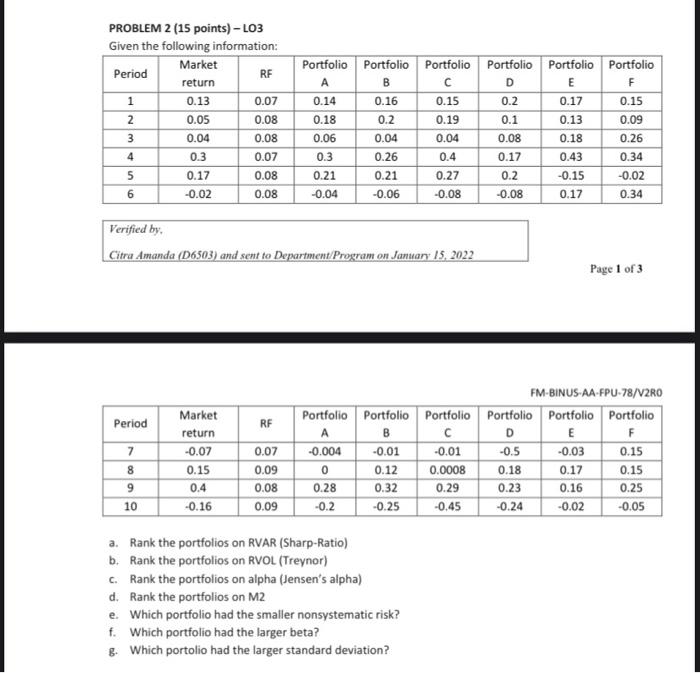

Question: Portfolio Portfolio A PROBLEM 2 (15 points) -L03 Given the following information: Market Period RF return 1 0.13 0.07 2 0.05 0.08 3 0.04 0.08

Portfolio Portfolio A PROBLEM 2 (15 points) -L03 Given the following information: Market Period RF return 1 0.13 0.07 2 0.05 0.08 3 0.04 0.08 4 0.3 0.15 0.14 0.18 Portfolio B 0.16 0.2 0.04 0.26 0.21 OWN 0.06 Portfolio Portfolio Portfolio D E F 0.2 0.17 0.15 0.1 0.13 0.09 0.08 0.18 0.26 0.17 0.43 0.34 0.2 -0.15 -0.02 -0.08 0.17 0.34 0.19 0.04 0.4 0.07 5 0.17 0.08 0.3 0.21 -0.04 0.27 -0.08 6 -0.02 0.08 -0.06 Verified by Citra Amanda (D6503) and sent to Department/Program on January 15, 2022 Page 1 of 3 Period RF 7 8 9 Market return -0.07 0.15 0.4 -0.16 0.07 0.09 0.08 0.09 FM-BINUS-AA-FPU-78/V2RO Portfolio Portfolio Portfolio Portfolio Portfolio Portfolio A B D E F -0.004 -0.01 -0.01 -0.5 -0.03 0.15 0 0.12 0.0008 0.18 0.17 0.15 0.28 0.32 0.29 0.23 0.16 0.25 -0.2 -0.25 -0.45 -0.24 -0.02 -0.05 10 a. Rank the portfolios on RVAR (Sharp-Ratio) b. Rank the portfolios on RVOL (Treynor) c. Rank the portfolios on alpha (Jensen's alpha) d. Rank the portfolios on M2 e. Which portfolio had the smaller nonsystematic risk? f. Which portfolio had the larger beta? 8. Which portolio had the larger standard deviation? Portfolio Portfolio A PROBLEM 2 (15 points) -L03 Given the following information: Market Period RF return 1 0.13 0.07 2 0.05 0.08 3 0.04 0.08 4 0.3 0.15 0.14 0.18 Portfolio B 0.16 0.2 0.04 0.26 0.21 OWN 0.06 Portfolio Portfolio Portfolio D E F 0.2 0.17 0.15 0.1 0.13 0.09 0.08 0.18 0.26 0.17 0.43 0.34 0.2 -0.15 -0.02 -0.08 0.17 0.34 0.19 0.04 0.4 0.07 5 0.17 0.08 0.3 0.21 -0.04 0.27 -0.08 6 -0.02 0.08 -0.06 Verified by Citra Amanda (D6503) and sent to Department/Program on January 15, 2022 Page 1 of 3 Period RF 7 8 9 Market return -0.07 0.15 0.4 -0.16 0.07 0.09 0.08 0.09 FM-BINUS-AA-FPU-78/V2RO Portfolio Portfolio Portfolio Portfolio Portfolio Portfolio A B D E F -0.004 -0.01 -0.01 -0.5 -0.03 0.15 0 0.12 0.0008 0.18 0.17 0.15 0.28 0.32 0.29 0.23 0.16 0.25 -0.2 -0.25 -0.45 -0.24 -0.02 -0.05 10 a. Rank the portfolios on RVAR (Sharp-Ratio) b. Rank the portfolios on RVOL (Treynor) c. Rank the portfolios on alpha (Jensen's alpha) d. Rank the portfolios on M2 e. Which portfolio had the smaller nonsystematic risk? f. Which portfolio had the larger beta? 8. Which portolio had the larger standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts