Question: Portfolio return and standard deviation Jamie Won g is thinking of building an investment portfolio containing two exchange traded funds ( ETFs ) . Jamie

Portfolio return and standard deviation Jamie Won

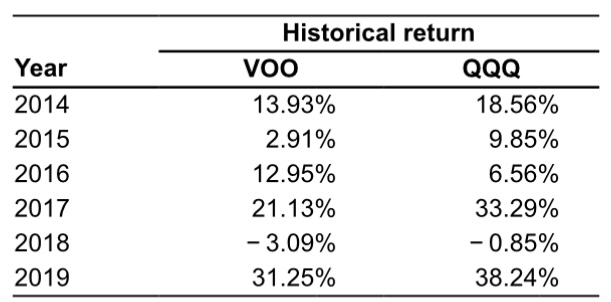

g is thinking of building an investment portfolio containing two exchange traded funds ETFs Jamie plans to invest $ in Vanguard S&P ETF VOO and $ in Invesco QQQ Trust QQQ Jamie has decided to analyze some historical returns to get a sense for her portfolio's possible future risk and return. Six years of historical annual returns for each ETF are shown in the following table:

a Calculate the portfolio return, for each of the years assuming that is invested in VOO and is invested in QQQ

b Calculate the average annual return for each ETF and the portfolio over the sixyear period.

c Calculate the standard deviation of annual returns for each ETF and the portfolio. How does the portfolio standard deviation compare to the standard deviations of the individual ETFs?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock