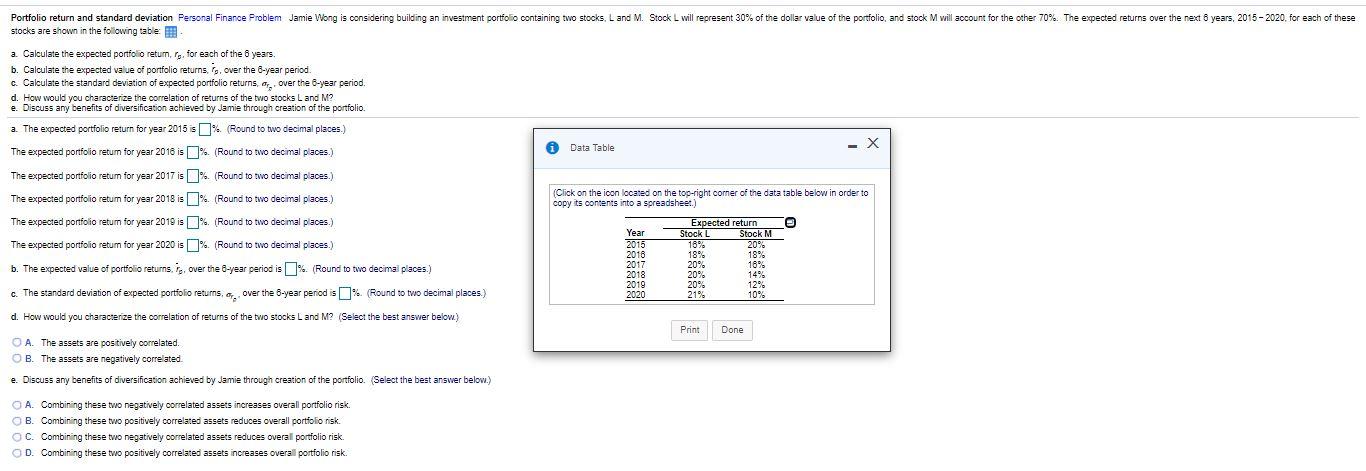

Question: - Portfolio return and standard deviation Personal Finance Problem Jamie Wong is considering building an investment portfolio containing two stocks, Land M. Stock L will

- Portfolio return and standard deviation Personal Finance Problem Jamie Wong is considering building an investment portfolio containing two stocks, Land M. Stock L will represent 30% of the dollar value of the portfolio, and stock M will account for the other 70%. The expected returns over the next 5 years, 2015-2020, for each of these stocks are shown in the following table: a. Calculate the expected portfolio retum,rg, for each of the years. b. Calculate the expected value of portfolio returns over the 8-year period. c. Calculate the standard deviation of expected portfolio returns, or over the 6-year period. d. How would you characterize the correlation of returns of the two stocks Land M? e. Discuss any benefits of diversification achieved by Jamie through creation of the portfolio a The expected portfolio return for year 2015 is 0% (Round to two decimal places.) X The expected portfolio return for year 2018 is 0%. (Round to two decimal places.) * Data Table The expected portfolio return for year 2017 is % (Round to two decimal places.) The expected portfolio retum for year 2018 is 0% (Round to two decimal places.) (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) The expected portfolio return for year 2019 is %. (Round to two decimal places.) Expected return Year Stock L Stock M M The expected portfolio retum for year 2020 is 0% (Round to two decimal places.) 20% 2016 18% 18% b. The expected value of portfolio returns, Tg, over the 6-year period is % (Round to two decimal places.) 2017 20% 18% 2018 20% 14% 20% 12% c. The standard deviation of expected portfolio returns, or over the 5-year period is % (Round to two decimal places.) 21% 10% d. How would you characterize the correlation of returns of the two stocks Land M? Select the best answer below) Print Done A. The assets are positively correlated B. The assets are negatively correlated e. Discuss any benefits of diversification achieved by Jamie through creation of the portfolio. Select the best answer below.) 2015 18% 2019 2020 A. Combining these two negatively correlated assets increases overall portfolio risk. B. Combining these two positively correlated assets reduces overall portiolo risk. C. Combining these two negatively correlated assets reduces overall portfolio risk. D. Combining these two positively correlated assets increases overall portfolio risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts