Question: Portfolio risk can be broken down into two types. -Select- risk is that part of a security's risk associated with random events. It can be

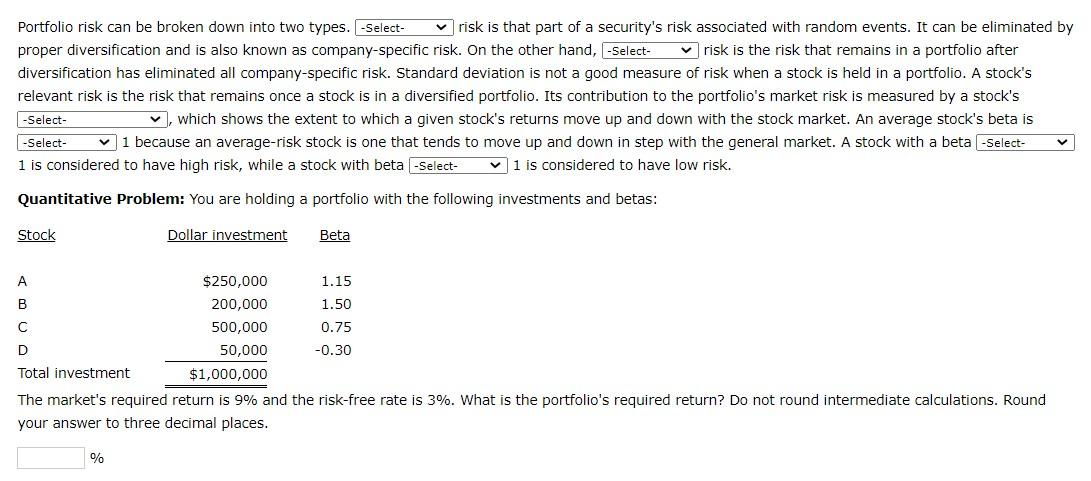

Portfolio risk can be broken down into two types. -Select- risk is that part of a security's risk associated with random events. It can be eliminated by proper diversification and is also known as company-specific risk. On the other hand, -Select- risk is the risk that remains in a portfolio after diversification has eliminated all company-specific risk. Standard deviation is not a good measure of risk when a stock is held in a portfolio. A stock's relevant risk is the risk that remains once a stock is in a diversified portfolio. Its contribution to the portfolio's market risk is measured by a stock's -Select- , which shows the extent to which a given stock's returns move up and down with the stock market. An average stock's beta is -Select- 1 because an average-risk stock is one that tends to move up and down in step with the general market. A stock with a beta -Select- 1 is considered to have high risk, while a stock with beta -Select- 1 is considered to have low risk. Quantitative Problem: You are holding a portfolio with the following investments and betas: Stock Dollar investment Beta 1.50 A $250,000 1.15 B 200,000 500,000 0.75 D 50,000 -0.30 Total investment $1,000,000 The market's required return is 9% and the risk-free rate is 3%. What is the portfolio's required return? Do not round intermediate calculations. Round your answer to three decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts