Question: PORTFOLIO SELECTION ( 2 0 Pts ) A client wishes to invest $ 2 , 0 0 0 , 0 0 0 in the following

PORTFOLIO SELECTION

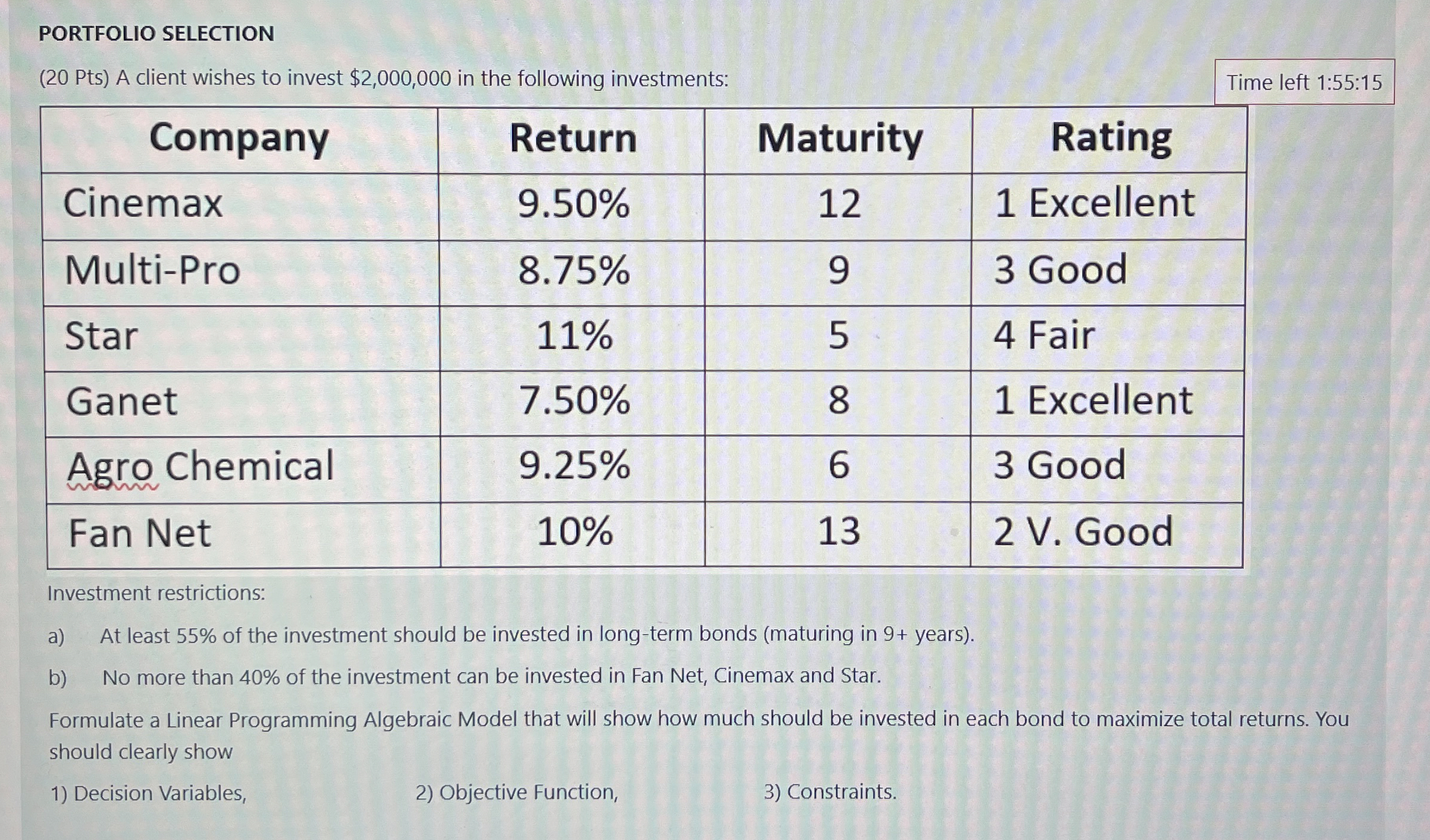

Pts A client wishes to invest $ in the following investments:

Time left ::

tableCompanyReturn,Maturity,RatingCinemax ExcellentMultiPro, GoodStar FairGanet ExcellentAgro Chemical, GoodFan Net, V Good

Investment restrictions:

a At least of the investment should be invested in longterm bonds maturing in years

b No more than of the investment can be invested in Fan Net, Cinemax and Star

Formulate a Linear Programming Algebraic Model that will show how much should be invested in each bond to maximize total returns. You should clearly show

Decision Variables,

Objective Function,

Constraints.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock