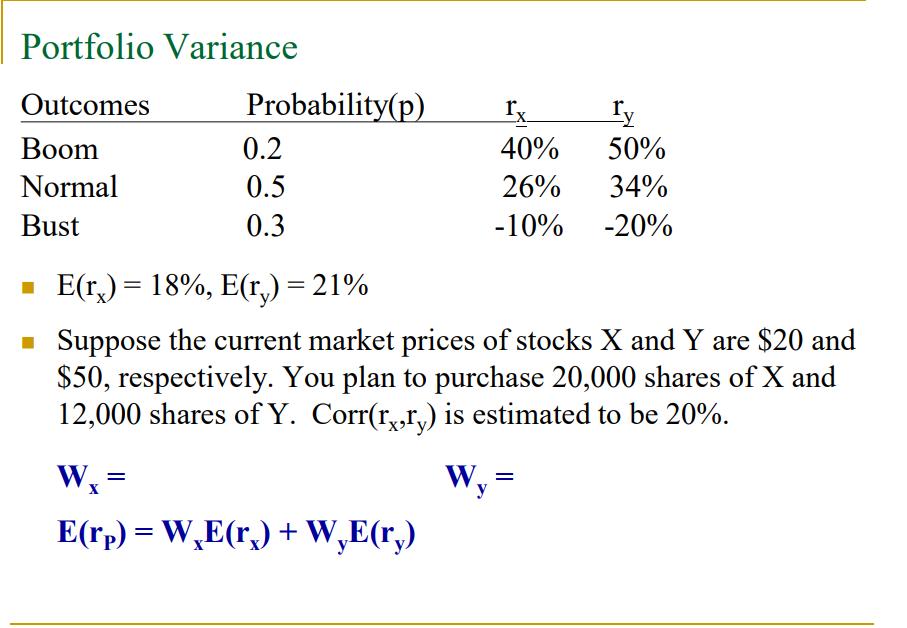

Question: Portfolio Variance Outcomes Boom Normal Bust Probability(p) 0.2 0.5 0.3 rx 40% 26% -10% Wx= E(rp) = WE(r.) + W,E(r.) ry 50% 34% -20%

Portfolio Variance Outcomes Boom Normal Bust Probability(p) 0.2 0.5 0.3 rx 40% 26% -10% Wx= E(rp) = WE(r.) + W,E(r.) ry 50% 34% -20% E(r) = 18%, E(ry) = 21% Suppose the current market prices of stocks X and Y are $20 and $50, respectively. You plan to purchase 20,000 shares of X and 12,000 shares of Y. Corr(r,,ry) is estimated to be 20%. Wy=

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

ANS WER W x 20 000 32 000 0 625 W y 12 000 32 000 0 375 E r p 0 625 18 0 375 21 19 125 EX PL AN ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock