Question: Portfolio variance / Overall correlation coefficient Please answer Q3 A/B QUESTION: The Correlation Coefficient has a range from 1 to +1. Explain in your own

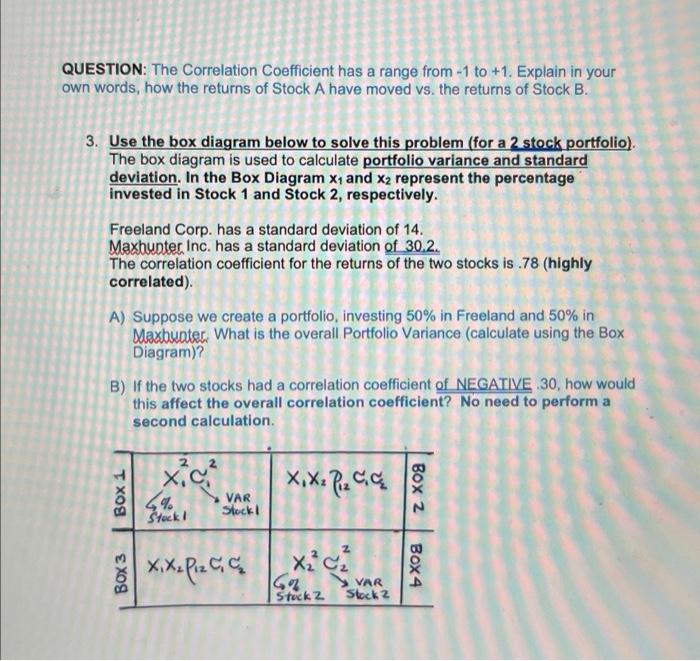

QUESTION: The Correlation Coefficient has a range from 1 to +1. Explain in your own words, how the returns of Stock A have moved vs. the returns of Stock B. 3. Use the box diagram below to solve this problem (for a 2 stock portfolio). The box diagram is used to calculate portfolio variance and standard deviation. In the Box Diagram x1 and x2 represent the percentage invested in Stock 1 and Stock 2, respectively. Freeland Corp. has a standard deviation of 14. Maxhunter Inc. has a standard deviation of 30,2 . The correlation coefficient for the returns of the two stocks is .78 (highly correlated). A) Suppose we create a portfolio, investing 50% in Freeland and 50% in Maxbunter. What is the overall Portfolio Variance (calculate using the Box Diagram)? B) If the two stocks had a correlation coefficient of NEGATIVE 30 , how would this affect the overall correlation coefficient? No need to perform a second calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts