Question: Portfolio X, a CPPI portfolio, has a floor value of $8.0 million, a market value of $10 million, and a multiplier of 2.5. The

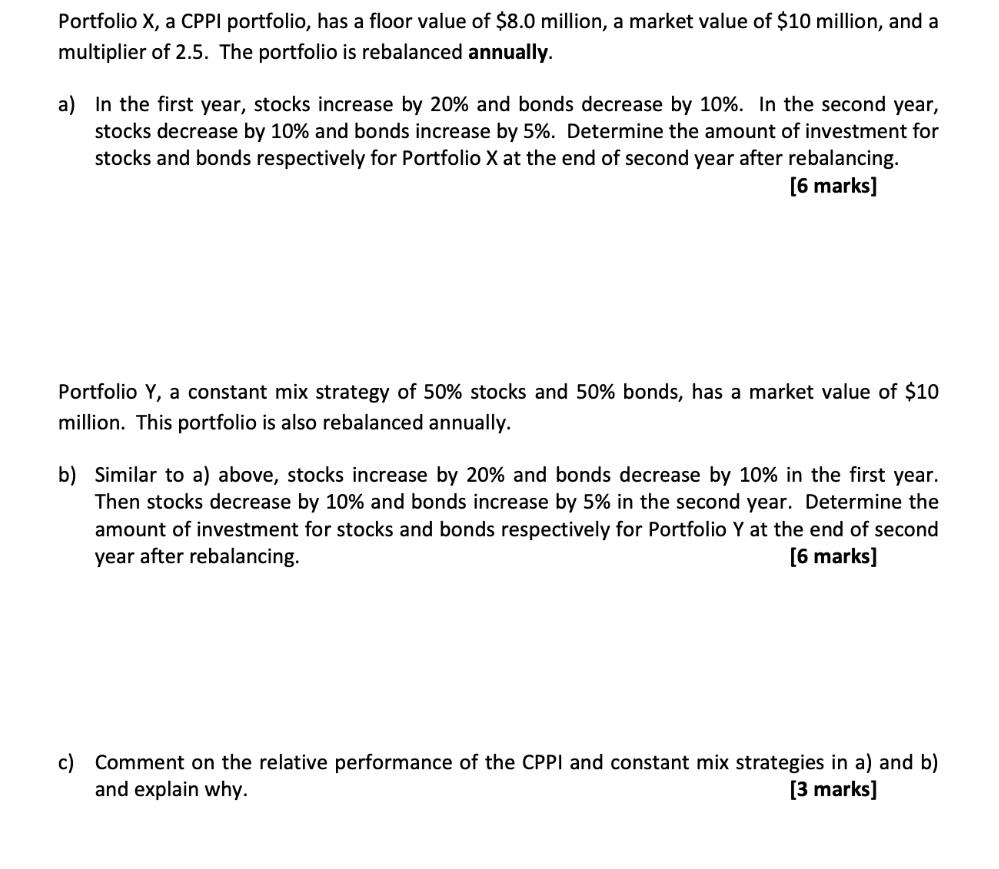

Portfolio X, a CPPI portfolio, has a floor value of $8.0 million, a market value of $10 million, and a multiplier of 2.5. The portfolio is rebalanced annually. a) In the first year, stocks increase by 20% and bonds decrease by 10%. In the second year, stocks decrease by 10% and bonds increase by 5%. Determine the amount of investment for stocks and bonds respectively for Portfolio X at the end of second year after rebalancing. [6 marks] Portfolio Y, a constant mix strategy of 50% stocks and 50% bonds, has a market value of $10 million. This portfolio is also rebalanced annually. b) Similar to a) above, stocks increase by 20% and bonds decrease by 10% in the first year. Then stocks decrease by 10% and bonds increase by 5% in the second year. Determine the amount of investment for stocks and bonds respectively for Portfolio Y at the end of second year after rebalancing. [6 marks] c) Comment on the relative performance of the CPPI and constant mix strategies in a) and b) and explain why. [3 marks] Portfolio X, a CPPI portfolio, has a floor value of $8.0 million, a market value of $10 million, and a multiplier of 2.5. The portfolio is rebalanced annually. a) In the first year, stocks increase by 20% and bonds decrease by 10%. In the second year, stocks decrease by 10% and bonds increase by 5%. Determine the amount of investment for stocks and bonds respectively for Portfolio X at the end of second year after rebalancing. [6 marks] Portfolio Y, a constant mix strategy of 50% stocks and 50% bonds, has a market value of $10 million. This portfolio is also rebalanced annually. b) Similar to a) above, stocks increase by 20% and bonds decrease by 10% in the first year. Then stocks decrease by 10% and bonds increase by 5% in the second year. Determine the amount of investment for stocks and bonds respectively for Portfolio Y at the end of second year after rebalancing. [6 marks] c) Comment on the relative performance of the CPPI and constant mix strategies in a) and b) and explain why. [3 marks] Portfolio X, a CPPI portfolio, has a floor value of $8.0 million, a market value of $10 million, and a multiplier of 2.5. The portfolio is rebalanced annually. a) In the first year, stocks increase by 20% and bonds decrease by 10%. In the second year, stocks decrease by 10% and bonds increase by 5%. Determine the amount of investment for stocks and bonds respectively for Portfolio X at the end of second year after rebalancing. [6 marks] Portfolio Y, a constant mix strategy of 50% stocks and 50% bonds, has a market value of $10 million. This portfolio is also rebalanced annually. b) Similar to a) above, stocks increase by 20% and bonds decrease by 10% in the first year. Then stocks decrease by 10% and bonds increase by 5% in the second year. Determine the amount of investment for stocks and bonds respectively for Portfolio Y at the end of second year after rebalancing. [6 marks] c) Comment on the relative performance of the CPPI and constant mix strategies in a) and b) and explain why. [3 marks]

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

a For Portfolio X at the end of the second year after rebalancing the amount of investment for st... View full answer

Get step-by-step solutions from verified subject matter experts