Question: Portfolios A and 8 are actively managed. Based on current dividend yield and expected capital gains, the expected rates of return on portfolios A and

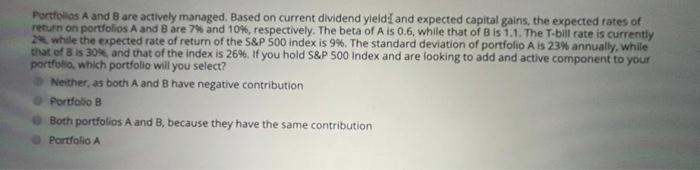

Portfolios A and 8 are actively managed. Based on current dividend yield and expected capital gains, the expected rates of return on portfolios A and B are 7% and 10%, respectively. The beta of A is 0.6, while that of Bis 1.1. The T-biltrate is currently 2 while the expected rate of return of the S&P 500 index is 9%. The standard deviation of portfolio A is 23% annually, while that of 3 is 30% and that of the index is 26%. If you hold S&P 500 Index and are looking to add and active component to your portfolio, which portfolio will you select? Nether, as both A and B have negative contribution Portfolio B Both portfolios A and B, because they have the same contribution Portfolio A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts