Question: possible options 1) increase in stock price/dividends 2) increase in stock price/dividends 3) Avg. CG/ Avg.Cl + Avg VI/ Avg.Cl + Avg. CG/ Avg. Cl/

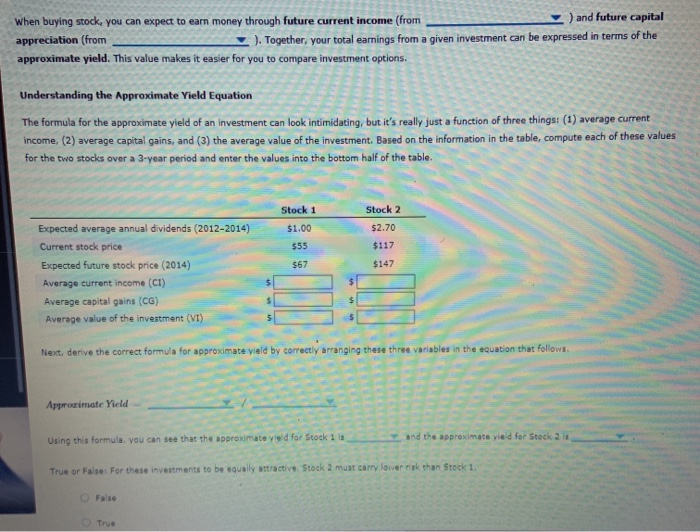

When buying stock, you can expect to earn money through future current income (from ) and future capital appreciation (from ). Together, your total earnings fro earnings from a given investment can be expressed in terms of the approximate yield. This value makes it easier for you to compare investment options. Understanding the Approximate Yield Equation The formula for the approximate yield of an investment can look intimidating, but it's really just a function of three things (1) average current income. (2) average capital gains, and (3) the average value of the investment. Based on the information in the table, compute each of these values for the two stocks over a 3-year period and enter the values into the bottom half of the table. Stock 1 Stock 2 52.70 $1.00 $55 $67 $117 $147 Expected average annual dividends (2012-2014) Current stock price Expected future stock price (2014) Average current income (CI) Average capital gains (CG) Average value of the investment (VI) Next, derive the correct formula for approximate vield by correctly arranging these three variables in the equation that follows Apprunimate Yield Using this formula. you can see that the approximate veld for Stock 11 and the approximate vied for Stock 2 True or False for these investments to be only attractive Stock2 must carry lower than stock 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts