Question: Post a comment on the question below: Define Realism (see Realism handout). Apply the definition to any one of our assigned Brooks ' poems .

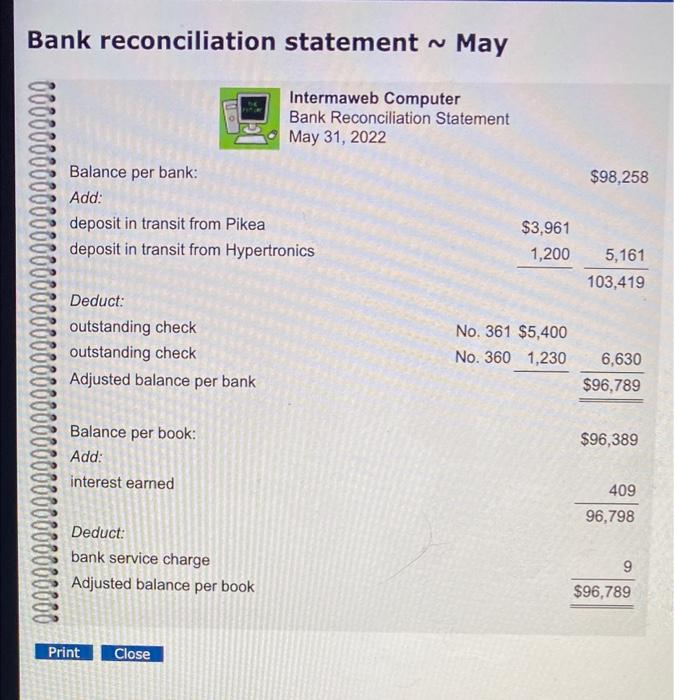

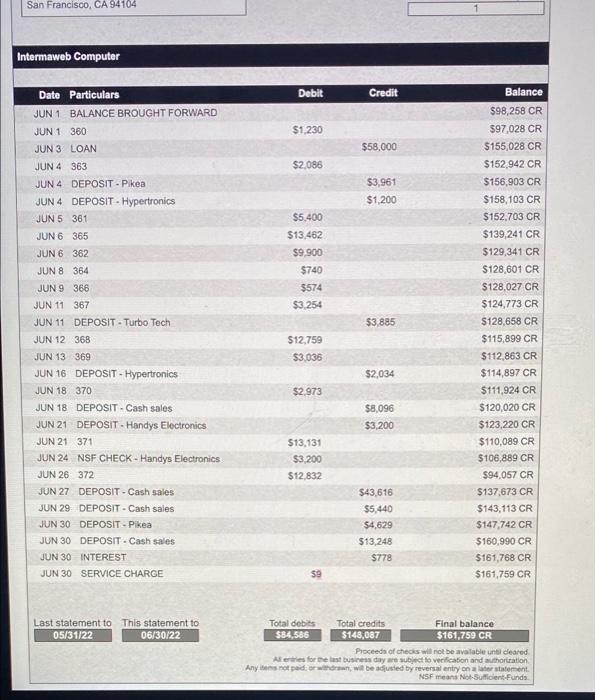

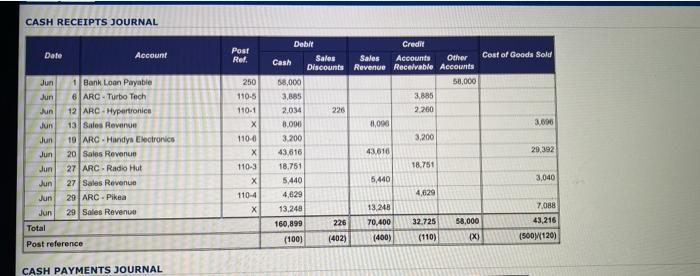

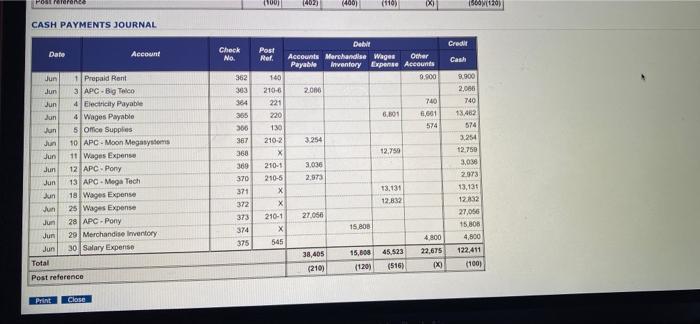

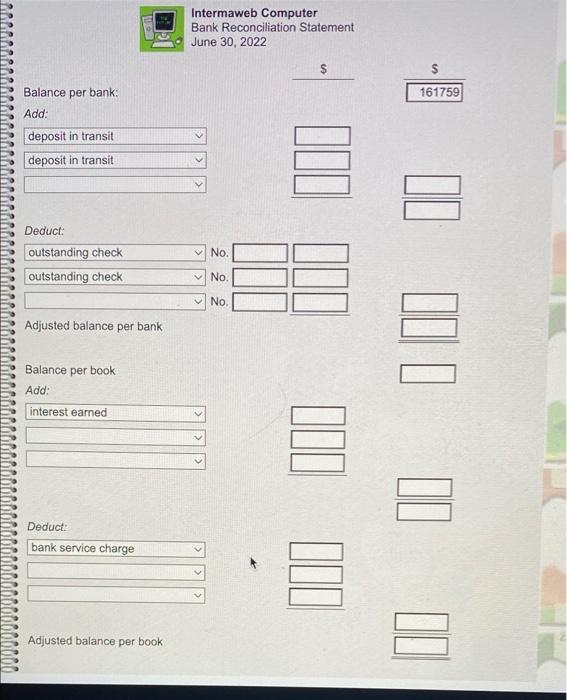

Bank reconciliation Now that you have completed the end of month posting procedure, you are required to prepare a bank reconciliaton as at June 30, 2022. The purpose of the bank reconciliation process is to reconcile the balance of cash shown in the company's ledge account against the balance of cash reported in the bank statement. Instructions for bank reconciliation 1) Prepare the bank reconciliation statement as at June 30, 2022. To do this, you will need to use: . the previous month's bank reconciliation statement, and the current month's bank statement and cash journals Note that the bank reconciliation statement provided below may contain more rows than required. 2) Use the bank reconciliation statement to record the relevant reconciling items in the general journal. 3) Post entries recorded in the general journal to the appropriate ledger accounts according to the company's accounting policies and procedures 4) Record the updated balance of each ledger account in the Balance row of each ledger, even for ledgers with a balance of zero. Although each ledger already has a running balance, the Balance row must still be filled out in order to receive full points. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page o in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. Remember: Enter all answers to the nearest whole dollar. There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1' into the Post Ref. column. You are also required to apply the journals and ledgers Instructions provided in previous weeks. Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. Bank reconciliation statement May 60 00000000000 Intermaweb Computer Bank Reconciliation Statement May 31, 2022 $98,258 Balance per bank: Add: deposit in transit from Pikea deposit in transit from Hypertronics $3,961 1,200 5,161 103,419 Deduct: outstanding check outstanding check Adjusted balance per bank No. 361 $5,400 No. 360 1,230 6,630 $96,789 $96,389 Balance per book: Add: interest earned 0000000000000000000 409 96,798 Deduct: bank service charge Adjusted balance per book 9 $96,789 Print Close San Francisco, CA 94104 Intermaweb Computer Debit Credit $1.230 $58,000 $2,086 Date Particulars JUN 1 BALANCE BROUGHT FORWARD JUN 1 360 JUN 3 LOAN JUN 4 363 JUN 4 DEPOSIT - Pikea JUN 4 DEPOSIT - Hypertronics JUN 5 361 JUN 6 365 JUN 6 362 JUN 8 364 $3,961 $1,200 $5.400 $13,462 $9.900 $740 $574 $3,254 $3,885 Balance $98,258 CR $97,028 CR $155,028 CR $152,942 CR $156,903 CR $158,103 CR $152.703 CR $139,241 CR $129,341 CR S128,601 CR $128.027 CR $124,773 CR $128,658 CR $115,899 CR $112,863 CR $114,897 CR $111,924 CR $120,020 CR $123,220 CR $110,089 CR $106,889 CR $94,057 CR $137,673 CR $143.113 CR $147,742 CR $160.990 CR $161,768 CR $161,759 CR $12,759 $3.036 $2,034 $2.973 JUN 9 366 JUN 11 367 JUN 11 DEPOSIT - Turbo Tech JUN 12 368 JUN 13 369 JUN 16 DEPOSIT - Hypertronics JUN 18 370 JUN 18 DEPOSIT - Cash sales JUN 21 DEPOSIT - Handys Electronics JUN 21 371 JUN 24 NSF CHECK - Handys Electronics JUN 26 372 JUN 27 DEPOSIT - Cash sales JUN 29 DEPOSIT - Cash sales JUN 30 DEPOSIT - Pikea JUN 30 DEPOSIT Cash sales JUN 30 INTEREST JUN 30 SERVICE CHARGE $8,096 $3,200 $13.131 $3,200 $12,832 $43,616 $5.440 $4,629 $13,248 $778 59 Last statement to this statement to 05/31/22 06/30/22 Total debitis Total credits Final balance $84,566 $148,087 $161,759 CR Proceeds of checks will not be available untildeared Al rities for the last business day are subject to verification and authorization Anys nodown, will be adjusted by reversal entry on a statement NSF means Not suficient Funds CASH RECEIPTS JOURNAL Date Account Pos! Ref. Cost of Goods Sold 250 110-5 110-1 X 110-0 X 110-3 3.000 Jun 1 Bank Loan Payable Jun 6 ARC-Turbo Tech Jun 12 ARC - Hypertronice Jun 13 Sales Revenue Jun 19 ARG. Handys Electronics Jun 20 Sales Revenue Jun 27 ARC Radio Hut Jun 27 Sales Revenue Jun 29 ARC - Pikea Jun 29 Sales Revenue Total Post reference Debit Credit Cash Sales Sales Accounts Other Discounts Revenue Receivable Accounts 58.000 50,000 3,885 3,885 2,034 226 2.200 8.000 8,000 3.200 3,200 43.616 43.610 18.751 18.751 5440 5,440 4,629 4,629 13.248 13.248 160,899 226 70,400 32.725 58,000 (100) (402) (400) (110) (X) 20,392 X 3,040 110-4 7,088 43.216 (500/120) CASH PAYMENTS JOURNAL Postrererence (407) (400) (110) SCM 120 CASH PAYMENTS JOURNAL Credit Date Account Check No. Post Ref. Cash Jun Jun un 362 363 384 365 306 140 210-6 221 220 130 210-2 Jun Jun Jun Jun Jun Debit Accounts Merchandise Wages Other Payable Inventory Expense Accounts 9.900 2006 740 6.301 f1,601 574 3.254 12.750 3.030 2.975 13.131 12,832 387 Prepaid Rent APC Big Telco 4 Electricity Payable 4 Wages Payable 5 orice Supplies 10 APC - Moon Megabytes 11 Wages Expense 12 APC Pony 13 APC - Mega Tech 18 Wages Expense 25 Wages Expense 28 APC - Pony 29 Merchandise Inventory 30 Salary Expense 9.900 2.000 740 13.482 574 3,254 12.750 3,038 2973 13,130 12832 X 368 369 370 371 372 210-1 210-5 X Jun Jun Jun X 27.066 27.056 Jun 373 374 210-1 X 545 15 808 4800 Jun Jun 15 800 4,500 122,411 (100) 15,600 45.523 22,675 Total 38,405 (210) (120) (516) (X) Post reference PURE Close Intermaweb Computer Bank Reconciliation Statement June 30, 2022 s 161759 Balance per bank: Add: deposit in transit deposit in transit 5 Deduct: No. outstanding check outstanding check No No Adjusted balance per bank II I Balance per book Add: interest earned Deduct: bank service charge 5 Adjusted balance per book Bank reconciliation Now that you have completed the end of month posting procedure, you are required to prepare a bank reconciliaton as at June 30, 2022. The purpose of the bank reconciliation process is to reconcile the balance of cash shown in the company's ledge account against the balance of cash reported in the bank statement. Instructions for bank reconciliation 1) Prepare the bank reconciliation statement as at June 30, 2022. To do this, you will need to use: . the previous month's bank reconciliation statement, and the current month's bank statement and cash journals Note that the bank reconciliation statement provided below may contain more rows than required. 2) Use the bank reconciliation statement to record the relevant reconciling items in the general journal. 3) Post entries recorded in the general journal to the appropriate ledger accounts according to the company's accounting policies and procedures 4) Record the updated balance of each ledger account in the Balance row of each ledger, even for ledgers with a balance of zero. Although each ledger already has a running balance, the Balance row must still be filled out in order to receive full points. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page o in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. Remember: Enter all answers to the nearest whole dollar. There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1' into the Post Ref. column. You are also required to apply the journals and ledgers Instructions provided in previous weeks. Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. Bank reconciliation statement May 60 00000000000 Intermaweb Computer Bank Reconciliation Statement May 31, 2022 $98,258 Balance per bank: Add: deposit in transit from Pikea deposit in transit from Hypertronics $3,961 1,200 5,161 103,419 Deduct: outstanding check outstanding check Adjusted balance per bank No. 361 $5,400 No. 360 1,230 6,630 $96,789 $96,389 Balance per book: Add: interest earned 0000000000000000000 409 96,798 Deduct: bank service charge Adjusted balance per book 9 $96,789 Print Close San Francisco, CA 94104 Intermaweb Computer Debit Credit $1.230 $58,000 $2,086 Date Particulars JUN 1 BALANCE BROUGHT FORWARD JUN 1 360 JUN 3 LOAN JUN 4 363 JUN 4 DEPOSIT - Pikea JUN 4 DEPOSIT - Hypertronics JUN 5 361 JUN 6 365 JUN 6 362 JUN 8 364 $3,961 $1,200 $5.400 $13,462 $9.900 $740 $574 $3,254 $3,885 Balance $98,258 CR $97,028 CR $155,028 CR $152,942 CR $156,903 CR $158,103 CR $152.703 CR $139,241 CR $129,341 CR S128,601 CR $128.027 CR $124,773 CR $128,658 CR $115,899 CR $112,863 CR $114,897 CR $111,924 CR $120,020 CR $123,220 CR $110,089 CR $106,889 CR $94,057 CR $137,673 CR $143.113 CR $147,742 CR $160.990 CR $161,768 CR $161,759 CR $12,759 $3.036 $2,034 $2.973 JUN 9 366 JUN 11 367 JUN 11 DEPOSIT - Turbo Tech JUN 12 368 JUN 13 369 JUN 16 DEPOSIT - Hypertronics JUN 18 370 JUN 18 DEPOSIT - Cash sales JUN 21 DEPOSIT - Handys Electronics JUN 21 371 JUN 24 NSF CHECK - Handys Electronics JUN 26 372 JUN 27 DEPOSIT - Cash sales JUN 29 DEPOSIT - Cash sales JUN 30 DEPOSIT - Pikea JUN 30 DEPOSIT Cash sales JUN 30 INTEREST JUN 30 SERVICE CHARGE $8,096 $3,200 $13.131 $3,200 $12,832 $43,616 $5.440 $4,629 $13,248 $778 59 Last statement to this statement to 05/31/22 06/30/22 Total debitis Total credits Final balance $84,566 $148,087 $161,759 CR Proceeds of checks will not be available untildeared Al rities for the last business day are subject to verification and authorization Anys nodown, will be adjusted by reversal entry on a statement NSF means Not suficient Funds CASH RECEIPTS JOURNAL Date Account Pos! Ref. Cost of Goods Sold 250 110-5 110-1 X 110-0 X 110-3 3.000 Jun 1 Bank Loan Payable Jun 6 ARC-Turbo Tech Jun 12 ARC - Hypertronice Jun 13 Sales Revenue Jun 19 ARG. Handys Electronics Jun 20 Sales Revenue Jun 27 ARC Radio Hut Jun 27 Sales Revenue Jun 29 ARC - Pikea Jun 29 Sales Revenue Total Post reference Debit Credit Cash Sales Sales Accounts Other Discounts Revenue Receivable Accounts 58.000 50,000 3,885 3,885 2,034 226 2.200 8.000 8,000 3.200 3,200 43.616 43.610 18.751 18.751 5440 5,440 4,629 4,629 13.248 13.248 160,899 226 70,400 32.725 58,000 (100) (402) (400) (110) (X) 20,392 X 3,040 110-4 7,088 43.216 (500/120) CASH PAYMENTS JOURNAL Postrererence (407) (400) (110) SCM 120 CASH PAYMENTS JOURNAL Credit Date Account Check No. Post Ref. Cash Jun Jun un 362 363 384 365 306 140 210-6 221 220 130 210-2 Jun Jun Jun Jun Jun Debit Accounts Merchandise Wages Other Payable Inventory Expense Accounts 9.900 2006 740 6.301 f1,601 574 3.254 12.750 3.030 2.975 13.131 12,832 387 Prepaid Rent APC Big Telco 4 Electricity Payable 4 Wages Payable 5 orice Supplies 10 APC - Moon Megabytes 11 Wages Expense 12 APC Pony 13 APC - Mega Tech 18 Wages Expense 25 Wages Expense 28 APC - Pony 29 Merchandise Inventory 30 Salary Expense 9.900 2.000 740 13.482 574 3,254 12.750 3,038 2973 13,130 12832 X 368 369 370 371 372 210-1 210-5 X Jun Jun Jun X 27.066 27.056 Jun 373 374 210-1 X 545 15 808 4800 Jun Jun 15 800 4,500 122,411 (100) 15,600 45.523 22,675 Total 38,405 (210) (120) (516) (X) Post reference PURE Close Intermaweb Computer Bank Reconciliation Statement June 30, 2022 s 161759 Balance per bank: Add: deposit in transit deposit in transit 5 Deduct: No. outstanding check outstanding check No No Adjusted balance per bank II I Balance per book Add: interest earned Deduct: bank service charge 5 Adjusted balance per book

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts