Question: post all working please Question 3 (8 marks) You are given the following information: A stock is currently priced at $60 and pays dividends at

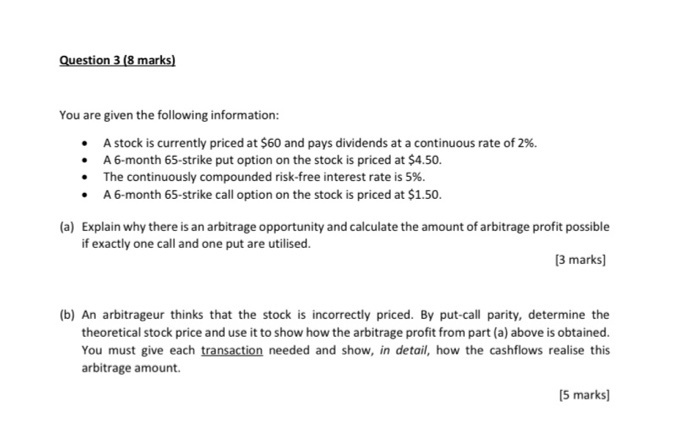

Question 3 (8 marks) You are given the following information: A stock is currently priced at $60 and pays dividends at a continuous rate of 2%. A 6-month 65-strike put option on the stock is priced at $4.50. The continuously compounded risk-free interest rate is 5%. A6-month 65-strike call option on the stock is priced at $1.50. (a) Explain why there is an arbitrage opportunity and calculate the amount of arbitrage profit possible if exactly one call and one put are utilised. [3 marks) (b) An arbitrageur thinks that the stock is incorrectly priced. By put-call parity, determine the theoretical stock price and use it to show how the arbitrage profit from part (a) above is obtained. You must give each transaction needed and show, in detail, how the cashflows realise this arbitrage amount. 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts