Question: Post answer with comprehensive quantitative analysis and explanation Ethioflora (est. 1990) is a family-run manufacturer and marketer of cut-rose products with a 325 hectare production

Post answer with comprehensive quantitative analysis and explanation

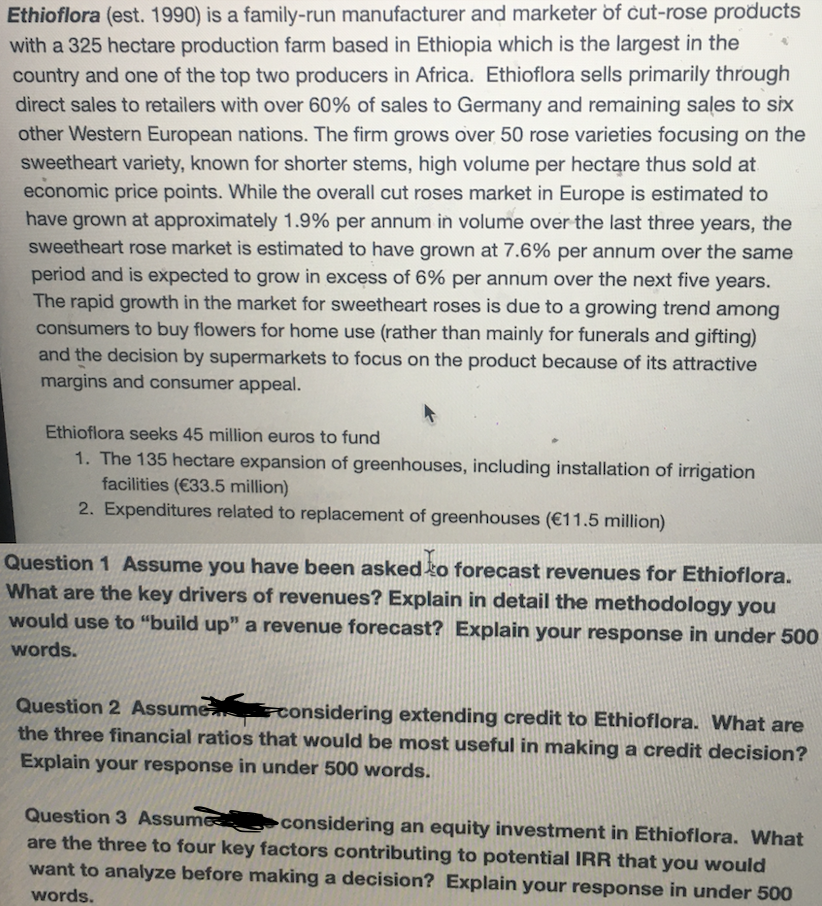

Ethioflora (est. 1990) is a family-run manufacturer and marketer of cut-rose products with a 325 hectare production farm based in Ethiopia which is the largest in the country and one of the top two producers in Africa. Ethioflora sells primarily through direct sales to retailers with over 60% of sales to Germany and remaining sales to six other Western European nations. The firm grows over 50 rose varieties focusing on the sweetheart variety, known for shorter stems, high volume per hectare thus sold at economic price points. While the overall cut roses market in Europe is estimated to have grown at approximately 1.9% per annum in volume over the last three years, the sweetheart rose market is estimated to have grown at 7.6% per annum over the same period and is expected to grow in excess of 6% per annum over the next five years. The rapid growth in the market for sweetheart roses is due to a growing trend among consumers to buy flowers for home use (rather than mainly for funerals and gifting) and the decision by supermarkets to focus on the product because of its attractive margins and consumer appeal. Ethioflora seeks 45 million euros to fund 1. The 135 hectare expansion of greenhouses, including installation of irrigation facilities (33.5 million) 2. Expenditures related to replacement of greenhouses ( 11.5 million) Question 1 Assume you have been asked fo forecast revenues for Ethioflora. What are the key drivers of revenues? Explain in detail the methodology you would use to "build up" a revenue forecast? Explain your response in under 500 words. Question 2 Assumeonsidering extending credit to Ethioflora. What are the three financial ratios that would be most useful in making a credit decision? Explain your response in under 500 words. Question 3 Assumeconsidering an equity investment in Ethioflora. What are the three to four key factors contributing to potential IRR that you would want to analyze before making a decision? Explain your response in under 500 words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts