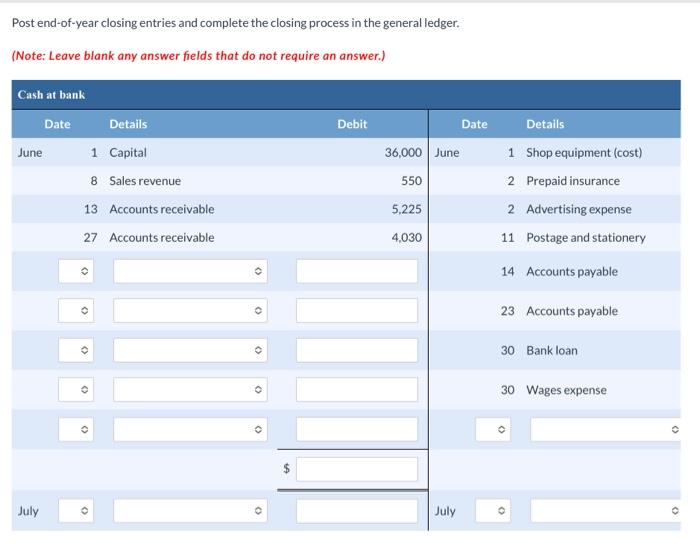

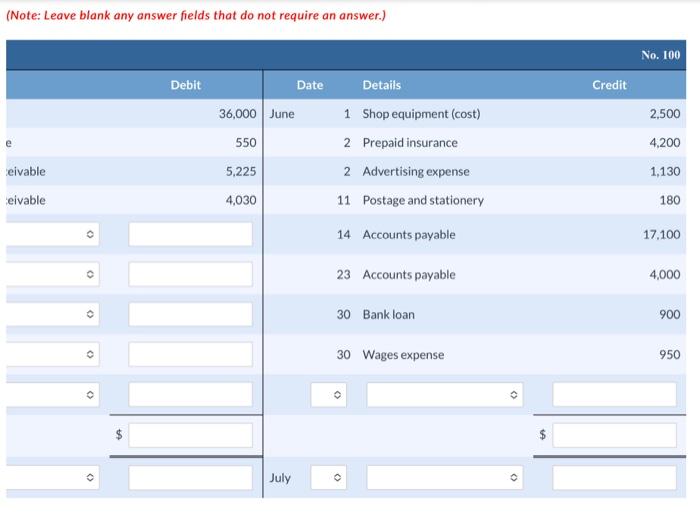

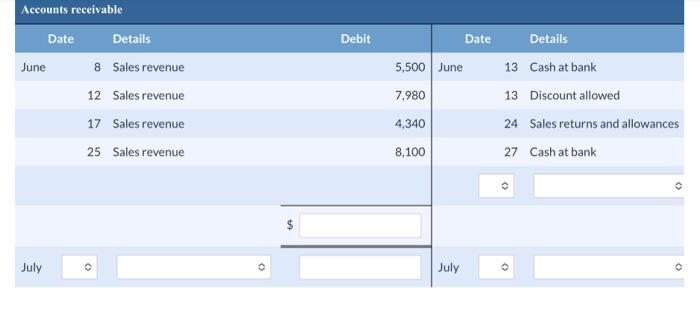

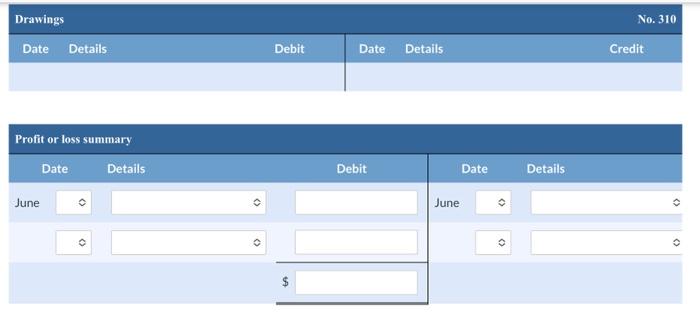

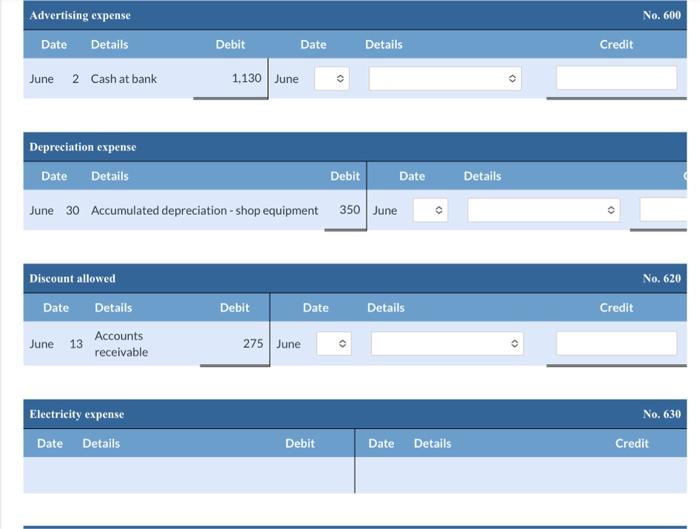

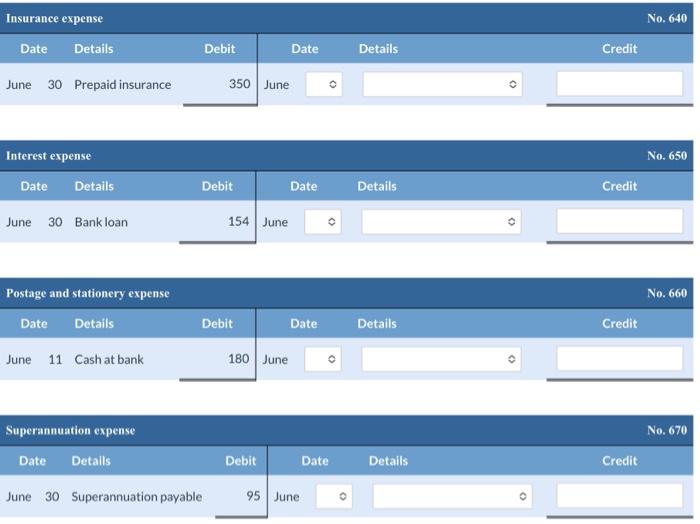

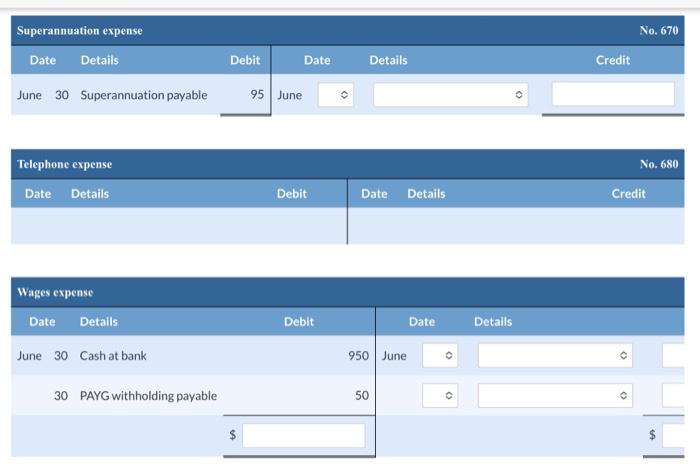

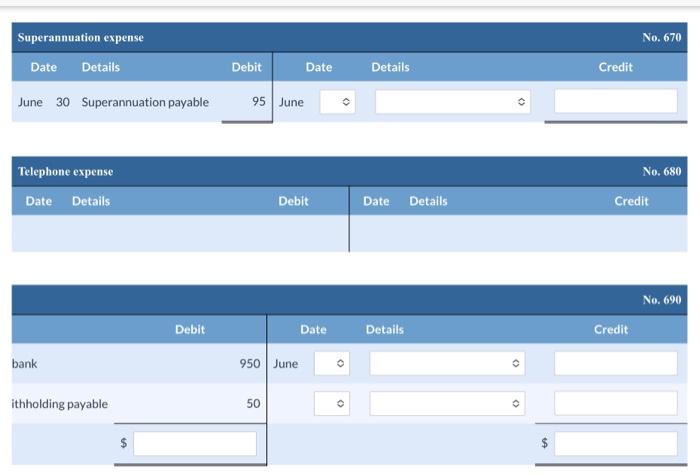

Question: Post end-of-year closing entries and complete the closing process in the general ledger. (Note: Leave blank any answer fields that do not require an answer.)

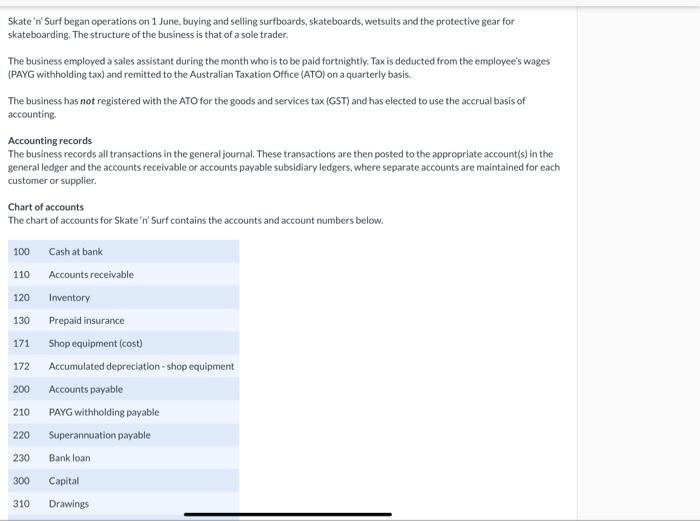

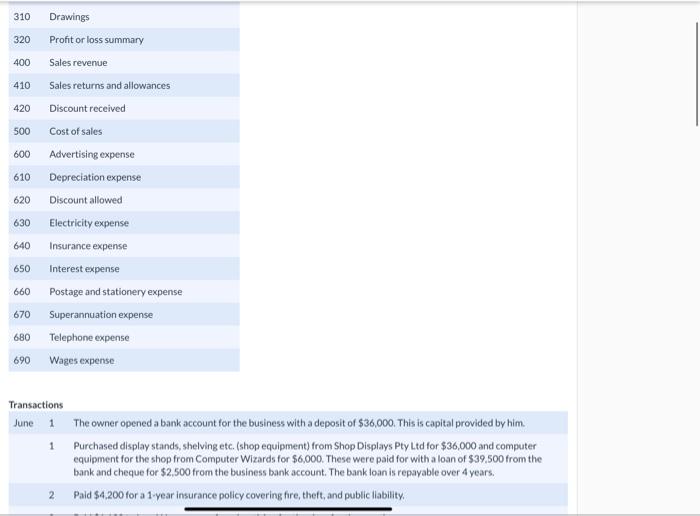

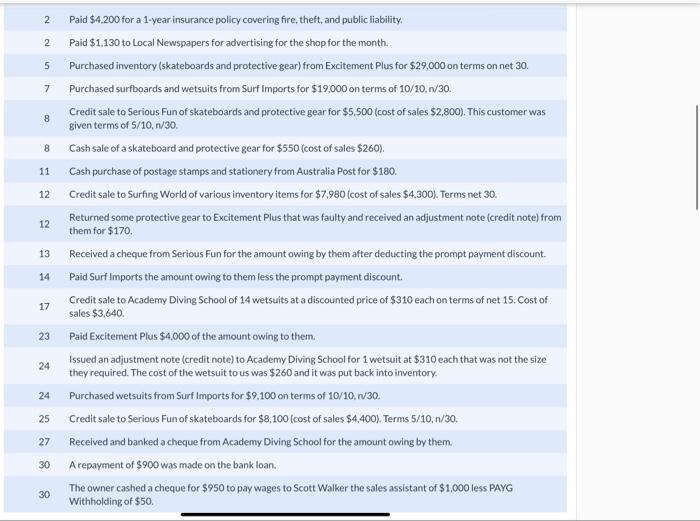

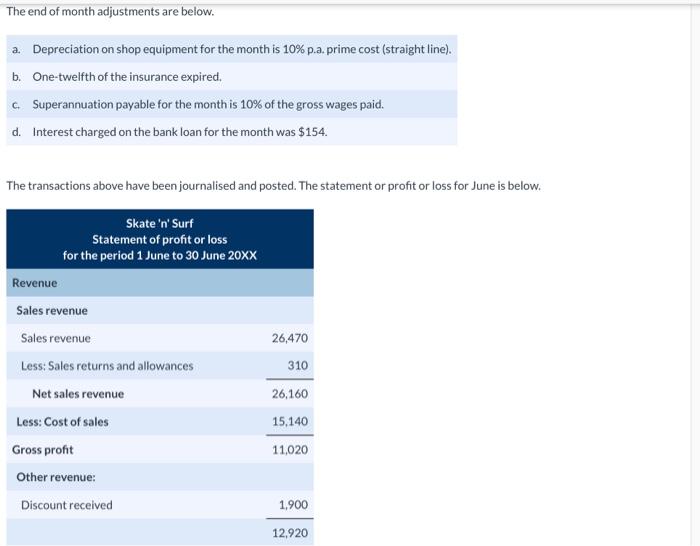

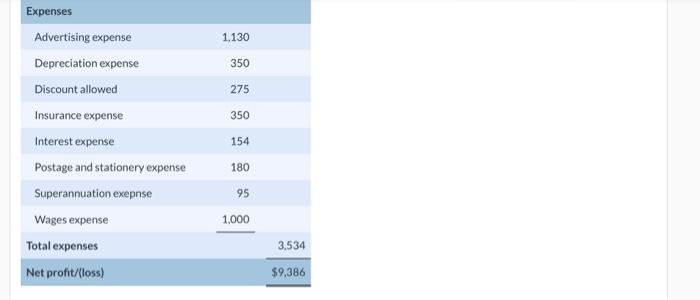

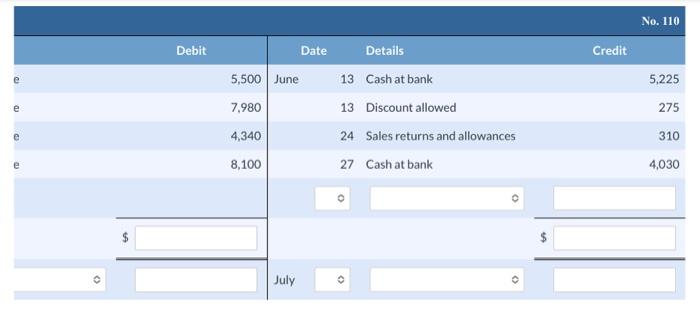

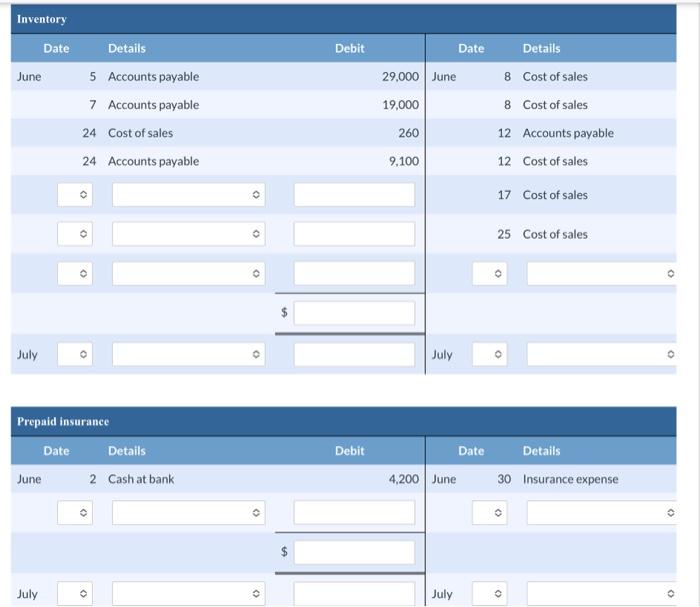

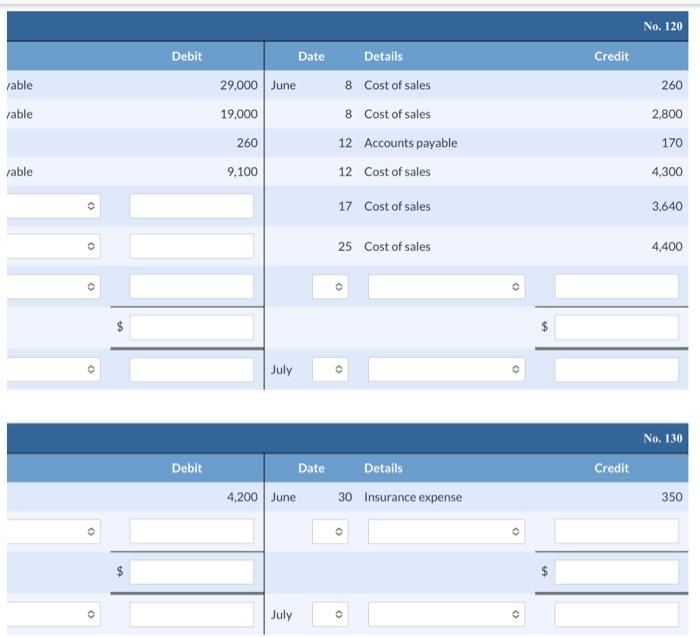

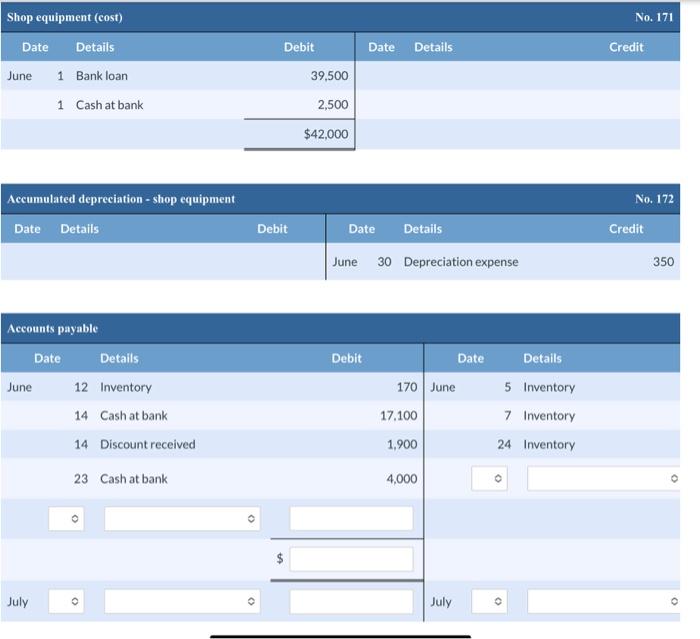

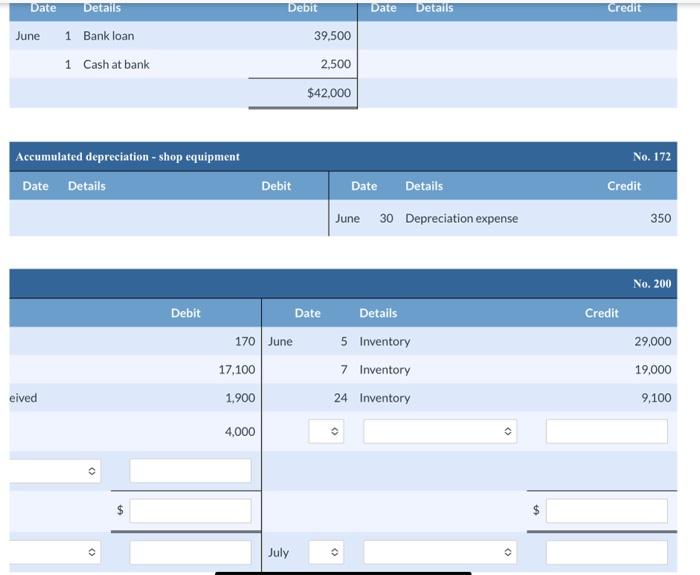

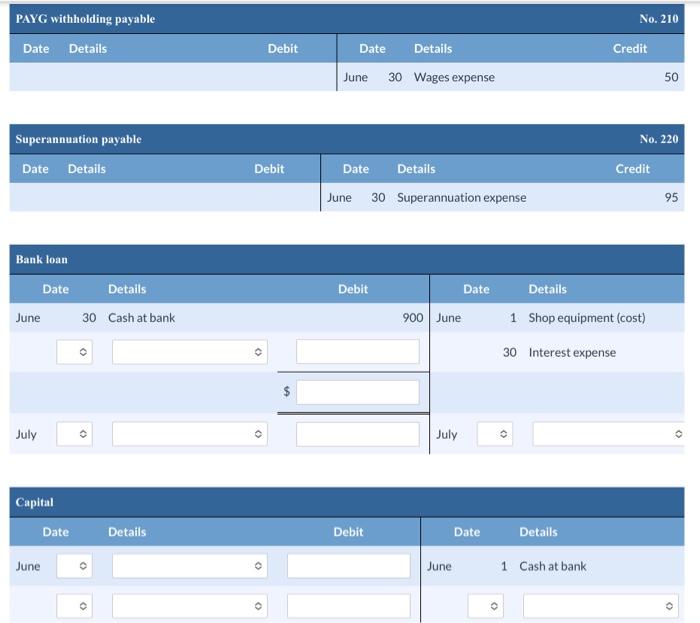

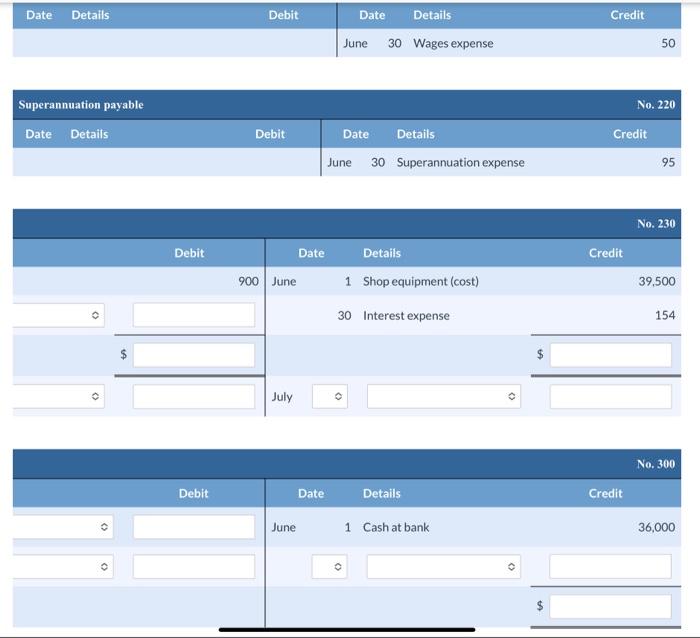

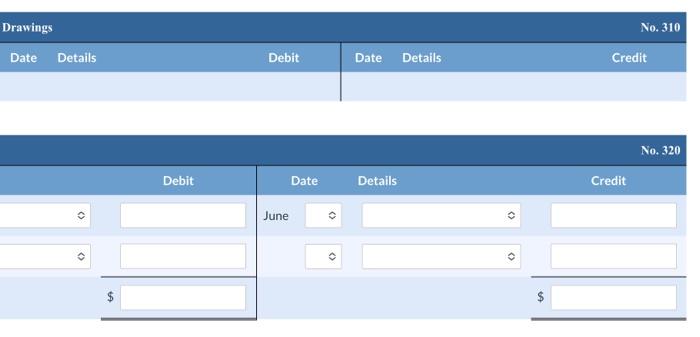

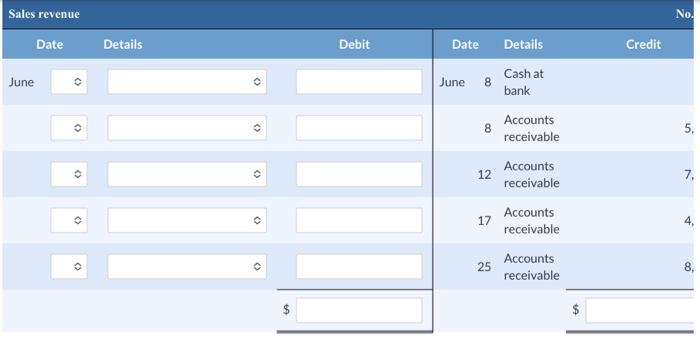

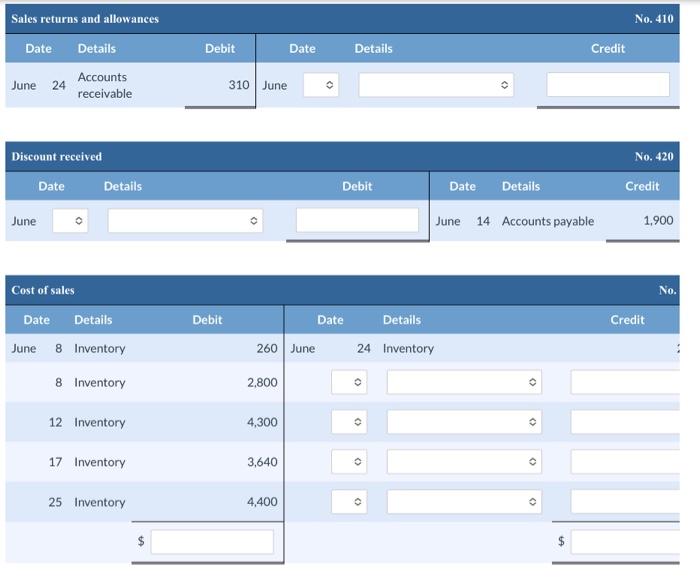

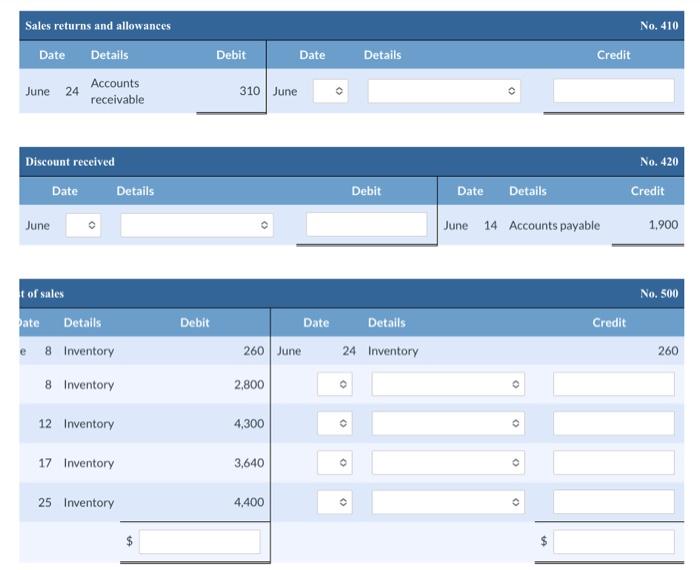

\\begin{tabular}{|l|l|ll|} \\hline \\multicolumn{2}{l|}{ Drawings } & & No. 310 \\\\ \\hline Date Details & Debit & Date Details & Credit \\\\ \\hline & & \\\\ \\hline \\end{tabular} Accounts receivable The end of month adjustments are below. a. Depreciation on shop equipment for the month is \10 p.a. prime cost (straight line). b. One-twelfth of the insurance expired. C. Superannuation payable for the month is \10 of the gross wages paid. d. Interest charged on the bank loan for the month was \\( \\$ 154 \\). The transactions above have been journalised and posted. The statement or profit or loss for June is below. \\begin{tabular}{|l|llr|} \\hline PAYG withholding payable & No.210 \\\\ \\hline Date Details & Debit & Date \\( \\quad \\) Details & Credit \\\\ \\hline & June 30 & Wagesexpense & 50 \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|llr|r|} \\hline \\multicolumn{2}{|l|}{ Superannuation payable } & No.220 \\\\ \\hline Date Details & Debit & Date \\( \\quad \\) Details & Credit \\\\ \\hline & June 30 & Superannuationexpense & 95 \\\\ \\hline \\end{tabular} 2 Paid \\( \\$ 4.200 \\) for a 1-year insurance policy covering fire, theft, and public liability. 2 Paid \\( \\$ 1,130 \\) to Local Newspapers for advertising for the shop for the month. 5 Purchased inventory (skateboards and protective gear) from Excitement Plus for \\( \\$ 29,000 \\) on terms on net 30 . 7 Purchased surfboards and wetsuits from Surf imports for \\( \\$ 19,000 \\) on terms of \\( 10 / 10, \\mathrm{n} / 30 \\). 8 Credit sale to Serious Fun of skateboards and protective gear for \\( \\$ 5,500 \\) (cost of sales \\( \\$ 2,800 \\) ). This customer was given terms of \\( 5 / 10, \\mathrm{n} / 30 \\). 8 Cash sale of a skateboard and protective gear for \\( \\$ 550 \\) (cost of sales \\( \\$ 260 \\) ). 11 Cash purchase of postage stamps and stationery from Australia Post for \\( \\$ 180 \\). 12 Credit sale to Surfing World of various imventory items for \\( \\$ 7,980 \\) (cost of sales \\( \\$ 4,300 \\) ). Terms net 30 . 12. Returned some protective gear to Excitement Plus that was faulty and received an adjustment note (credit note) from them for \\( \\$ 170 \\). 13 Received a cheque from Serious Fun for the amount owing by them after deducting the prompt payment discount. 14 Paid Surf imports the amount owing to them less the prompt payment discount. 17 Credit sale to Academy Diving School of 14 wetsuits at a discounted price of \\( \\$ 310 \\) each on terms of net 15 . Cost of sales \\( \\$ 3,640 \\). 23 Paid Excitement Plus \\( \\$ 4,000 \\) of the amount owing to them. 24 Issued an adjustment note (credit note) to Academy Diving School for 1 wetsuit at \\( \\$ 310 \\) each that was not the size they required. The cost of the wetsuit to us was \\( \\$ 260 \\) and it was put back into inventory. 24 Purchased wetsuits from Surf Imports for \\( \\$ 9.100 \\) on terms of \\( 10 / 10, n / 30 \\). 25 Credit sale to Serious Fun of skateboards for \\( \\$ 8,100 \\) (cost of sales \\( \\$ 4,400 \\) ). Terms \\( 5 / 10, n / 30 \\), 27 Received and banked a cheque from Academy Diving School for the amount owing by them. 30 A repayment of \\( \\$ 900 \\) was made on the bank loan. 30 The owner cashed a cheque for \\( \\$ 950 \\) to pay wages to Scott Walker the sales assistant of \\( \\$ 1,000 \\) less PAYG Withholding of \\( \\$ 50 \\). (Note: Leave blank any answer fields that do not require an answer.) Skate ' \\( n \\) ' Surf began operations on 1 June, buying and selling surfboards, skateboards, wetsuits and the protective gear for skateboarding. The structure of the business is that of a sole trader. The business employed a sales assistant during the month who is to be paid fortnightly. Tax is deducted from the employee's wages (PAYG withholding tax) and remitted to the Australian Taxation Office (ATO) on a quarterly basis. The business has not registered with the ATO for the goods and services tax (GST) and has elected to use the accrual basis of accounting. Accounting records The business records all transactions in the general journal. These transactions are then posted to the appropriate account(s) in the general ledger and the accounts receivable or accounts payable subsidiary ledgers, where separate accounts are maintained for each customer or supplier. Chart of accounts The chart of accounts for Skate ' \\( n \\) ' Surf contains the accounts and account numbers below. Post end-of-year closing entries and complete the closing process in the general ledger. (Note: Leave blank any answer fields that do not require an answer.) Transactions June 1 The owner opened a bank account for the business with a deposit of \\( \\$ 36,000 \\). This is capital provided by him. 1 Purchased display stands, shelving etc. (shop equipment) from Shop Displays Pty L.t for \\( \\$ 36,000 \\) and computer equipment for the shop from Computer Wizards for \\( \\$ 6,000 \\). These were paid for with a loan of \\( \\$ 39,500 \\) from the bank and cheque for \\( \\$ 2,500 \\) from the business bank account. The bank loan is repayable over 4 years. 2. Paid \\$4,200 for a 1-year insurance policy covering fire, theft, and public liability. \\begin{tabular}{|c|l|l|} \\hline \\multicolumn{2}{|l|}{ Nelephone expense } & No. 680 \\\\ \\hline Date Details & Debit & Date Details \\\\ \\hline & & Credit \\\\ \\hline \\end{tabular} Accounts payable \\begin{tabular}{|l|l|ll|} \\hline \\multicolumn{2}{l|}{ Drawings } & & No. 310 \\\\ \\hline Date Details & Debit & Date Details & Credit \\\\ \\hline & & \\\\ \\hline \\end{tabular} Accounts receivable The end of month adjustments are below. a. Depreciation on shop equipment for the month is \10 p.a. prime cost (straight line). b. One-twelfth of the insurance expired. C. Superannuation payable for the month is \10 of the gross wages paid. d. Interest charged on the bank loan for the month was \\( \\$ 154 \\). The transactions above have been journalised and posted. The statement or profit or loss for June is below. \\begin{tabular}{|l|llr|} \\hline PAYG withholding payable & No.210 \\\\ \\hline Date Details & Debit & Date \\( \\quad \\) Details & Credit \\\\ \\hline & June 30 & Wagesexpense & 50 \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|llr|r|} \\hline \\multicolumn{2}{|l|}{ Superannuation payable } & No.220 \\\\ \\hline Date Details & Debit & Date \\( \\quad \\) Details & Credit \\\\ \\hline & June 30 & Superannuationexpense & 95 \\\\ \\hline \\end{tabular} 2 Paid \\( \\$ 4.200 \\) for a 1-year insurance policy covering fire, theft, and public liability. 2 Paid \\( \\$ 1,130 \\) to Local Newspapers for advertising for the shop for the month. 5 Purchased inventory (skateboards and protective gear) from Excitement Plus for \\( \\$ 29,000 \\) on terms on net 30 . 7 Purchased surfboards and wetsuits from Surf imports for \\( \\$ 19,000 \\) on terms of \\( 10 / 10, \\mathrm{n} / 30 \\). 8 Credit sale to Serious Fun of skateboards and protective gear for \\( \\$ 5,500 \\) (cost of sales \\( \\$ 2,800 \\) ). This customer was given terms of \\( 5 / 10, \\mathrm{n} / 30 \\). 8 Cash sale of a skateboard and protective gear for \\( \\$ 550 \\) (cost of sales \\( \\$ 260 \\) ). 11 Cash purchase of postage stamps and stationery from Australia Post for \\( \\$ 180 \\). 12 Credit sale to Surfing World of various imventory items for \\( \\$ 7,980 \\) (cost of sales \\( \\$ 4,300 \\) ). Terms net 30 . 12. Returned some protective gear to Excitement Plus that was faulty and received an adjustment note (credit note) from them for \\( \\$ 170 \\). 13 Received a cheque from Serious Fun for the amount owing by them after deducting the prompt payment discount. 14 Paid Surf imports the amount owing to them less the prompt payment discount. 17 Credit sale to Academy Diving School of 14 wetsuits at a discounted price of \\( \\$ 310 \\) each on terms of net 15 . Cost of sales \\( \\$ 3,640 \\). 23 Paid Excitement Plus \\( \\$ 4,000 \\) of the amount owing to them. 24 Issued an adjustment note (credit note) to Academy Diving School for 1 wetsuit at \\( \\$ 310 \\) each that was not the size they required. The cost of the wetsuit to us was \\( \\$ 260 \\) and it was put back into inventory. 24 Purchased wetsuits from Surf Imports for \\( \\$ 9.100 \\) on terms of \\( 10 / 10, n / 30 \\). 25 Credit sale to Serious Fun of skateboards for \\( \\$ 8,100 \\) (cost of sales \\( \\$ 4,400 \\) ). Terms \\( 5 / 10, n / 30 \\), 27 Received and banked a cheque from Academy Diving School for the amount owing by them. 30 A repayment of \\( \\$ 900 \\) was made on the bank loan. 30 The owner cashed a cheque for \\( \\$ 950 \\) to pay wages to Scott Walker the sales assistant of \\( \\$ 1,000 \\) less PAYG Withholding of \\( \\$ 50 \\). (Note: Leave blank any answer fields that do not require an answer.) Skate ' \\( n \\) ' Surf began operations on 1 June, buying and selling surfboards, skateboards, wetsuits and the protective gear for skateboarding. The structure of the business is that of a sole trader. The business employed a sales assistant during the month who is to be paid fortnightly. Tax is deducted from the employee's wages (PAYG withholding tax) and remitted to the Australian Taxation Office (ATO) on a quarterly basis. The business has not registered with the ATO for the goods and services tax (GST) and has elected to use the accrual basis of accounting. Accounting records The business records all transactions in the general journal. These transactions are then posted to the appropriate account(s) in the general ledger and the accounts receivable or accounts payable subsidiary ledgers, where separate accounts are maintained for each customer or supplier. Chart of accounts The chart of accounts for Skate ' \\( n \\) ' Surf contains the accounts and account numbers below. Post end-of-year closing entries and complete the closing process in the general ledger. (Note: Leave blank any answer fields that do not require an answer.) Transactions June 1 The owner opened a bank account for the business with a deposit of \\( \\$ 36,000 \\). This is capital provided by him. 1 Purchased display stands, shelving etc. (shop equipment) from Shop Displays Pty L.t for \\( \\$ 36,000 \\) and computer equipment for the shop from Computer Wizards for \\( \\$ 6,000 \\). These were paid for with a loan of \\( \\$ 39,500 \\) from the bank and cheque for \\( \\$ 2,500 \\) from the business bank account. The bank loan is repayable over 4 years. 2. Paid \\$4,200 for a 1-year insurance policy covering fire, theft, and public liability. \\begin{tabular}{|c|l|l|} \\hline \\multicolumn{2}{|l|}{ Nelephone expense } & No. 680 \\\\ \\hline Date Details & Debit & Date Details \\\\ \\hline & & Credit \\\\ \\hline \\end{tabular} Accounts payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts