Question: post excel sheet & formula used 4. Last year, your small business (an LLC corporation) had $150,000,000 in revenue, $100,000,000 in operating expenses, and depreciation

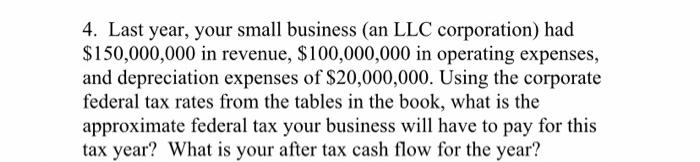

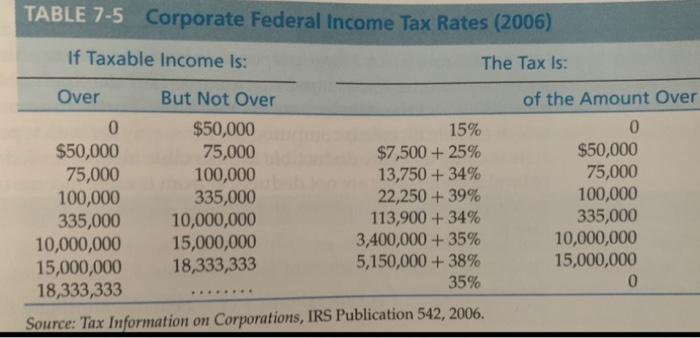

4. Last year, your small business (an LLC corporation) had $150,000,000 in revenue, $100,000,000 in operating expenses, and depreciation expenses of $20,000,000. Using the corporate federal tax rates from the tables in the book, what is the approximate federal tax your business will have to pay for this tax year? What is your after tax cash flow for the year? TABLE 7-5 Corporate Federal Income Tax Rates (2006) If Taxable income is: The Tax is: Over But Not Over of the Amount Over 0 $50,000 15% 0 $50,000 75,000 $7,500 + 25% $50,000 75,000 100,000 13,750 + 34% 75,000 100,000 335,000 22,250 + 39% 100,000 335,000 10,000,000 113,900 + 34% 335,000 10,000,000 15,000,000 3,400,000 + 35% 10,000,000 15,000,000 18,333,333 5,150,000+ 38% 15,000,000 18,333,333 35% 0 Source: Tax Information on Corporations, IRS Publication 542, 2006

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts